Nordea1, SICAV 2011 pusmeÄio ataskaita - Nordea Bank Lietuva

Nordea1, SICAV 2011 pusmeÄio ataskaita - Nordea Bank Lietuva

Nordea1, SICAV 2011 pusmeÄio ataskaita - Nordea Bank Lietuva

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

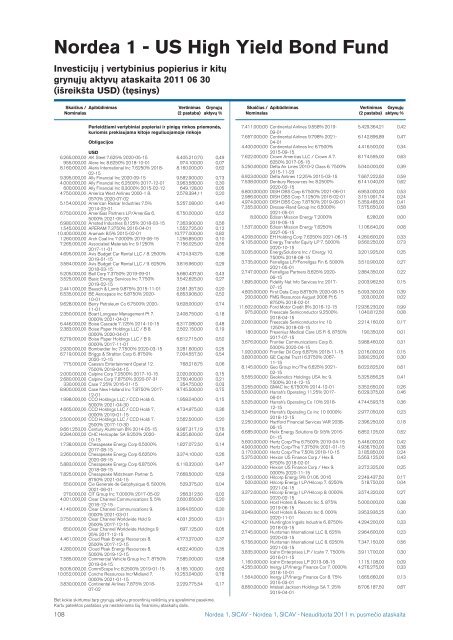

<strong>Nordea</strong> 1 - US High Yield Bond Fund<br />

Investicijų į vertybinius popierius ir kitų<br />

grynųjų aktyvų <strong>ataskaita</strong> <strong>2011</strong> 06 30<br />

(išreikšta USD) (tęsinys)<br />

Skaičius / Apibūdinimas<br />

Nominalas<br />

Vertinimas<br />

(2 pastaba)<br />

Grynųjų<br />

aktyvų %<br />

Skaičius / Apibūdinimas<br />

Nominalas<br />

Vertinimas<br />

(2 pastaba)<br />

Grynųjų<br />

aktyvų %<br />

Perleidžiami vertybiniai popieriai ir pinigų rinkos priemonės,<br />

kuriomis prekiaujama kitoje reguliuojamoje rinkoje<br />

Obligacijos<br />

USD<br />

6.265.000,00 AK Steel 7.625% 2020-05-15 6.405.210,70 0,49<br />

955.000,00 Alere Inc 8.6250% 2018-10-01 974.100,00 0,07<br />

8.160.000,00 Aleris International Inc 7.6250% 2018- 8.160.000,00 0,62<br />

02-15<br />

9.395.000,00 Ally Financial Inc 2020-09-15 9.582.900,00 0,73<br />

4.000.000,00 Ally Financial Inc 6.2500% 2017-12-01 3.963.580,00 0,30<br />

600.000,00 Ally Financial Inc 8.3000% 2015-02-12 649.128,00 0,05<br />

4.750.000,00 America West Airlines 2000-1 8.<br />

2.578.394,11 0,20<br />

0570% 2020-07-02<br />

5.154.000,00 American Railcar Industries 7.5%<br />

5.257.080,00 0,40<br />

2014-03-01<br />

6.750.000,00 AmeriGas Partners LP/AmeriGa 6. 6.750.000,00 0,52<br />

5000% 2021-05-20<br />

6.980.000,00 Amsted Industries 8.125% 2018-03-15 7.363.900,00 0,56<br />

1.545.000,00 APERAM 7.3750% 2016-04-01 1.552.725,00 0,12<br />

10.400.000,00 Aramark 8.5% 2015-02-01 10.777.000,00 0,82<br />

1.260.000,00 Arch Coal Inc 7.0000% 2019-06-15 1.256.850,00 0,10<br />

7.265.000,00 Associated Materials Inc 9.1250% 7.156.025,00 0,55<br />

2017-11-01<br />

4.695.000,00 Avis Budget Car Rental LLC / 8. 2500% 4.724.343,75 0,36<br />

2019-01-15<br />

3.584.000,00 Avis Budget Car Rental LLC / 9. 6250% 3.816.960,00 0,29<br />

2018-03-15<br />

5.205.000,00 Ball Corp 7.3750% 2019-09-01 5.660.437,50 0,43<br />

3.525.000,00 Basic Energy Services Inc 7.750% 3.542.625,00 0,27<br />

2019-02-15<br />

2.441.000,00 Bausch & Lomb 9.875% 2015-11-01 2.581.357,50 0,20<br />

6.535.000,00 BE Aerospace Inc 6.8750% 2020- 6.853.908,00 0,52<br />

10-01<br />

9.628.000,00 Berry Petroleum Co 6.7500% 2020- 9.628.000,00 0,74<br />

11-01<br />

2.350.000,00 Boart Longyear Management Pt 7. 2.408.750,00 0,18<br />

0000% 2021-04-01<br />

6.446.000,00 Boise Cascade 7.125% 2014-10-15 6.317.080,00 0,48<br />

