REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

REGISTRATION DOCUMENT AND FINANCIAL REPORT - Iliad

- TAGS

- registration

- iliad

- iliad.fr

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

21.1 SHARE CAPITAL<br />

21.1.1 Amount of share capital<br />

21. ADDITIONAL INFORMATION<br />

21. ADDITIONAL INFORMATION<br />

21.1 SHARE CAPITAL<br />

At the date this registration document was filed, the Company’s share capital amounted to €12,013,188.97,<br />

divided into 54,211,067 shares, all issued, fully paid up and of the same class. The par value of the shares is not<br />

set in the Company’s bylaws.<br />

21.1.2 Shares not representing capital<br />

At the date this registration document was filed, the Company has not issued any shares not representing capital.<br />

21.1.3 Share buyback programs<br />

The eighth resolution of the May 29, 2007 Shareholders’ Meeting authorized the Board of Directors, with<br />

authority to delegate under the terms provided by law, to acquire shares representing up to 4% of the Company’s<br />

capital. This authorization was granted for a period of eighteen months and remains in effect until November 27,<br />

2008.<br />

The maximum purchase price under this program is €200 per share.<br />

The objectives of the share buyback program, in decreasing order of priority, were as follows:<br />

• Market making for the Company’s shares under a liquidity contract that complies with the code of ethics of<br />

the French Association of Investment Firms (AFEI) which is recognized by the French securities regulator<br />

(AMF) as an approved market practice.<br />

• To allocate shares to employees and corporate officers of the Company and Group subsidiaries, in<br />

accordance with the applicable legislation, including by awarding bonus shares, as permitted by Articles<br />

L.225-197-1 et seq. of the French Commercial Code, or by granting stock options in accordance with<br />

Articles L.225-179 et seq. of the French Commercial Code, or in relation to profit-sharing schemes.<br />

• To allocate shares on the exercise of stock options granted to the Company’s employees and corporate<br />

officers in accordance with the law.<br />

• To purchase shares to be held and subsequently used in connection with external growth transactions (as<br />

consideration, in exchange for shares in another company, or any other use).<br />

• To cancel all or some of the shares purchased, provided that the May 29, 2007 Extraordinary Shareholders’<br />

Meeting adopts the fourteenth resolution set out below.<br />

• To attribute shares on redemption, conversion, exercise or exchange of share equivalents.<br />

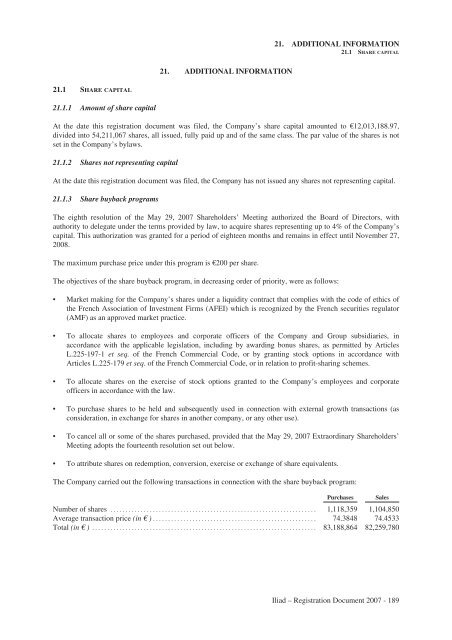

The Company carried out the following transactions in connection with the share buyback program:<br />

Purchases Sales<br />

Number of shares .................................................................... 1,118,359 1,104,850<br />

Average transaction price (in € ) ...................................................... 74.3848 74.4533<br />

Total (in € ) .......................................................................... 83,188,864 82,259,780<br />

<strong>Iliad</strong> – Registration Document 2007 - 189