annual financial statement 2011 - conwert Immobilien Invest SE

annual financial statement 2011 - conwert Immobilien Invest SE

annual financial statement 2011 - conwert Immobilien Invest SE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CONWERT IMMOBILIEN INVEST <strong>SE</strong><br />

ANNUAL FINANCIAL STATEMENT <strong>2011</strong><br />

16<br />

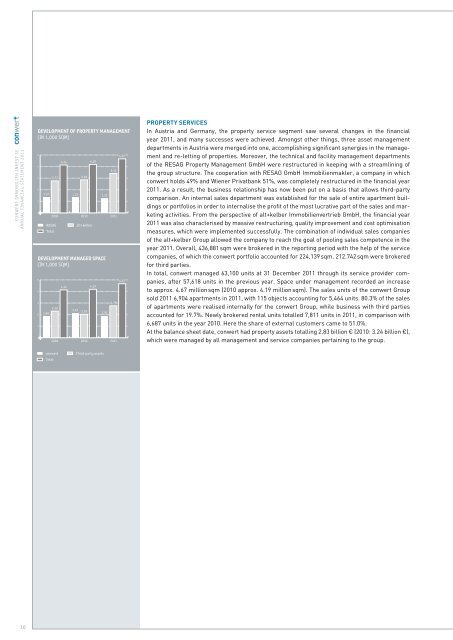

DEVELOPMENT OF PROPERTY MANAGEMENT<br />

(IN 1,000 SQM)<br />

5<br />

4<br />

3<br />

2<br />

1<br />

1.37<br />

2.77<br />

4.14<br />

1.33<br />

2.86<br />

4.19<br />

1.27<br />

3.41<br />

2009 2010 <strong>2011</strong><br />

RESAG alt+kelber<br />

Total<br />

DEVELOPMENT MANAGED SPACE<br />

(IN 1,000 SQM)<br />

5<br />

4<br />

3<br />

2<br />

1<br />

1.84<br />

2.30<br />

4.14<br />

2.16 2.03<br />

4.19<br />

1.91<br />

2.76<br />

2009 2010 <strong>2011</strong><br />

<strong>conwert</strong> Third-party assets<br />

Total<br />

4.67<br />

4.67<br />

PROPERTY <strong>SE</strong>RVICES<br />

In Austria and Germany, the property service segment saw several changes in the <strong>financial</strong><br />

year <strong>2011</strong>, and many successes were achieved. Amongst other things, three asset management<br />

departments in Austria were merged into one, accomplishing significant synergies in the management<br />

and re-letting of properties. Moreover, the technical and facility management departments<br />

of the RESAG Property Management GmbH were restructured in keeping with a streamlining of<br />

the group structure. The cooperation with RESAG GmbH <strong>Immobilien</strong>makler, a company in which<br />

<strong>conwert</strong> holds 49% and Wiener Privatbank 51%, was completely restructured in the <strong>financial</strong> year<br />

<strong>2011</strong>. As a result, the business relationship has now been put on a basis that allows third-party<br />

comparison. An internal sales department was established for the sale of entire apartment buildings<br />

or portfolios in order to internalise the profit of the most lucrative part of the sales and marketing<br />

activities. From the perspective of alt+kelber <strong>Immobilien</strong>vertrieb GmbH, the <strong>financial</strong> year<br />

<strong>2011</strong> was also characterised by massive restructuring, quality improvement and cost optimisation<br />

measures, which were implemented successfully. The combination of individual sales companies<br />

of the alt+kelber Group allowed the company to reach the goal of pooling sales competence in the<br />

year <strong>2011</strong>. Overall, 436,881 sqm were brokered in the reporting period with the help of the service<br />

companies, of which the <strong>conwert</strong> portfolio accounted for 224,139 sqm. 212.742 sqm were brokered<br />

for third parties.<br />

In total, <strong>conwert</strong> managed 63,100 units at 31 December <strong>2011</strong> through its service provider companies,<br />

after 57,618 units in the previous year. Space under management recorded an increase<br />

to approx. 4.67 million sqm (2010 approx. 4.19 million sqm). The sales units of the <strong>conwert</strong> Group<br />

sold <strong>2011</strong> 6,904 apartments in <strong>2011</strong>, with 115 objects accounting for 5,464 units. 80.3% of the sales<br />

of apartments were realised internally for the <strong>conwert</strong> Group, while business with third parties<br />

accounted for 19.7%. Newly brokered rental units totalled 7,811 units in <strong>2011</strong>, in comparison with<br />

6,687 units in the year 2010. Here the share of external customers came to 51.0%.<br />

At the balance sheet date, <strong>conwert</strong> had property assets totalling 2.83 billion € (2010: 3.24 billion €),<br />

which were managed by all management and service companies pertaining to the group.