2.383.000,00 Boise Paper Holdings LLC / B 8.<br />

2.502.150,00 0,19<br />

0000% 2020-04-01<br />

6.279.000,00 Boise Paper Holdings LLC / B 9.<br />

6.812.715,00 0,52<br />

0000% 2017-11-01<br />

2.930.000,00 Bombardier Inc 7.7500% 2020-03-15 3.281.600,00 0,25<br />

6.719.000,00 Briggs & Stratton Corp 6. 8750%<br />

7.004.557,50 0,54<br />

2020-12-15<br />

775.000,00 Caesars Entertainment Operat 12.<br />

768.218,75 0,06<br />

7500% 2018-04-15<br />

2.000.000,00 Calpine Corp 7.2500% 2017-10-15 2.020.000,00 0,15<br />

2.680.000,00 Calpine Corp 7.8750% 2020-07-31 2.760.400,00 0,21<br />

330.000,00 Case 7.25% 2016-01-15 354.750,00 0,03<br />

8.900.000,00 Case New Holland Inc 7.8750% 2017- 9.745.500,00 0,75<br />

12-01<br />

1.998.000,00 CCO Holdings LLC / CCO Holdi 6. 1.958.040,00 0,15<br />

5000% 2021-04-30<br />

4.665.000,00 CCO Holdings LLC / CCO Holdi 7. 4.734.975,00 0,36<br />

0000% 2019-01-15<br />

2.500.000,00 CCO Holdings LLC / CCO Holdi 7. 2.562.500,00 0,20<br />

2500% 2017-10-30<br />

9.661.250,00 Century Aluminum 8% 2014-05-15 9.987.317,19 0,76<br />

9.284.000,00 CHC Helicopter SA 9.250% 2020- 8.355.600,00 0,64<br />

10-15<br />

1.738.000,00 Chesapeake Energy Corp 6.5000% 1.827.072,50 0,14<br />

2017-08-15<br />

3.260.000,00 Chesapeake Energy Corp 6.6250% 3.374.100,00 0,26<br />

2020-08-15<br />

5.883.000,00 Chesapeake Energy Corp 6.8750% 6.118.320,00 0,47<br />

2018-08-15<br />

7.825.000,00 Chesapeake Midstream Partner 5.<br />

7.668.500,00 0,59<br />

8750% 2021-04-15<br />

550.000,00 Cie Generale de Geophysique 6. 5000% 529.375,00 0,04<br />

2021-06-01<br />

270.000,00 CIT Group Inc 7.0000% 2017-05-02 268.312,50 0,02<br />

4.001.000,00 Clear Channel Communications 5. 5% 2.600.650,00 0,20<br />

2016-12-15<br />

4.140.000,00 Clear Channel Communications 9.<br />

3.964.050,00 0,30<br />

0000% 2021-03-01<br />

3.750.000,00 Clear Channel Worldwide Hold 9.<br />

4.031.250,00 0,31<br />

2500% 2017-12-15<br />

650.000,00 Clear Channel Worldwide Holdings 9 697.125,00 0,05<br />

25% 2017-12-15<br />

4.461.000,00 Cloud Peak Energy Resources 8.<br />

4.773.270,00 0,37<br />

2500% 2017-12-15<br />

4.280.000,00 Cloud Peak Energy Resources 8.<br />

4.622.400,00 0,35<br />

5000% 2019-12-15<br />

7.585.000,00 Commercial Vehicle Group Inc 7. 8750% 7.585.000,00 0,58<br />

2019-04-15<br />

8.005.000,00 CommScope Inc 8.2500% 2019-01-15 8.165.100,00 0,62<br />

10.052.000,00 Concho Resources Inc/Midland 7. 10.253.040,00 0,78<br />

0000% 2021-01-15<br />

3.830.000,00 Continental Airlines 7.875% 2018-<br />

07-02<br />

2.229.775,54 0,17<br />

Bet kokie skirtumai tarp grynųjų aktyvų procentinių reikšmių yra apvalinimo pasekmė.<br />

