REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

- TAGS

- registration

- iliad

- iliad.fr

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

20. <strong>FINANCIAL</strong> INFORMATION CONCERNING THE COMPANY’S ASSETS <strong>AND</strong> LIABILITIES,<br />

<strong>FINANCIAL</strong> POSITION <strong>AND</strong> PROFITS <strong>AND</strong> LOSSES<br />

20.1 CONSOLIDATED <strong>FINANCIAL</strong> STATEMENTS FOR 2007, 2006 <strong>AND</strong> 2005<br />

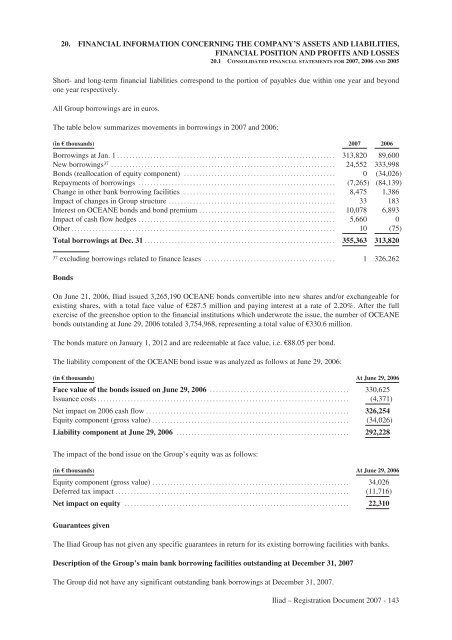

Short- and long-term financial liabilities correspond to the portion of payables due within one year and beyond<br />

one year respectively.<br />

All Group borrowings are in euros.<br />

The table below summarizes movements in borrowings in 2007 and 2006:<br />

(in € thousands) 2007 2006<br />

Borrowings at Jan. 1 ........................................................................ 313,820 89,600<br />

New borrowings37 .......................................................................... 24,552 333,998<br />

Bonds (reallocation of equity component) .................................................. 0 (34,026)<br />

Repayments of borrowings ................................................................. (7,265) (84,139)<br />

Change in other bank borrowing facilities .................................................. 8,475 1,386<br />

Impact of changes in Group structure ....................................................... 33 183<br />

Interest on OCEANE bonds and bond premium ............................................. 10,078 6,893<br />

Impact of cash flow hedges ................................................................. 5,660 0<br />

Other ....................................................................................... 10 (75)<br />

Total borrowings at Dec. 31 ............................................................... 355,363 313,820<br />

37 excluding borrowings related to finance leases ........................................... 1 326,262<br />

Bonds<br />

On June 21, 2006, <strong>Iliad</strong> issued 3,265,190 OCEANE bonds convertible into new shares and/or exchangeable for<br />

existing shares, with a total face value of €287.5 million and paying interest at a rate of 2.20%. After the full<br />

exercise of the greenshoe option to the financial institutions which underwrote the issue, the number of OCEANE<br />

bonds outstanding at June 29, 2006 totaled 3,754,968, representing a total value of €330.6 million.<br />

The bonds mature on January 1, 2012 and are redeemable at face value, i.e. €88.05 per bond.<br />

The liability component of the OCEANE bond issue was analyzed as follows at June 29, 2006:<br />

(in € thousands) At June 29, 2006<br />

Face value of the bonds issued on June 29, 2006 .............................................. 330,625<br />

Issuance costs ................................................................................... (4,371)<br />

Net impact on 2006 cash flow ................................................................... 326,254<br />

Equity component (gross value) ................................................................. (34,026)<br />

Liability component at June 29, 2006 ......................................................... 292,228<br />

The impact of the bond issue on the Group’s equity was as follows:<br />

(in € thousands) At June 29, 2006<br />

Equity component (gross value) ................................................................. 34,026<br />

Deferred tax impact ............................................................................. (11,716)<br />

Net impact on equity .......................................................................... 22,310<br />

Guarantees given<br />

The <strong>Iliad</strong> Group has not given any specific guarantees in return for its existing borrowing facilities with banks.<br />

Description of the Group’s main bank borrowing facilities outstanding at December 31, 2007<br />

The Group did not have any significant outstanding bank borrowings at December 31, 2007.<br />

<strong>Iliad</strong> – Registration Document 2007 - 143