Nordea1, SICAV 2011 pusmeÄio ataskaita - Nordea Bank Lietuva

Nordea1, SICAV 2011 pusmeÄio ataskaita - Nordea Bank Lietuva

Nordea1, SICAV 2011 pusmeÄio ataskaita - Nordea Bank Lietuva

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

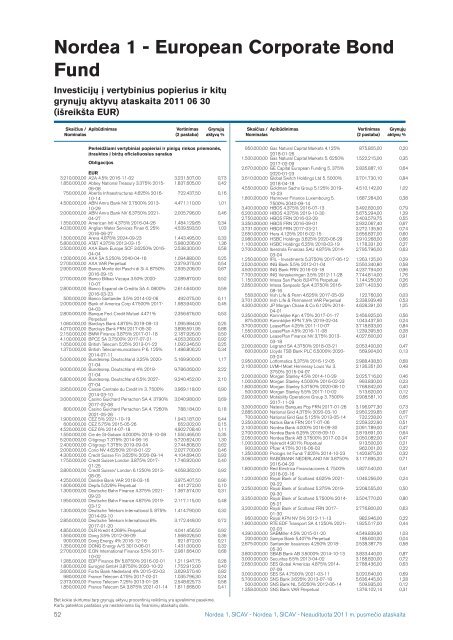

<strong>Nordea</strong> 1 - European Corporate Bond<br />

Fund<br />

Investicijų į vertybinius popierius ir kitų<br />

grynųjų aktyvų <strong>ataskaita</strong> <strong>2011</strong> 06 30<br />

(išreikšta EUR)<br />

Skaičius / Apibūdinimas<br />

Nominalas<br />

Vertinimas<br />

(2 pastaba)<br />

Grynųjų<br />

aktyvų %<br />

Skaičius / Apibūdinimas<br />

Nominalas<br />

Vertinimas<br />

(2 pastaba)<br />

Grynųjų<br />

aktyvų %<br />

Perleidžiami vertybiniai popieriai ir pinigų rinkos priemonės,<br />

įtrauktos į biržų oficialiuosius sąrašus<br />

Obligacijos<br />

EUR<br />

3.210.000,00 A2A 4.5% 2016-11-02 3.231.507,00 0,73<br />

1.850.000,00 Abbey National Treasury 3.375% 2015- 1.837.605,00 0,42<br />

06-08<br />

750.000,00 Abertis Infraestructuras 4.625% 2016- 722.437,50 0,16<br />

10-14<br />

4.500.000,00 ABN Amro <strong>Bank</strong> NV 2.7500% 2013- 4.471.110,00 1,01<br />

10-29<br />

2.000.000,00 ABN Amro <strong>Bank</strong> NV 6.3750% 2021- 2.005.796,00 0,46<br />

04-27<br />

1.550.000,00 American Intl 4.375% 2016-04-26 1.484.129,65 0,34<br />

4.030.000,00 Anglian Water Services Finan 6. 25% 4.539.593,50 1,03<br />

2016-06-27<br />

1.500.000,00 Areva 4.875% 2024-09-23 1.443.495,00 0,33<br />

5.800.000,00 AT&T 4.375% 2013-03-15 5.980.206,00 1,36<br />

2.500.000,00 AXA <strong>Bank</strong> Europe SCF 3.6250% 2016- 2.538.300,00 0,58<br />

04-04<br />

1.200.000,00 AXA SA 5.250% 2040-04-16 1.094.880,00 0,25<br />

2.700.000,00 AXA VAR Perpetual 2.379.375,00 0,54<br />

2.900.000,00 Banca Monte dei Paschi di Si 4. 8750% 2.935.206,00 0,67<br />

2016-09-15<br />

2.700.000,00 Banco Bilbao Vizcaya 3.50% 2020- 2.289.870,00 0,52<br />

10-07<br />

2.800.000,00 Banco Espanol de Credito SA 4. 0800% 2.614.640,00 0,59<br />

2016-03-23<br />

500.000,00 Banco Santander 3.5% 2014-02-06 492.075,00 0,11<br />

2.000.000,00 <strong>Bank</strong> of America Corp 4.7500% 2017- 1.983.940,00 0,45<br />