Kartu pateiktos pastabos yra neatskiriama šių finansinių ataskaitų dalis.<br />

7.411.000,00 Continental Airlines 9.558% 2019- 5.429.364,21 0,42<br />

09-01<br />

7.657.000,00 Continental Airlines 9.798% 2021- 6.142.896,89 0,47<br />

04-01<br />

4.400.000,00 Continental Airlines Inc 6.7500%<br />

4.416.500,00 0,34<br />

2015-09-15<br />

7.622.000,00 Crown Americas LLC / Crown A 7. 8.174.595,00 0,63<br />

6250% 2017-05-15<br />

5.250.000,00 Delta Air Lines 2010-2 Class 6. 7500% 5.040.000,00 0,39<br />

2015-11-23<br />

6.923.000,00 Delta Airlines 12,25% 2015-03-15 7.667.222,50 0,59<br />

7.538.000,00 Denbury Resources Inc 8.2500%<br />

8.141.040,00 0,62<br />

2020-02-15<br />

6.800.000,00 DISH DBS Corp 6.7500% 2021-06-01 6.953.000,00 0,53<br />

2.986.000,00 DISH DBS Corp 7.1250% 2016-02-01 3.151.991,74 0,24<br />

4.974.000,00 DISH DBS Corp 7.8750% 2019-09-01 5.359.485,00 0,41<br />

7.355.000,00 Dresser-Rand Group Inc 6.5000% 7.575.650,00 0,58<br />

2021-05-01<br />

8.000,00 Edison Mission Energy 7.2000%<br />

6.280,00 0,00<br />

2019-05-15<br />

1.537.000,00 Edison Mission Energy 7.6250%<br />

1.106.640,00 0,08<br />

2027-05-15<br />

4.208.000,00 EH Holding Corp 7.6250% 2021-06-15 4.260.600,00 0,33<br />

9.105.000,00 Energy Transfer Equity LP 7. 5000% 9.560.250,00 0,73<br />

2020-10-15<br />

3.035.000,00 EnergySolutions Inc / Energy 10.<br />

3.201.925,00 0,25<br />

7500% 2018-08-15<br />

3.735.000,00 Ferrellgas LP/Ferrellgas Fin 6. 5000% 3.510.900,00 0,27<br />

2021-05-01<br />

2.747.000,00 Ferrellgas Partners 8.625% 2020- 2.884.350,00 0,22<br />

06-15<br />

1.895.000,00 Fidelity Nat Info Services Inc 2017- 2.003.962,50 0,15<br />

07-15<br />

4.805.000,00 First Data Corp 8.8750% 2020-08-15 5.093.300,00 0,39<br />

200.000,00 FMG Resources August 2006 Pt 6.<br />

203.000,00 0,02<br />

8750% 2018-02-01<br />

11.602.000,00 Ford Motor Credit 8% 2016-12-15 12.936.230,00 0,99<br />

975.000,00 Freescale Semiconductor 9.2500% 1.040.812,50 0,08<br />

2018-04-15<br />

2.000.000,00 Freescale Semiconductor Inc 10.<br />

2.214.160,00 0,17<br />

1250% 2018-03-15<br />

180.000,00 Fresenius Medical Care US Fi 6. 8750% 190.350,00 0,01<br />

2017-07-15<br />

3.676.000,00 Frontier Communications Corp 8.<br />

3.988.460,00 0,31<br />

5000% 2020-04-15<br />

1.920.000,00 Frontier Oil Corp 6.875% 2018-11-15 2.016.000,00 0,15<br />

3.800.000,00 GE Capital Trust I 6.3750% 2067- 3.890.250,00 0,30<br />

