REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

- TAGS

- registration

- iliad

- iliad.fr

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

5. INFORMATION ABOUT THE COMPANY <strong>AND</strong> THE GROUP<br />

5.1 HISTORY <strong>AND</strong> DEVELOPMENT<br />

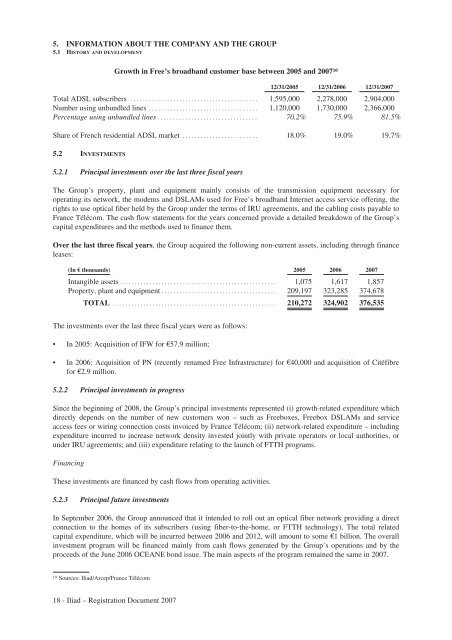

Growth in Free’s broadband customer base between 2005 and 2007 10<br />

12/31/2005 12/31/2006 12/31/2007<br />

Total ADSL subscribers .......................................... 1,595,000 2,278,000 2,904,000<br />

Number using unbundled lines .................................... 1,120,000 1,730,000 2,366,000<br />

Percentage using unbundled lines ................................. 70.2% 75.9% 81.5%<br />

Share of French residential ADSL market ......................... 18.0% 19.0% 19.7%<br />

5.2 INVESTMENTS<br />

5.2.1 Principal investments over the last three fiscal years<br />

The Group’s property, plant and equipment mainly consists of the transmission equipment necessary for<br />

operating its network, the modems and DSLAMs used for Free’s broadband Internet access service offering, the<br />

rights to use optical fiber held by the Group under the terms of IRU agreements, and the cabling costs payable to<br />

France Télécom. The cash flow statements for the years concerned provide a detailed breakdown of the Group’s<br />

capital expenditures and the methods used to finance them.<br />

Over the last three fiscal years, the Group acquired the following non-current assets, including through finance<br />

leases:<br />

(In € thousands) 2005 2006 2007<br />

Intangible assets ................................................... 1,075 1,617 1,857<br />

Property, plant and equipment ...................................... 209,197 323,285 374,678<br />

TOTAL ...................................................... 210,272 324,902 376,535<br />

The investments over the last three fiscal years were as follows:<br />

• In 2005: Acquisition of IFW for €57.9 million;<br />

• In 2006: Acquisition of PN (recently renamed Free Infrastructure) for €40,000 and acquisition of Citéfibre<br />

for €2.9 million.<br />

5.2.2 Principal investments in progress<br />

Since the beginning of 2008, the Group’s principal investments represented (i) growth-related expenditure which<br />

directly depends on the number of new customers won – such as Freeboxes, Freebox DSLAMs and service<br />

access fees or wiring connection costs invoiced by France Télécom; (ii) network-related expenditure – including<br />

expenditure incurred to increase network density invested jointly with private operators or local authorities, or<br />

under IRU agreements; and (iii) expenditure relating to the launch of FTTH programs.<br />

Financing<br />

These investments are financed by cash flows from operating activities.<br />

5.2.3 Principal future investments<br />

In September 2006, the Group announced that it intended to roll out an optical fiber network providing a direct<br />

connection to the homes of its subscribers (using fiber-to-the-home, or FTTH technology). The total related<br />

capital expenditure, which will be incurred between 2006 and 2012, will amount to some €1 billion. The overall<br />

investment program will be financed mainly from cash flows generated by the Group’s operations and by the<br />

proceeds of the June 2006 OCEANE bond issue. The main aspects of the program remained the same in 2007.<br />

10 Sources: <strong>Iliad</strong>/Arcep/France Télécom<br />

18 - <strong>Iliad</strong> – Registration Document 2007