annual financial statement 2011 - conwert Immobilien Invest SE

annual financial statement 2011 - conwert Immobilien Invest SE

annual financial statement 2011 - conwert Immobilien Invest SE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CONWERT IMMOBILIEN INVEST <strong>SE</strong><br />

ANNUAL FINANCIAL STATEMENT <strong>2011</strong><br />

14<br />

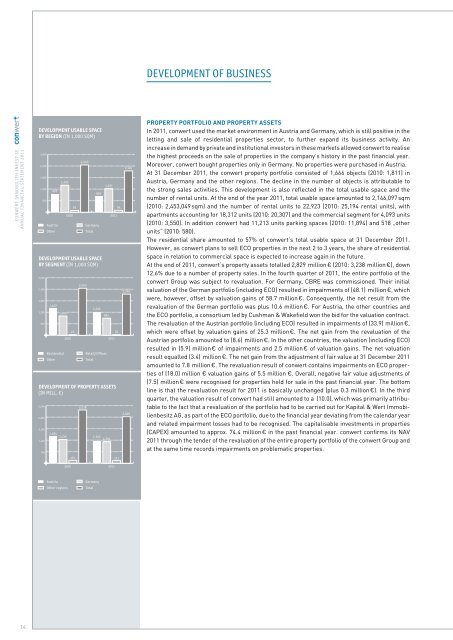

DEVELOPMENT USABLE SPACE<br />

BY REGION (IN 1,000 SQM)<br />

3,000<br />

2,400<br />

1,800<br />

1,200<br />

600<br />

3,000<br />

2,400<br />

1,800<br />

1,200<br />

600<br />

3,500<br />

2,800<br />

2,100<br />

1,400<br />

700<br />

955<br />

1,422<br />

1,405<br />

1,008<br />

1,624<br />

1,439<br />

23<br />

93<br />

DEVELOPMENT USABLE SPACE<br />

BY <strong>SE</strong>GMENT (IN 1,000 SQM)<br />

2,453<br />

1,262<br />

894<br />

2010 <strong>2011</strong><br />

DEVELOPMENT OF PROPERTY AS<strong>SE</strong>TS<br />

(IN MILL. €)<br />

175<br />

2,453<br />

3,238<br />

826<br />

1,221<br />

2010 <strong>2011</strong><br />

Austria Germany<br />

Other Total<br />

Residential Retail/Offi ces<br />

Other Total<br />

1,362<br />

1,304<br />

2010 <strong>2011</strong><br />

Austria Germany<br />

Other regions Total<br />

26<br />

99<br />

163<br />

2,146<br />

2,146<br />

2,829<br />

DEVELOPMENT OF BUSINESS<br />

PROPERTY PORTFOLIO AND PROPERTY AS<strong>SE</strong>TS<br />

In <strong>2011</strong>, <strong>conwert</strong> used the market environment in Austria and Germany, which is still positive in the<br />

letting and sale of residential properties sector, to further expand its business activity. An<br />

increase in demand by private and institutional investors in these markets allowed <strong>conwert</strong> to realise<br />

the highest proceeds on the sale of properties in the company’s history in the past <strong>financial</strong> year.<br />

Moreover, <strong>conwert</strong> bought properties only in Germany. No properties were purchased in Austria.<br />

At 31 December <strong>2011</strong>, the <strong>conwert</strong> property portfolio consisted of 1,666 objects (2010: 1,811) in<br />

Austria, Germany and the other regions. The decline in the number of objects is attributable to<br />

the strong sales activities. This development is also reflected in the total usable space and the<br />

number of rental units. At the end of the year <strong>2011</strong>, total usable space amounted to 2,146,097 sqm<br />

(2010: 2,453,049 sqm) and the number of rental units to 22,923 (2010: 25,194 rental units), with<br />

apartments accounting for 18,312 units (2010: 20,307) and the commercial segment for 4,093 units<br />

(2010: 3,550). In addition <strong>conwert</strong> had 11,213 units parking spaces (2010: 11,894) and 518 „other<br />

units“ (2010: 580).<br />

The residential share amounted to 57% of <strong>conwert</strong>’s total usable space at 31 December <strong>2011</strong>.<br />

However, as <strong>conwert</strong> plans to sell ECO properties in the next 2 to 3 years, the share of residential<br />

space in relation to commercial space is expected to increase again in the future.<br />

At the end of <strong>2011</strong>, <strong>conwert</strong>’s property assets totalled 2,829 million € (2010: 3,238 million €), down<br />

12.6% due to a number of property sales. In the fourth quarter of <strong>2011</strong>, the entire portfolio of the<br />

<strong>conwert</strong> Group was subject to revaluation. For Germany, CBRE was commissioned. Their initial<br />

valuation of the German portfolio (including ECO) resulted in impairments of (48.1) million €, which<br />

were, however, offset by valuation gains of 58.7 million €. Consequently, the net result from the<br />

revaluation of the German portfolio was plus 10.6 million €. For Austria, the other countries and<br />

the ECO portfolio, a consortium led by Cushman & Wakefield won the bid for the valuation contract.<br />

The revaluation of the Austrian portfolio (including ECO) resulted in impairments of (33.9) million €,<br />

which were offset by valuation gains of 25.3 million €. The net gain from the revaluation of the<br />

Austrian portfolio amounted to (8.6) million €. In the other countries, the valuation (including ECO)<br />

resulted in (5.9) million € of impairments and 2.5 million € of valuation gains. The net valuation<br />

result equalled (3.4) million €. The net gain from the adjustment of fair value at 31 December <strong>2011</strong><br />

amounted to 7.8 million €. The revaluation result of <strong>conwert</strong> contains impairments on ECO properties<br />

of (18.0) million € valuation gains of 5.5 million €. Overall, negative fair value adjustments of<br />

(7.5) million € were recognised for properties held for sale in the past <strong>financial</strong> year. The bottom<br />

line is that the revaluation result for <strong>2011</strong> is basically unchanged (plus 0.3 million €). In the third<br />

quarter, the valuation result of <strong>conwert</strong> had still amounted to a (10.0), which was primarily attributable<br />

to the fact that a revaluation of the portfolio had to be carried out for Kapital & Wert <strong>Immobilien</strong>besitz<br />

AG, as part of the ECO portfolio, due to the <strong>financial</strong> year deviating from the calendar year<br />

and related impairment losses had to be recognised. The capitalisable investments in properties<br />

(CAPEX) amounted to approx. 74.4 million € in the past <strong>financial</strong> year. <strong>conwert</strong> confirms its NAV<br />

<strong>2011</strong> through the tender of the revaluation of the entire property portfolio of the <strong>conwert</strong> Group and<br />

at the same time records impairments on problematic properties.