annual financial statement 2011 - conwert Immobilien Invest SE

annual financial statement 2011 - conwert Immobilien Invest SE

annual financial statement 2011 - conwert Immobilien Invest SE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

INTRO | MANAGEMENT REPORT |<br />

| FINANCIAL STATEMENTS<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

Notes<br />

8. NOTES TO THE BALANCE SHEET<br />

8.1. INVESTMENT PROPERTIES<br />

The properties owned by the <strong>conwert</strong> Group were valued by several independent experts as of<br />

31 December <strong>2011</strong>, similar to the procedure followed in the previous year. The objects located in<br />

foreign countries were valued in cooperation with local experts in accordance with international<br />

valuation principles and based on the relevant national circumstances.<br />

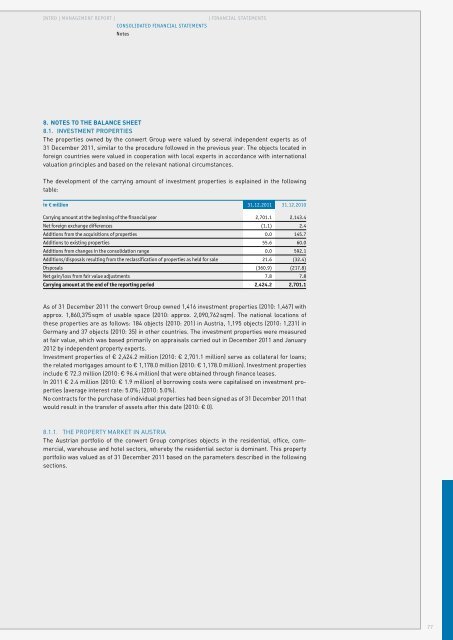

The development of the carrying amount of investment properties is explained in the following<br />

table:<br />

in € million 31.12.<strong>2011</strong> 31.12.2010<br />

Carrying amount at the beginning of the <strong>financial</strong> year 2,701.1 2,143.4<br />

Net foreign exchange differences (1.1) 2.4<br />

Additions from the acquisitions of properties 0.0 145.7<br />

Additions to existing properties 55.6 60.0<br />

Additions from changes in the consolidation range 0.0 592.1<br />

Additions/disposals resulting from the reclassification of properties as held for sale 21.6 (32.4)<br />

Disposals (360.9) (217.8)<br />

Net gain/loss from fair value adjustments 7.8 7.8<br />

Carrying amount at the end of the reporting period 2,424.2 2,701.1<br />

As of 31 December <strong>2011</strong> the <strong>conwert</strong> Group owned 1,416 investment properties (2010: 1,467) with<br />

approx. 1,860,375 sqm of usable space (2010: approx. 2,090,762 sqm). The national locations of<br />

these properties are as follows: 184 objects (2010: 201) in Austria, 1,195 objects (2010: 1,231) in<br />

Germany and 37 objects (2010: 35) in other countries. The investment properties were measured<br />

at fair value, which was based primarily on appraisals carried out in December <strong>2011</strong> and January<br />

2012 by independent property experts.<br />

<strong>Invest</strong>ment properties of € 2,424.2 million (2010: € 2,701.1 million) serve as collateral for loans;<br />

the related mortgages amount to € 1,178.0 million (2010: € 1,178.0 million). <strong>Invest</strong>ment properties<br />

include € 72.3 million (2010: € 96.4 million) that were obtained through finance leases.<br />

In <strong>2011</strong> € 2.4 million (2010: € 1.9 million) of borrowing costs were capitalised on investment properties<br />

(average interest rate: 5.0%; (2010: 5.0%).<br />

No contracts for the purchase of individual properties had been signed as of 31 December <strong>2011</strong> that<br />

would result in the transfer of assets after this date (2010: € 0).<br />

8.1.1. THE PROPERTY MARKET IN AUSTRIA<br />

The Austrian portfolio of the <strong>conwert</strong> Group comprises objects in the residential, office, commercial,<br />

warehouse and hotel sectors, whereby the residential sector is dominant. This property<br />

portfolio was valued as of 31 December <strong>2011</strong> based on the parameters described in the following<br />

sections.<br />

77