REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

- TAGS

- registration

- iliad

- iliad.fr

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

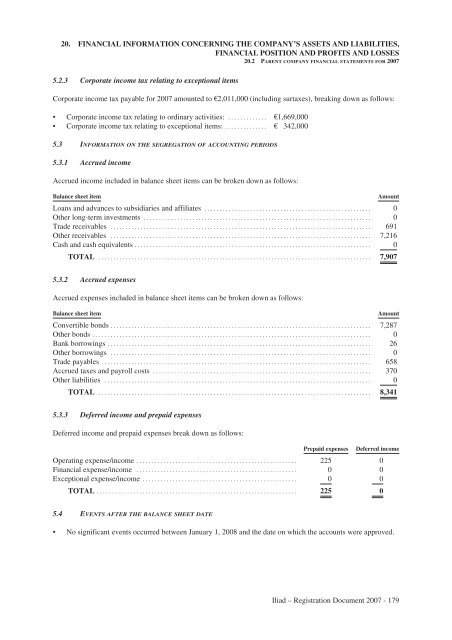

20. <strong>FINANCIAL</strong> INFORMATION CONCERNING THE COMPANY’S ASSETS <strong>AND</strong> LIABILITIES,<br />

<strong>FINANCIAL</strong> POSITION <strong>AND</strong> PROFITS <strong>AND</strong> LOSSES<br />

20.2 PARENT COMPANY <strong>FINANCIAL</strong> STATEMENTS FOR 2007<br />

5.2.3 Corporate income tax relating to exceptional items<br />

Corporate income tax payable for 2007 amounted to €2,011,000 (including surtaxes), breaking down as follows:<br />

• Corporate income tax relating to ordinary activities: ............. €1,669,000<br />

• Corporate income tax relating to exceptional items: .............. € 342,000<br />

5.3 INFORMATION ON THE SEGREGATION OF ACCOUNTING PERIODS<br />

5.3.1 Accrued income<br />

Accrued income included in balance sheet items can be broken down as follows:<br />

Balance sheet item Amount<br />

Loans and advances to subsidiaries and affiliates ....................................................... 0<br />

Other long-term investments ........................................................................... 0<br />

Trade receivables ...................................................................................... 691<br />

Other receivables ...................................................................................... 7,216<br />

Cash and cash equivalents .............................................................................. 0<br />

TOTAL .......................................................................................... 7,907<br />

5.3.2 Accrued expenses<br />

Accrued expenses included in balance sheet items can be broken down as follows:<br />

Balance sheet item Amount<br />

Convertible bonds ...................................................................................... 7,287<br />

Other bonds ............................................................................................ 0<br />

Bank borrowings ....................................................................................... 26<br />

Other borrowings ...................................................................................... 0<br />

Trade payables ......................................................................................... 658<br />

Accrued taxes and payroll costs ........................................................................ 370<br />

Other liabilities ........................................................................................ 0<br />

TOTAL .......................................................................................... 8,341<br />

5.3.3 Deferred income and prepaid expenses<br />

Deferred income and prepaid expenses break down as follows:<br />

Prepaid expenses Deferred income<br />

Operating expense/income ..................................................... 225 0<br />

Financial expense/income ..................................................... 0 0<br />

Exceptional expense/income ................................................... 0 0<br />

TOTAL .................................................................. 225 0<br />

5.4 EVENTS AFTER THE BALANCE SHEET DATE<br />

• No significant events occurred between January 1, 2008 and the date on which the accounts were approved.<br />

<strong>Iliad</strong> – Registration Document 2007 - 179