annual financial statement 2011 - conwert Immobilien Invest SE

annual financial statement 2011 - conwert Immobilien Invest SE

annual financial statement 2011 - conwert Immobilien Invest SE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

INTRO | MANAGEMENT REPORT |<br />

| FINANCIAL STATEMENTS<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

Notes<br />

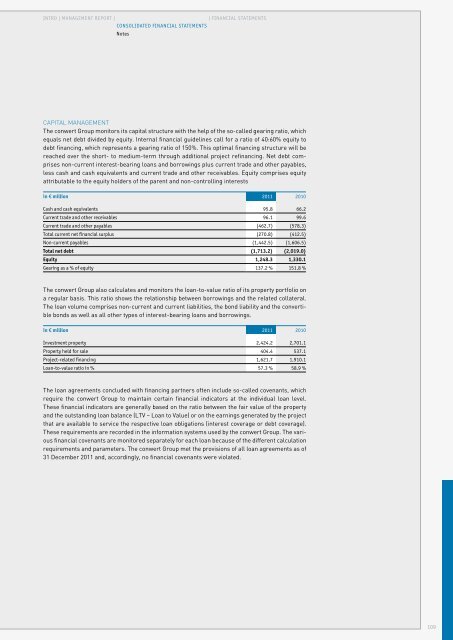

CAPITAL MANAGEMENT<br />

The <strong>conwert</strong> Group monitors its capital structure with the help of the so-called gearing ratio, which<br />

equals net debt divided by equity. Internal <strong>financial</strong> guidelines call for a ratio of 40:60% equity to<br />

debt financing, which represents a gearing ratio of 150%. This optimal financing structure will be<br />

reached over the short- to medium-term through additional project refinancing. Net debt comprises<br />

non-current interest-bearing loans and borrowings plus current trade and other payables,<br />

less cash and cash equivalents and current trade and other receivables. Equity comprises equity<br />

attributable to the equity holders of the parent and non-controlling interests<br />

in € million <strong>2011</strong> 2010<br />

Cash and cash equivalents 95.8 66.2<br />

Current trade and other receivables 96.1 99.6<br />

Current trade and other payables (462.7) (578.3)<br />

Total current net <strong>financial</strong> surplus (270.8) (412.5)<br />

Non-current payables (1,442.5) (1,606.5)<br />

Total net debt (1,713.2) (2,019.0)<br />

Equity 1,248.3 1,330.1<br />

Gearing as a % of equity 137.2 % 151.8 %<br />

The <strong>conwert</strong> Group also calculates and monitors the loan-to-value ratio of its property portfolio on<br />

a regular basis. This ratio shows the relationship between borrowings and the related collateral.<br />

The loan volume comprises non-current and current liabilities, the bond liability and the convertible<br />

bonds as well as all other types of interest-bearing loans and borrowings.<br />

in € million <strong>2011</strong> 2010<br />

<strong>Invest</strong>ment property 2,424.2 2,701.1<br />

Property held for sale 404.4 537.1<br />

Project-related financing 1,621.7 1,910.1<br />

Loan-to-value ratio in % 57.3 % 58.9 %<br />

The loan agreements concluded with financing partners often include so-called covenants, which<br />

require the <strong>conwert</strong> Group to maintain certain <strong>financial</strong> indicators at the individual loan level.<br />

These <strong>financial</strong> indicators are generally based on the ratio between the fair value of the property<br />

and the outstanding loan balance (LTV – Loan to Value) or on the earnings generated by the project<br />

that are available to service the respective loan obligations (interest coverage or debt coverage).<br />

These requirements are recorded in the information systems used by the <strong>conwert</strong> Group. The various<br />

<strong>financial</strong> covenants are monitored separately for each loan because of the different calculation<br />

requirements and parameters. The <strong>conwert</strong> Group met the provisions of all loan agreements as of<br />

31 December <strong>2011</strong> and, accordingly, no <strong>financial</strong> covenants were violated.<br />

109