annual financial statement 2011 - conwert Immobilien Invest SE

annual financial statement 2011 - conwert Immobilien Invest SE

annual financial statement 2011 - conwert Immobilien Invest SE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

INTRO | MANAGEMENT REPORT |<br />

| FINANCIAL STATEMENTS<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

Notes<br />

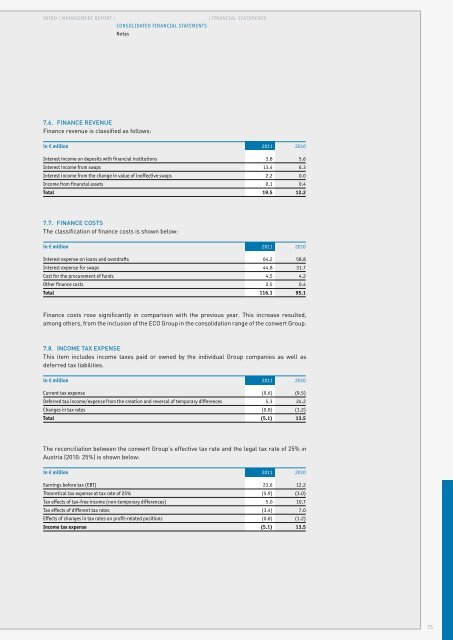

7.6. FINANCE REVENUE<br />

Finance revenue is classified as follows:<br />

in € million <strong>2011</strong> 2010<br />

Interest income on deposits with <strong>financial</strong> institutions 3.8 5.6<br />

Interest income from swaps 13.4 6.3<br />

Interest income from the change in value of ineffective swaps 2.2 0.0<br />

Income from <strong>financial</strong> assets 0.1 0.4<br />

Total 19.5 12.2<br />

7.7. FINANCE COSTS<br />

The classification of finance costs is shown below:<br />

in € million <strong>2011</strong> 2010<br />

Interest expense on loans and overdrafts 64.2 58.8<br />

Interest expense for swaps 44.8 31.7<br />

Cost for the procurement of funds 4.5 4.2<br />

Other finance costs 2.5 0.4<br />

Total 116.1 95.1<br />

Finance costs rose significantly in comparison with the previous year. This increase resulted,<br />

among others, from the inclusion of the ECO Group in the consolidation range of the <strong>conwert</strong> Group.<br />

7.8. INCOME TAX EXPEN<strong>SE</strong><br />

This item includes income taxes paid or owned by the individual Group companies as well as<br />

deferred tax liabilities.<br />

in € million <strong>2011</strong> 2010<br />

Current tax expense (9.6) (9.5)<br />

Deferred tax income/expense from the creation and reversal of temporary differences 5.3 24.2<br />

Changes in tax rates (0.8) (1.2)<br />

Total (5.1) 13.5<br />

The reconciliation between the <strong>conwert</strong> Group’s effective tax rate and the legal tax rate of 25% in<br />

Austria (2010: 25%) is shown below:<br />

in € million <strong>2011</strong> 2010<br />

Earnings before tax (EBT) 23.6 12.2<br />

Theoretical tax expense at tax rate of 25% (5.9) (3.0)<br />

Tax effects of tax-free income (non-temporary differences) 5.0 10.7<br />

Tax effects of different tax rates (3.4) 7.0<br />

Effects of changes in tax rates on profit-related positions (0.8) (1.2)<br />

Income tax expense (5.1) 13.5<br />

75