04-03<br />

2.800.000,00 Banque Fed. Credit Mutuel 4.471% 2.356.676,00 0,53<br />

Perpetual<br />

1.080.000,00 Barclays <strong>Bank</strong> 4.875% 2019-08-13 1.095.984,00 0,25<br />

4.070.000,00 Barclays <strong>Bank</strong> FRN 2017-05-30 3.898.591,95 0,88<br />

2.150.000,00 BMW Finance 3.875% 2017-01-18 2.187.926,00 0,50<br />

4.100.000,00 BPCE SA 3.7500% 2017-07-21 4.053.260,00 0,92<br />

1.050.000,00 British Telecom 5.25% 2013-01-22 1.092.346,50 0,25<br />

1.370.000,00 British Telecommunications P 6. 125% 1.486.806,20 0,34<br />

2014-07-11<br />

5.000.000,00 Bundesrep. Deutschland 3.25% 2020- 5.169.900,00 1,17<br />

01-04<br />

9.000.000,00 Bundesrep. Deutschland 4% 2018- 9.786.060,00 2,22<br />

01-04<br />

6.800.000,00 Bundesrep. Deutschland 6.5% 2027- 9.240.452,00 2,10<br />

07-04<br />

3.950.000,00 Caisse Centrale du Credit Im 3. 7500% 3.969.118,00 0,90<br />

2014-03-10<br />

3.000.000,00 Casino Guichard Perrachon SA 4. 3790% 3.040.980,00 0,69<br />

2017-02-08<br />

800.000,00 Casino Guichard Perrachon SA 4. 7260% 788.184,00 0,18<br />

2021-05-26<br />

1.900.000,00 CEZ 5% 2021-10-19 1.943.187,00 0,44<br />

600.000,00 CEZ 5.75% 2015-05-26 652.002,00 0,15<br />

4.520.000,00 CEZ 6% 2014-07-18 4.902.708,40 1,11<br />

1.550.000,00 Cie de St-Gobain 4.0000% 2018-10-08 1.550.465,00 0,35<br />

5.200.000,00 Citigroup 7.375% 2014-06-16 5.720.624,00 1,30<br />

2.400.000,00 Citigroup 7.375% 2019-09-04 2.744.808,00 0,62<br />

2.000.000,00 Corio NV 4.6250% 2018-01-22 2.027.700,00 0,46<br />

4.300.000,00 Credit Suisse Fin 3.625% 2020-09-14 4.104.694,00 0,93<br />

1.750.000,00 Credit Suisse London 3.875% 2017- 1.746.920,00 0,40<br />

01-25<br />

3.800.000,00 Credit Suisse/ London 6.1250% 2013- 4.058.362,00 0,92<br />

08-05<br />

4.250.000,00 Danske <strong>Bank</strong> VAR 2018-03-16 3.975.407,50 0,90<br />

1.600.000,00 Depfa 5,029% Perpetual 441.272,00 0,10<br />

1.300.000,00 Deutsche Bahn Finance 4.375% 2021- 1.367.574,00 0,31<br />

09-23<br />

1.950.000,00 Deutsche Bahn Finance 4.875% 2019- 2.117.115,00 0,48<br />

03-12<br />

1.300.000,00 Deutsche Telekom International 5. 875% 1.414.790,00 0,32<br />

2014-09-10<br />

2.850.000,00 Deutsche Telekom International 6% 3.172.449,00 0,72<br />

2017-01-20<br />

4.850.000,00 DLR Kredit 4,269% Perpetual 4.041.456,50 0,92<br />

1.550.000,00 Dong 3.5% 2012-06-09 1.568.026,50 0,36<br />

900.000,00 Dong Energy 4% 2016-12-16 921.672,00 0,21<br />

1.350.000,00 DONG Energy A/S 3010-06-01 1.431.000,00 0,32<br />

2.700.000,00 E.ON International Finance 5.5% 2017- 2.981.664,00 0,68<br />

10-02<br />

1.285.000,00 EDP Finance BV 5.8750% 2016-02-01 1.211.947,75 0,28<br />

1.800.000,00 Eurogrid GmbH 3.8750% 2020-10-22 1.752.912,00 0,40<br />

3.600.000,00 Fortis <strong>Bank</strong> Nederland 4% 2015-02-03 3.629.570,40 0,82<br />