11-15<br />

8.145.000,00 Geo Group Inc/The 6.625% 2021- 8.022.825,00 0,61<br />

02-15<br />

5.555.000,00 Geokinetics Holdings USA Inc 9.<br />

5.325.856,25 0,41<br />

7500% 2014-12-15<br />

3.255.000,00 GMAC Inc 6.7500% 2014-12-01 3.352.650,00 0,26<br />

5.500.000,00 Harrah’s Operating 11.25% 2017- 6.029.375,00 0,46<br />

06-01<br />

5.525.000,00 Harrah’s Operating Co 10% 2018- 4.744.593,75 0,36<br />

12-15<br />

3.345.000,00 Harrah’s Operating Co Inc 10 0000% 2.977.050,00 0,23<br />

2018-12-15<br />

2.250.000,00 Hartford Financial Services VAR 2038- 2.396.250,00 0,18<br />

06-15<br />

6.685.000,00 Helix Energy Solutions Gr 9.5% 2016- 6.852.125,00 0,52<br />

01-15<br />

5.600.000,00 Hertz Corp/The 6.7500% 2019-04-15 5.446.000,00 0,42<br />

4.900.000,00 Hertz Corp/The 7.3750% 2021-01-15 4.936.750,00 0,38<br />

3.170.000,00 Hertz Corp/The 7.50% 2018-10-15 3.185.850,00 0,24<br />

5.375.000,00 Hexion US Finance Corp / Hex 8.<br />

5.563.125,00 0,43<br />

8750% 2018-02-01<br />

3.220.000,00 Hexion US Finance Corp / Hex 9.<br />

3.272.325,00 0,25<br />

0000% 2020-11-15<br />

2.150.000,00 Hilcorp Energy 9% 01.06. 2016 2.249.437,50 0,17<br />

500.000,00 Hilcorp Energy I LP/Hilcorp 7. 6250% 518.750,00 0,04<br />

2021-04-15<br />

3.372.000,00 Hilcorp Energy I LP/Hilcorp 8. 0000% 3.574.320,00 0,27<br />

2020-02-15<br />

5.000.000,00 Host Hotels & Resorts Inc 5. 875% 5.000.000,00 0,38<br />

2019-06-15<br />

3.949.000,00 Host Hotels & Resorts Inc 6. 000% 3.953.936,25 0,30<br />

2020-11-01<br />

4.210.000,00 Huntington Ingalls Industrie 6. 8750% 4.294.200,00 0,33<br />

2018-03-15<br />

2.745.000,00 Huntsman International LLC 8, 625% 2.964.600,00 0,23<br />

2020-03-15<br />

6.756.000,00 Huntsman International LLC 8. 6250% 7.347.150,00 0,56<br />

2021-03-15<br />

3.835.000,00 Icahn Enterprises LP / Icahn 7. 7500% 3.911.700,00 0,30<br />

2016-01-15<br />

1.160.000,00 Icahn Enterprises LP 2013-08-15 1.115.108,00 0,09<br />

4.255.000,00 Inergy LP/Inergy Finance Cor 7. 0000% 4.276.275,00 0,33<br />

2018-10-01<br />

1.564.000,00 Inergy LP/Inergy Finance Cor 8. 75% 1.665.660,00 0,13<br />

2015-03-01<br />

8.850.000,00 Intelsat Jackson Holdings SA 7. 25%<br />

2019-04-01<br />

8.706.187,50 0,67<br />

108 <strong>Nordea</strong> 1, <strong>SICAV</strong> - <strong>Nordea</strong> 1, <strong>SICAV</strong> - Neaudituota <strong>2011</strong> m. pusmečio <strong>ataskaita</strong>