REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

- TAGS

- registration

- iliad

- iliad.fr

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

20. <strong>FINANCIAL</strong> INFORMATION CONCERNING THE COMPANY’S ASSETS <strong>AND</strong> LIABILITIES,<br />

<strong>FINANCIAL</strong> POSITION <strong>AND</strong> PROFITS <strong>AND</strong> LOSSES<br />

20.2 PARENT COMPANY <strong>FINANCIAL</strong> STATEMENTS FOR 2007<br />

5.1 CONSOLIDATION<br />

5 OTHER INFORMATION<br />

<strong>Iliad</strong> SA prepares consolidated financial statements in its capacity as parent company of the <strong>Iliad</strong> Group.<br />

5.2 TAX-RELATED INFORMATION<br />

5.2.1 Tax group<br />

<strong>Iliad</strong> has set up a tax group which included the following companies in 2007:<br />

• SA ILIAD • SA IH<br />

• SA CENTRAPEL • SASU IRE<br />

• SA CITEFIBRE • SA KEDRA<br />

• SAS FREE • SAS ONE TEL<br />

• SAS FREE BOX • SASU ONLINE<br />

• SASU FREE INFRASTRUCTURE • SARL SNDM<br />

• SASU IFW • SARL TOUTCOM<br />

The following rules apply within the tax group:<br />

• Each company in the tax group, including the parent company, records in its accounts the amount of tax that<br />

it would have paid on a stand-alone basis.<br />

• Any tax savings relating to tax losses made by members of the tax group are held at the level of the parent<br />

company and therefore do not have any impact on profit.<br />

For as long as they remain members of the tax group, subsidiaries may offset their tax losses generated<br />

during their membership of the tax group against future taxable income.<br />

<strong>Iliad</strong> records these tax savings on the liabilities side of its balance sheet under “Other liabilities”. They<br />

totaled €3,910,000 at December 31, 2007.<br />

• Any tax charges or savings relating to adjustments to total earnings, as well as any tax credits for lossmaking<br />

companies, are recorded at the level of <strong>Iliad</strong> SA.<br />

• No payments in relation to these matters may be due by <strong>Iliad</strong> when a company leaves the tax group.<br />

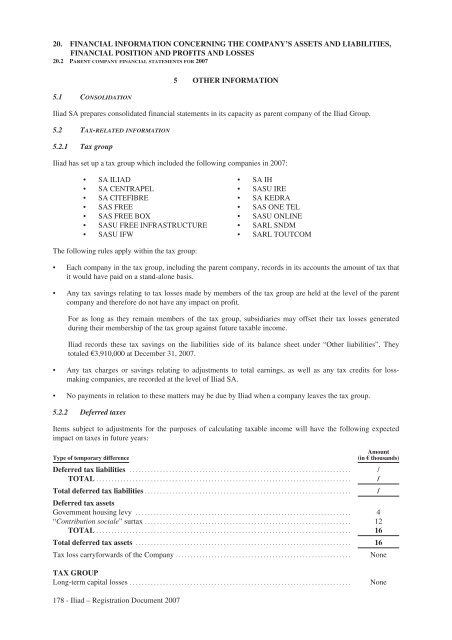

5.2.2 Deferred taxes<br />

Items subject to adjustments for the purposes of calculating taxable income will have the following expected<br />

impact on taxes in future years:<br />

Type of temporary difference<br />

Amount<br />

(in € thousands)<br />

Deferred tax liabilities ......................................................................... /<br />

TOTAL .................................................................................... /<br />

Total deferred tax liabilities ....................................................................<br />

Deferred tax assets<br />

/<br />

Government housing levy ....................................................................... 4<br />

“Contribution sociale” surtax .................................................................... 12<br />

TOTAL .................................................................................... 16<br />

Total deferred tax assets ....................................................................... 16<br />

Tax loss carryforwards of the Company .......................................................... None<br />

TAX GROUP<br />

Long-term capital losses ......................................................................... None<br />

178 - <strong>Iliad</strong> – Registration Document 2007