980.000,00 France Telecom 4.75% 2017-02-21 1.035.796,30 0,24<br />

2.373.000,00 France Telecom 7.25% 2013-01-28 2.548.625,73 0,58<br />

1.850.000,00 France Telecom SA 3.875% 2021-01-14 1.811.668,00 0,41<br />

950.000,00 Gas Natural Capital Markets 4.125% 875.805,00 0,20<br />

2018-01-26<br />

1.500.000,00 Gas Natural Capital Markets 5. 6250% 1.522.215,00 0,35<br />

2017-02-09<br />

2.670.000,00 GE Capital European Funding 5. 375% 2.835.887,10 0,64<br />

2020-01-23<br />

3.610.000,00 Global Switch Holdings Ltd 5. 5000% 3.701.730,10 0,84<br />

2018-04-18<br />

4.550.000,00 Goldman Sachs Group 5.125% 2019- 4.510.142,00 1,02<br />

10-23<br />

1.800.000,00 Hannover Finance Luxembourg 5. 1.687.284,00 0,38<br />

7500% 2040-09-14<br />

3.400.000,00 HBOS 4.375% 2016-07-13 3.492.820,00 0,79<br />

6.200.000,00 HBOS 4.375% 2019-10-30 5.675.294,00 1,29<br />

2.750.000,00 HBOS FRN 2016-03-29 2.403.579,75 0,55<br />

3.350.000,00 HBOS FRN 2016-09-01 2.932.067,40 0,67<br />

3.731.000,00 HBOS FRN 2017-03-21 3.272.135,50 0,74<br />

2.650.000,00 Hera 4.125% 2016-02-15 2.656.837,00 0,60<br />

2.980.000,00 HSBC Holdings 3.625% 2020-06-29 2.910.268,00 0,66<br />

1.100.000,00 HSBC Holdings 6.25% 2018-03-19 1.178.331,00 0,27<br />

2.700.000,00 Iberdrola Finanzas SAU 4.875% 2014- 2.795.796,00 0,63<br />

03-04<br />

1.250.000,00 IFIL - Investments 5.3750% 2017-06-12 1.263.125,00 0,29<br />

2.520.000,00 ING <strong>Bank</strong> 5.5% 2012-01-04 2.550.340,80 0,58<br />

4.500.000,00 ING <strong>Bank</strong> FRN 2016-03-18 4.237.794,00 0,96<br />

7.700.000,00 ING Verzekeringen 3.5% 2012-11-28 7.744.814,00 1,76<br />

1.150.000,00 Intesa San Paolo 8,047% Perpetual 1.144.250,00 0,26<br />

2.850.000,00 Intesa Sanpaolo SpA 4.3750% 2016- 2.871.403,50 0,65<br />

08-16<br />

558.000,00 Irish Life & Perm 4.625% 2017-05-09 122.760,00 0,03<br />

3.701.000,00 Irish Life & Permanent VAR Perpetual 2.338.939,48 0,53<br />

4.300.000,00 JP Morgan Chase & Co 6.125% 2014- 4.628.391,00 1,05<br />

04-01<br />

2.350.000,00 Koninklijke Kpn 4.75% 2017-01-17 2.456.925,00 0,56<br />

875.000,00 Koninklijke KPN 7.5% 2019-02-04 1.043.437,50 0,24<br />

3.700.000,00 LeasePlan 4.25% <strong>2011</strong>-10-07 3.718.833,00 0,84<br />

1.550.000,00 LeasePlan 4.5% 2016-11-08 1.239.395,50 0,28<br />

4.000.000,00 LeasePlan Finance NV 3.75% 2013- 4.027.600,00 0,91<br />

03-18<br />

2.000.000,00 Legrand SA 4.3750% 2018-03-21 2.053.400,00 0,47<br />

600.000,00 Lloyds TSB <strong>Bank</strong> PLC 6.5000% 2020- 569.904,00 0,13<br />

