REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

- TAGS

- registration

- iliad

- iliad.fr

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

20. <strong>FINANCIAL</strong> INFORMATION CONCERNING THE COMPANY’S ASSETS <strong>AND</strong> LIABILITIES,<br />

<strong>FINANCIAL</strong> POSITION <strong>AND</strong> PROFITS <strong>AND</strong> LOSSES<br />

20.1 CONSOLIDATED <strong>FINANCIAL</strong> STATEMENTS FOR 2007, 2006 <strong>AND</strong> 2005<br />

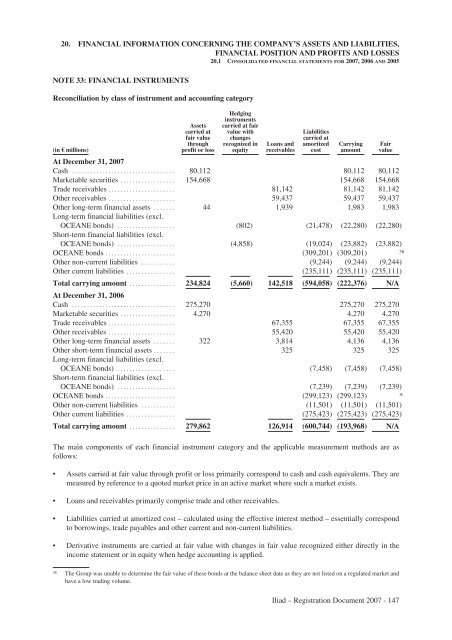

NOTE 33: <strong>FINANCIAL</strong> INSTRUMENTS<br />

Reconciliation by class of instrument and accounting category<br />

(in € millions)<br />

Assets<br />

carried at<br />

fair value<br />

through<br />

profit or loss<br />

Hedging<br />

instruments<br />

carried at fair<br />

value with<br />

changes<br />

recognized in<br />

equity<br />

Loans and<br />

receivables<br />

Liabilities<br />

carried at<br />

amortized<br />

cost<br />

Carrying<br />

amount<br />

At December 31, 2007<br />

Cash .................................. 80,112 80,112 80,112<br />

Marketable securities .................. 154,668 154,668 154,668<br />

Trade receivables ...................... 81,142 81,142 81,142<br />

Other receivables ...................... 59,437 59,437 59,437<br />

Other long-term financial assets .......<br />

Long-term financial liabilities (excl.<br />

44 1,939 1,983 1,983<br />

OCEANE bonds) ...................<br />

Short-term financial liabilities (excl.<br />

(802) (21,478) (22,280) (22,280)<br />

OCEANE bonds) ................... (4,858) (19,024) (23,882) (23,882)<br />

OCEANE bonds ....................... (309,201) (309,201) 38<br />

Other non-current liabilities ........... (9,244) (9,244) (9,244)<br />

Other current liabilities ................ (235,111) (235,111) (235,111)<br />

Total carrying amount ...............<br />

At December 31, 2006<br />

234,824 (5,660) 142,518 (594,058) (222,376) N/A<br />

Cash .................................. 275,270 275,270 275,270<br />

Marketable securities .................. 4,270 4,270 4,270<br />

Trade receivables ...................... 67,355 67,355 67,355<br />

Other receivables ...................... 55,420 55,420 55,420<br />

Other long-term financial assets ....... 322 3,814 4,136 4,136<br />

Other short-term financial assets .......<br />

Long-term financial liabilities (excl.<br />

325 325 325<br />

OCEANE bonds) ...................<br />

Short-term financial liabilities (excl.<br />

(7,458) (7,458) (7,458)<br />

OCEANE bonds) ................... (7,239) (7,239) (7,239)<br />

OCEANE bonds ....................... (299,123) (299,123) *<br />

Other non-current liabilities ........... (11,501) (11,501) (11,501)<br />

Other current liabilities ................ (275,423) (275,423) (275,423)<br />

Total carrying amount ............... 279,862 126,914 (600,744) (193,968) N/A<br />

The main components of each financial instrument category and the applicable measurement methods are as<br />

follows:<br />

• Assets carried at fair value through profit or loss primarily correspond to cash and cash equivalents. They are<br />

measured by reference to a quoted market price in an active market where such a market exists.<br />

• Loans and receivables primarily comprise trade and other receivables.<br />

• Liabilities carried at amortized cost – calculated using the effective interest method – essentially correspond<br />

to borrowings, trade payables and other current and non-current liabilities.<br />

• Derivative instruments are carried at fair value with changes in fair value recognized either directly in the<br />

income statement or in equity when hedge accounting is applied.<br />

38 The Group was unable to determine the fair value of these bonds at the balance sheet date as they are not listed on a regulated market and<br />

have a low trading volume.<br />

Fair<br />

value<br />

<strong>Iliad</strong> – Registration Document 2007 - 147