REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

- TAGS

- registration

- iliad

- iliad.fr

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

21. ADDITIONAL INFORMATION<br />

21.1 SHARE CAPITAL<br />

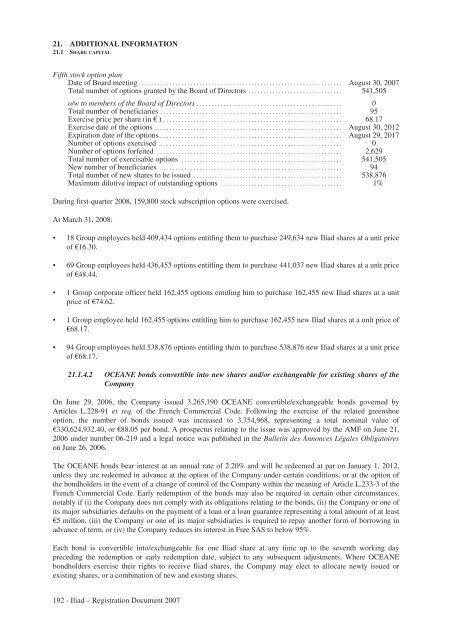

Fifth stock option plan<br />

Date of Board meeting ................................................................... August 30, 2007<br />

Total number of options granted by the Board of Directors ............................... 541,505<br />

o/w to members of the Board of Directors ................................................ 0<br />

Total number of beneficiaries ............................................................ 95<br />

Exercise price per share (in € ) ........................................................... 68.17<br />

Exercise date of the options .............................................................. August 30, 2012<br />

Expiration date of the options ............................................................ August 29, 2017<br />

Number of options exercised ............................................................ 0<br />

Number of options forfeited ............................................................. 2,629<br />

Total number of exercisable options ..................................................... 541,505<br />

New number of beneficiaries ............................................................ 94<br />

Total number of new shares to be issued ................................................. 538,876<br />

Maximum dilutive impact of outstanding options ........................................ 1%<br />

During first-quarter 2008, 159,800 stock subscription options were exercised.<br />

At March 31, 2008:<br />

• 18 Group employees held 409,434 options entitling them to purchase 249,634 new <strong>Iliad</strong> shares at a unit price<br />

of €16.30.<br />

• 69 Group employees held 436,453 options entitling them to purchase 441,037 new <strong>Iliad</strong> shares at a unit price<br />

of €48.44.<br />

• 1 Group corporate officer held 162,455 options entitling him to purchase 162,455 new <strong>Iliad</strong> shares at a unit<br />

price of €74.62.<br />

• 1 Group employee held 162,455 options entitling him to purchase 162,455 new <strong>Iliad</strong> shares at a unit price of<br />

€68.17.<br />

• 94 Group employees held 538,876 options entitling them to purchase 538,876 new <strong>Iliad</strong> shares at a unit price<br />

of €68.17.<br />

21.1.4.2 OCEANE bonds convertible into new shares and/or exchangeable for existing shares of the<br />

Company<br />

On June 29, 2006, the Company issued 3,265,190 OCEANE convertible/exchangeable bonds governed by<br />

Articles L.228-91 et seq. of the French Commercial Code. Following the exercise of the related greenshoe<br />

option, the number of bonds issued was increased to 3,754,968, representing a total nominal value of<br />

€330,624,932.40, or €88.05 per bond. A prospectus relating to the issue was approved by the AMF on June 21,<br />

2006 under number 06-219 and a legal notice was published in the Bulletin des Annonces Légales Obligatoires<br />

on June 26, 2006.<br />

The OCEANE bonds bear interest at an annual rate of 2.20% and will be redeemed at par on January 1, 2012,<br />

unless they are redeemed in advance at the option of the Company under certain conditions, or at the option of<br />

the bondholders in the event of a change of control of the Company within the meaning of Article L.233-3 of the<br />

French Commercial Code. Early redemption of the bonds may also be required in certain other circumstances,<br />

notably if (i) the Company does not comply with its obligations relating to the bonds, (ii) the Company or one of<br />

its major subsidiaries defaults on the payment of a loan or a loan guarantee representing a total amount of at least<br />

€5 million, (iii) the Company or one of its major subsidiaries is required to repay another form of borrowing in<br />

advance of term, or (iv) the Company reduces its interest in Free SAS to below 95%.<br />

Each bond is convertible into/exchangeable for one <strong>Iliad</strong> share at any time up to the seventh working day<br />

preceding the redemption or early redemption date, subject to any subsequent adjustments. Where OCEANE<br />

bondholders exercise their rights to receive <strong>Iliad</strong> shares, the Company may elect to allocate newly issued or<br />

existing shares, or a combination of new and existing shares.<br />

192 - <strong>Iliad</strong> – Registration Document 2007