03-24<br />

2.950.000,00 Lottomatica 5,375% 2016-12-05 2.988.438,50 0,68<br />

2.100.000,00 LVMH Moet Hennessy Louis Vui 3. 2.136.351,00 0,48<br />

3750% 2015-04-07<br />

2.000.000,00 Morgan Stanley 4.5% 2014-10-29 2.025.716,00 0,46<br />

1.000.000,00 Morgan Stanley 4.5000% 2016-02-23 993.830,00 0,23<br />

1.800.000,00 Morgan Stanley 5.3750% 2020-08-10 1.768.842,00 0,40<br />

500.000,00 Morgan Stanley 5.5% 2017-10-02 513.620,00 0,12<br />

2.900.000,00 Motability Operations Group 3. 7500% 2.908.581,10 0,66<br />

2017-11-29<br />

3.300.000,00 Natexis Banques Pop FRN 2017-01-26 3.196.977,30 0,73<br />

2.885.000,00 National Grid 4,375% 2020-03-10 2.950.229,85 0,67<br />

700.000,00 National Grid Gas 5.125% 2013-05-14 732.228,00 0,17<br />

2.350.000,00 Natixis <strong>Bank</strong> FRN 2017-07-06 2.259.322,90 0,51<br />

2.100.000,00 <strong>Nordea</strong> <strong>Bank</strong> 4.000% 2016-09-30 2.091.789,00 0,47<br />

2.700.000,00 <strong>Nordea</strong> <strong>Bank</strong> 6.25% 2018-09-10 2.819.691,00 0,64<br />

2.050.000,00 <strong>Nordea</strong> <strong>Bank</strong> AB 3.7500% 2017-02-24 2.050.082,00 0,47<br />

1.000.000,00 Nykredit 4,901% Perpetual 913.500,00 0,21<br />

900.000,00 Pfizer 4.75% 2016-06-03 962.001,00 0,22<br />

1.350.000,00 Prologis Int Fundi 7.625% 2014-10-23 1.420.875,00 0,32<br />

3.060.000,00 RABOBANK NEDERLAND NV 3.8750% 3.117.895,20 0,71<br />

2016-04-20<br />

1.800.000,00 Red Electrica Financiaciones 4. 7500% 1.827.540,00 0,41<br />

2018-02-16<br />

1.200.000,00 Royal <strong>Bank</strong> of Scotland 4.625% 2021- 1.046.256,00 0,24<br />

09-22<br />

2.250.000,00 Royal <strong>Bank</strong> of Scotland 5.375% 2019- 2.208.555,00 0,50<br />

09-30<br />

3.350.000,00 Royal <strong>Bank</strong> of Scotland 5.7500% 2014- 3.504.770,00 0,80<br />

05-21<br />

3.200.000,00 Royal <strong>Bank</strong> of Scotland FRN 2017- 2.776.800,00 0,63<br />

01-30<br />

950.000,00 Royal KPN NV 5% 2012-11-13 982.946,00 0,22<br />

1.900.000,00 RTE EDF Transport SA 4.1250% 2021- 1.925.517,00 0,44<br />

02-03<br />

4.390.000,00 SABMiller 4.5% 2015-01-20 4.549.839,90 1,03<br />

200.000,00 Sampo <strong>Bank</strong> 5,407% Perpetual 186.600,00 0,04<br />

2.675.000,00 Santander Issuances 4.250% 2018- 2.538.387,75 0,58<br />

05-30<br />

3.800.000,00 SBAB <strong>Bank</strong> AB 3.5000% 2014-10-13 3.833.440,00 0,87<br />

3.000.000,00 Securitas 6.5% 2013-04-02 3.188.820,00 0,72<br />

2.650.000,00 SES Global Americas 4.875% 2014- 2.788.436,00 0,63<br />

07-09<br />

3.000.000,00 SES SA 4.7500% 2021-03-11 3.020.640,00 0,69<br />

5.700.000,00 SNS <strong>Bank</strong> 3.625% 2013-07-18 5.636.445,00 1,28<br />

500.000,00 SNS <strong>Bank</strong> NL 5.6250% 2012-06-14 509.935,00 0,12<br />

1.358.000,00 SNS <strong>Bank</strong> VAR Perpetual 1.376.102,14 0,31<br />

Bet kokie skirtumai tarp grynųjų aktyvų procentinių reikšmių yra apvalinimo pasekmė.<br />

Kartu pateiktos pastabos yra neatskiriama šių finansinių ataskaitų dalis.<br />

52 <strong>Nordea</strong> 1, <strong>SICAV</strong> - <strong>Nordea</strong> 1, <strong>SICAV</strong> - Neaudituota <strong>2011</strong> m. pusmečio <strong>ataskaita</strong>