REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

- TAGS

- registration

- iliad

- iliad.fr

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

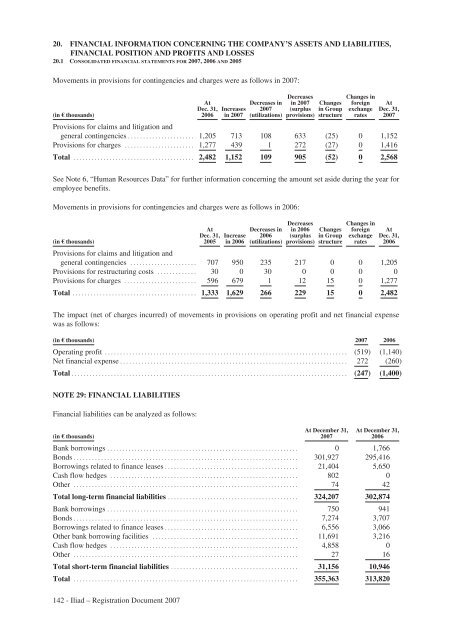

20. <strong>FINANCIAL</strong> INFORMATION CONCERNING THE COMPANY’S ASSETS <strong>AND</strong> LIABILITIES,<br />

<strong>FINANCIAL</strong> POSITION <strong>AND</strong> PROFITS <strong>AND</strong> LOSSES<br />

20.1 CONSOLIDATED <strong>FINANCIAL</strong> STATEMENTS FOR 2007, 2006 <strong>AND</strong> 2005<br />

Movements in provisions for contingencies and charges were as follows in 2007:<br />

(in € thousands)<br />

At<br />

Dec. 31,<br />

2006<br />

Increases<br />

in 2007<br />

Decreases in<br />

2007<br />

(utilizations)<br />

Decreases<br />

in 2007<br />

(surplus<br />

provisions)<br />

Changes<br />

in Group<br />

structure<br />

Changes in<br />

foreign<br />

exchange<br />

rates<br />

At<br />

Dec. 31,<br />

2007<br />

Provisions for claims and litigation and<br />

general contingencies ...................... 1,205 713 108 633 (25) 0 1,152<br />

Provisions for charges ....................... 1,277 439 1 272 (27) 0 1,416<br />

Total ........................................ 2,482 1,152 109 905 (52) 0 2,568<br />

See Note 6, “Human Resources Data” for further information concerning the amount set aside during the year for<br />

employee benefits.<br />

Movements in provisions for contingencies and charges were as follows in 2006:<br />

(in € thousands)<br />

At<br />

Dec. 31,<br />

2005<br />

Increase<br />

in 2006<br />

Decreases in<br />

2006<br />

(utilizations)<br />

Decreases<br />

in 2006<br />

(surplus<br />

provisions)<br />

Changes<br />

in Group<br />

structure<br />

Changes in<br />

foreign<br />

exchange<br />

rates<br />

At<br />

Dec. 31,<br />

2006<br />

Provisions for claims and litigation and<br />

general contingencies ...................... 707 950 235 217 0 0 1,205<br />

Provisions for restructuring costs ............. 30 0 30 0 0 0 0<br />

Provisions for charges ........................ 596 679 1 12 15 0 1,277<br />

Total ......................................... 1,333 1,629 266 229 15 0 2,482<br />

The impact (net of charges incurred) of movements in provisions on operating profit and net financial expense<br />

was as follows:<br />

(in € thousands) 2007 2006<br />

Operating profit ................................................................................ (519) (1,140)<br />

Net financial expense ........................................................................... 272 (260)<br />

Total ........................................................................................... (247) (1,400)<br />

NOTE 29: <strong>FINANCIAL</strong> LIABILITIES<br />

Financial liabilities can be analyzed as follows:<br />

At December 31, At December 31,<br />

(in € thousands)<br />

2007<br />

2006<br />

Bank borrowings ............................................................... 0 1,766<br />

Bonds .......................................................................... 301,927 295,416<br />

Borrowings related to finance leases ............................................ 21,404 5,650<br />

Cash flow hedges .............................................................. 802<br />

0<br />

Other .......................................................................... 74<br />

42<br />

Total long-term financial liabilities ........................................... 324,207 302,874<br />

Bank borrowings ............................................................... 750<br />

941<br />

Bonds .......................................................................... 7,274 3,707<br />

Borrowings related to finance leases ............................................ 6,556 3,066<br />

Other bank borrowing facilities ................................................ 11,691 3,216<br />

Cash flow hedges .............................................................. 4,858<br />

0<br />

Other .......................................................................... 27<br />

16<br />

Total short-term financial liabilities .......................................... 31,156 10,946<br />

Total .......................................................................... 355,363 313,820<br />

142 - <strong>Iliad</strong> – Registration Document 2007