DEGROOF EQUITIES - Banque Degroof

DEGROOF EQUITIES - Banque Degroof

DEGROOF EQUITIES - Banque Degroof

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

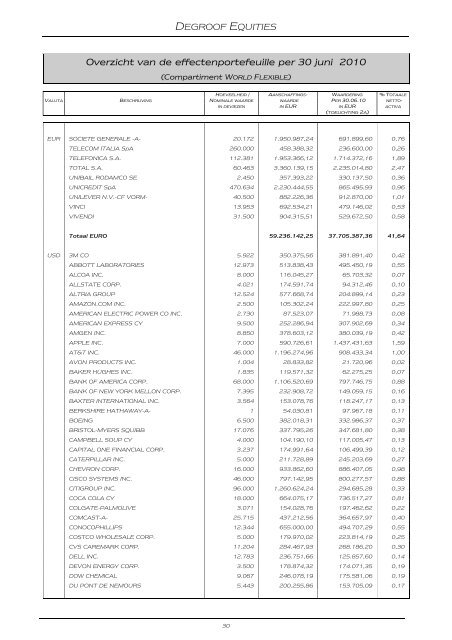

<strong>DEGROOF</strong> <strong>EQUITIES</strong><br />

Overzicht van de effectenportefeuille per 30 juni 2010<br />

(Compartiment WORLD FLEXIBLE)<br />

HOEVEELHEID / AANSCHAFFINGS- WAARDERING % TOTAALE<br />

VALUTA BESCHRIJVING NOMINALE WAARDE WAARDE PER 30.06.10 NETTO-<br />

IN DEVIEZEN IN EUR IN EUR<br />

(TOELICHTING 2A)<br />

ACTIVA<br />

EUR SOCIETE GENERALE -A- 20.172 1.950.987,24 691.899,60 0,76<br />

EUR TELECOM ITALIA SpA 260.000 458.388,32 236.600,00 0,26<br />

EUR TELEFONICA S.A. 112.381 1.953.366,12 1.714.372,16 1,89<br />

EUR TOTAL S.A. 60.463 3.360.139,15 2.235.014,80 2,47<br />

EUR UNIBAIL RODAMCO SE 2.450 357.393,22 330.137,50 0,36<br />

EUR UNICREDIT SpA 470.634 2.230.444,55 865.495,93 0,96<br />

EUR UNILEVER N.V.-CF VORM- 40.500 882.226,36 912.870,00 1,01<br />

EUR VINCI 13.953 692.534,21 479.146,02 0,53<br />

EUR VIVENDI 31.500 904.315,51 529.672,50 0,58<br />

Totaal EURO 59.236.142,25 37.705.387,36 41,64<br />

USD 3M CO 5.922 350.375,56 381.891,40 0,42<br />

USD ABBOTT LABORATORIES 12.973 513.838,43 495.450,19 0,55<br />

USD ALCOA INC. 8.000 116.045,27 65.703,32 0,07<br />

USD ALLSTATE CORP. 4.021 174.591,74 94.312,46 0,10<br />

USD ALTRIA GROUP 12.524 577.668,74 204.899,14 0,23<br />

USD AMAZON.COM INC. 2.500 105.302,24 222.997,80 0,25<br />

USD AMERICAN ELECTRIC POWER CO INC. 2.730 87.523,07 71.988,73 0,08<br />

USD AMERICAN EXPRESS CY 9.500 252.286,94 307.902,69 0,34<br />

USD AMGEN INC. 8.850 378.603,12 380.039,19 0,42<br />

USD APPLE INC. 7.000 590.726,61 1.437.431,63 1,59<br />

USD AT&T INC. 46.000 1.196.274,96 908.433,34 1,00<br />

USD AVON PRODUCTS INC. 1.004 28.833,82 21.720,96 0,02<br />

USD BAKER HUGHES INC. 1.835 119.571,32 62.275,25 0,07<br />

USD BANK OF AMERICA CORP. 68.000 1.106.520,69 797.746,75 0,88<br />

USD BANK OF NEW YORK MELLON CORP. 7.395 232.908,72 149.059,15 0,16<br />

USD BAXTER INTERNATIONAL INC. 3.564 153.078,76 118.247,17 0,13<br />

USD BERKSHIRE HATHAWAY-A- 1 54.030,81 97.967,18 0,11<br />

USD BOEING 6.500 382.018,31 332.986,37 0,37<br />

USD BRISTOL-MYERS SQUIBB 17.076 337.795,26 347.681,80 0,38<br />

USD CAMPBELL SOUP CY 4.000 104.190,10 117.005,47 0,13<br />

USD CAPITAL ONE FINANCIAL CORP. 3.237 174.991,64 106.499,39 0,12<br />

USD CATERPILLAR INC. 5.000 211.728,89 245.203,69 0,27<br />

USD CHEVRON CORP. 16.000 933.862,60 886.407,05 0,98<br />

USD CISCO SYSTEMS INC. 46.000 797.142,95 800.277,57 0,88<br />

USD CITIGROUP INC. 96.000 1.260.624,24 294.685,28 0,33<br />

USD COCA COLA CY 18.000 664.075,17 736.517,27 0,81<br />

USD COLGATE-PALMOLIVE 3.071 154.028,76 197.462,62 0,22<br />

USD COMCAST-A- 25.715 437.212,56 364.657,97 0,40<br />

USD CONOCOPHILLIPS 12.344 655.000,00 494.707,29 0,55<br />

USD COSTCO WHOLESALE CORP. 5.000 179.970,02 223.814,19 0,25<br />

USD CVS CAREMARK CORP. 11.204 284.467,93 268.186,20 0,30<br />

USD DELL INC. 12.783 236.751,66 125.857,60 0,14<br />

USD DEVON ENERGY CORP. 3.500 178.874,32 174.071,35 0,19<br />

USD DOW CHEMICAL 9.067 246.078,19 175.581,06 0,19<br />

USD DU PONT DE NEMOURS 5.443 200.255,86 153.705,09 0,17<br />

30