annual financial statement 2011 - conwert Immobilien Invest SE

annual financial statement 2011 - conwert Immobilien Invest SE

annual financial statement 2011 - conwert Immobilien Invest SE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CONWERT IMMOBILIEN INVEST <strong>SE</strong><br />

ANNUAL FINANCIAL STATEMENT <strong>2011</strong><br />

22<br />

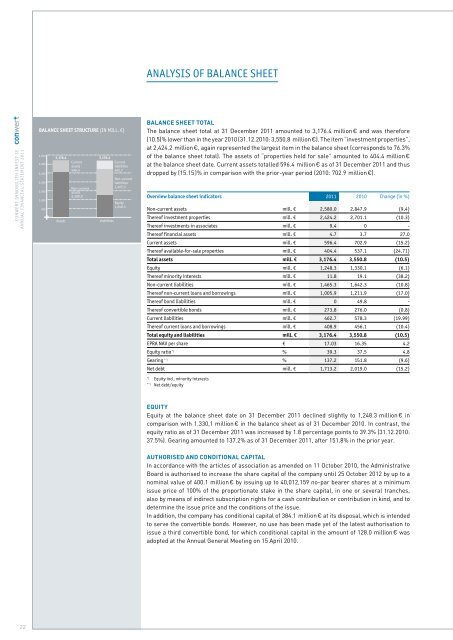

BALANCE SHEET STRUCTURE (IN MILL. €)<br />

3,500<br />

3,000<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

3,176.4 3,176.4<br />

Current<br />

assets<br />

596,4<br />

Non-current<br />

assets<br />

2,580.0<br />

Assets Liabilities<br />

<strong>conwert</strong><br />

Current<br />

liabilities<br />

462.7<br />

Non-current<br />

liabilities<br />

1,465.3<br />

Equity<br />

1,248.3<br />

ANALYSIS OF BALANCE SHEET<br />

BALANCE SHEET TOTAL<br />

The balance sheet total at 31 December <strong>2011</strong> amounted to 3,176.4 million € and was therefore<br />

(10.5)% lower than in the year 2010 (31.12.2010: 3,550.8 million €). The item “investment properties”,<br />

at 2,424.2 million €, again represented the largest item in the balance sheet (corresponds to 76.3%<br />

of the balance sheet total). The assets of “properties held for sale” amounted to 404.4 million €<br />

at the balance sheet date. Current assets totalled 596.4 million € as of 31 December <strong>2011</strong> and thus<br />

dropped by (15.15 )% in comparison with the prior-year period (2010: 702.9 million €).<br />

Overview balance sheet indicators <strong>2011</strong> 2010 Change (in %)<br />

Non-current assets mill. € 2,580.0 2,847.9 (9.4)<br />

Thereof investment properties mill. € 2,424.2 2,701.1 (10.3)<br />

Thereof investments in associates mill. € 9.4 0 -<br />

Thereof <strong>financial</strong> assets mill. € 4.7 3.7 27.0<br />

Current assets mill. € 596.4 702.9 (15.2)<br />

Thereof available-for-sale properties mill. € 404.4 537.1 (24.71)<br />

Total assets mill. € 3,176.4 3,550.8 (10.5)<br />

Equity mill. € 1,248.3 1,330.1 (6.1)<br />

Thereof minority interests mill. € 11.8 19.1 (38.2)<br />

Non-current liabilities mill. € 1,465.3 1,642.3 (10.8)<br />

Thereof non-current loans and borrowings mill. € 1,005.9 1,211.9 (17.0)<br />

Thereof bond liabilities mill. € 0 49.8 -<br />

Thereof convertible bonds mill. € 273.8 276.0 (0.8)<br />

Current liabilities mill. € 462.7 578.3 (19.99)<br />

Thereof current loans and borrowings mill. € 408.9 456.1 (10.4)<br />

Total equity and liabilities mill. € 3,176.4 3,550.8 (10.5)<br />

EPRA NAV per share € 17.03 16.35 4.2<br />

Equity ratio *) % 39.3 37.5 4.8<br />

Gearing **) % 137.2 151.8 (9.6)<br />

Net debt mill. € 1,713.2 2,019.0 (15.2)<br />

*) Equity incl. minority interests<br />

**) Net debt/equity<br />

EQUITY<br />

Equity at the balance sheet date on 31 December <strong>2011</strong> declined slightly to 1,248.3 million € in<br />

comparison with 1.330,1 million € in the balance sheet as of 31 December 2010. In contrast, the<br />

equity ratio as of 31 December <strong>2011</strong> was increased by 1.8 percentage points to 39.3% (31.12.2010:<br />

37.5%). Gearing amounted to 137.2% as of 31 December <strong>2011</strong>, after 151.8% in the prior year.<br />

AUTHORI<strong>SE</strong>D AND CONDITIONAL CAPITAL<br />

In accordance with the articles of association as amended on 11 October 2010, the Administrative<br />

Board is authorised to increase the share capital of the company until 25 October 2012 by up to a<br />

nominal value of 400.1 million € by issuing up to 40,012,159 no-par bearer shares at a minimum<br />

issue price of 100% of the proportionate stake in the share capital, in one or several tranches,<br />

also by means of indirect subscription rights for a cash contribution or contribution in kind, and to<br />

determine the issue price and the conditions of the issue.<br />

In addition, the company has conditional capital of 384.1 million € at its disposal, which is intended<br />

to serve the convertible bonds. However, no use has been made yet of the latest authorisation to<br />

issue a third convertible bond, for which conditional capital in the amount of 128.0 million € was<br />

adopted at the Annual General Meeting on 15 April 2010.