annual financial statement 2011 - conwert Immobilien Invest SE

annual financial statement 2011 - conwert Immobilien Invest SE

annual financial statement 2011 - conwert Immobilien Invest SE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CONWERT IMMOBILIEN INVEST <strong>SE</strong><br />

ANNUAL FINANCIAL STATEMENT <strong>2011</strong><br />

20<br />

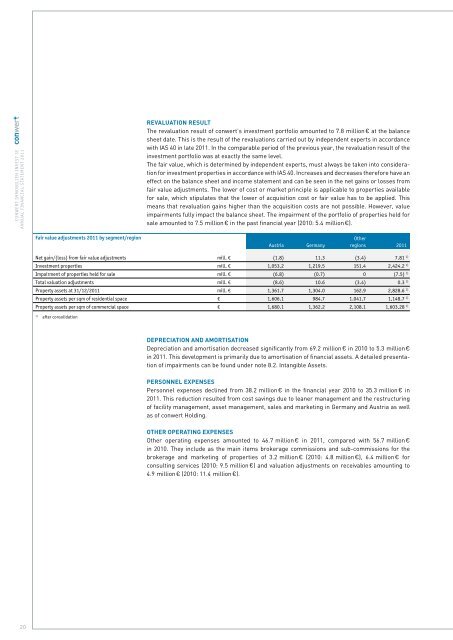

Fair value adjustments <strong>2011</strong> by segment/region<br />

REVALUATION RESULT<br />

The revaluation result of <strong>conwert</strong>’s investment portfolio amounted to 7.8 million € at the balance<br />

sheet date. This is the result of the revaluations carried out by independent experts in accordance<br />

with IAS 40 in late <strong>2011</strong>. In the comparable period of the previous year, the revaluation result of the<br />

investment portfolio was at exactly the same level.<br />

The fair value, which is determined by independent experts, must always be taken into consideration<br />

for investment properties in accordance with IAS 40. Increases and decreases therefore have an<br />

effect on the balance sheet and income <strong>statement</strong> and can be seen in the net gains or losses from<br />

fair value adjustments. The lower of cost or market principle is applicable to properties available<br />

for sale, which stipulates that the lower of acquisition cost or fair value has to be applied. This<br />

means that revaluation gains higher than the acquisition costs are not possible. However, value<br />

impairments fully impact the balance sheet. The impairment of the portfolio of properties held for<br />

sale amounted to 7.5 million € in the past <strong>financial</strong> year (2010: 5.4 million €).<br />

Austria Germany<br />

Other<br />

regions <strong>2011</strong><br />

Net gain/(loss) from fair value adjustments mill. € (1.8) 11.3 (3.4) 7.81 1)<br />

<strong>Invest</strong>ment properties mill. € 1,053.2 1,219.5 151.4 2,424.2 1)<br />

Impairment of properties held for sale mill. € (6.8) (0.7) 0 (7.5) 1)<br />

Total valuation adjustments mill. € (8.6) 10.6 (3.4) 0.3 1)<br />

Property assets at 31/12/<strong>2011</strong> mill. € 1,361.7 1,304.0 162.9 2,828.6 1)<br />

Property assets per sqm of residential space € 1,606.1 984.7 1.041.7 1,148.7 1)<br />

Property assets per sqm of commercial space € 1,680.1 1,362.2 2,108.1 1,603.28 1)<br />

1) after consolidation<br />

DEPRECIATION AND AMORTISATION<br />

Depreciation and amortisation decreased significantly from 69.2 million € in 2010 to 5.3 million €<br />

in <strong>2011</strong>. This development is primarily due to amortisation of <strong>financial</strong> assets. A detailed presentation<br />

of impairments can be found under note 8.2. Intangible Assets.<br />

PERSONNEL EXPEN<strong>SE</strong>S<br />

Personnel expenses declined from 38.2 million € in the <strong>financial</strong> year 2010 to 35.3 million € in<br />

<strong>2011</strong>. This reduction resulted from cost savings due to leaner management and the restructuring<br />

of facility management, asset management, sales and marketing in Germany and Austria as well<br />

as of <strong>conwert</strong> Holding.<br />

OTHER OPERATING EXPEN<strong>SE</strong>S<br />

Other operating expenses amounted to 46.7 million € in <strong>2011</strong>, compared with 56.7 million €<br />

in 2010. They include as the main items brokerage commissions and sub-commissions for the<br />

brokerage and marketing of properties of 3.2 million € (2010: 4.8 million €), 6.4 million € for<br />

consulting services (2010: 9.5 million €) and valuation adjustments on receivables amounting to<br />

4.9 million € (2010: 11.4 million €).