annual financial statement 2011 - conwert Immobilien Invest SE

annual financial statement 2011 - conwert Immobilien Invest SE

annual financial statement 2011 - conwert Immobilien Invest SE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CONWERT IMMOBILIEN INVEST <strong>SE</strong><br />

ANNUAL FINANCIAL STATEMENT <strong>2011</strong><br />

32<br />

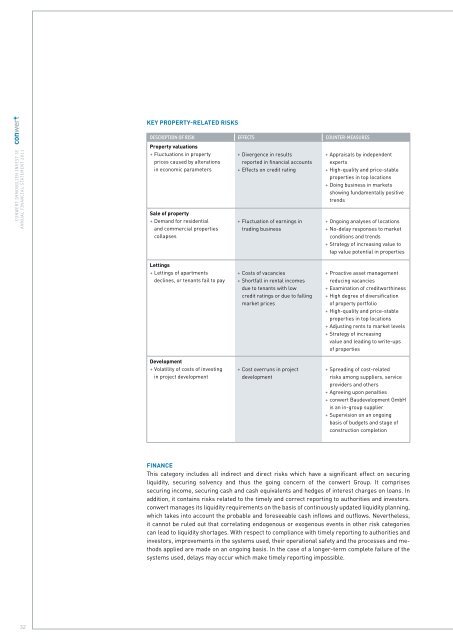

KEY PROPERTY-RELATED RISKS<br />

DESCRIPTION OF RISK EFFECTS COUNTER-MEASURES<br />

Property valuations<br />

+ Fluctuations in property<br />

prices caused by alterations<br />

in economic parameters<br />

Sale of property<br />

+ Demand for residential<br />

and commercial properties<br />

collapses<br />

Lettings<br />

+ Lettings of apartments<br />

declines, or tenants fail to pay<br />

Development<br />

+ Volatility of costs of investing<br />

in project development<br />

+ Divergence in results<br />

reported in <strong>financial</strong> accounts<br />

+ Effects on credit rating<br />

+ Fluctuation of earnings in<br />

trading business<br />

+ Costs of vacancies<br />

+ Shortfall in rental incomes<br />

due to tenants with low<br />

credit ratings or due to falling<br />

market prices<br />

+ Cost overruns in project<br />

development<br />

+ Appraisals by independent<br />

experts<br />

+ High-quality and price-stable<br />

properties in top locations<br />

+ Doing business in markets<br />

showing fundamentally positive<br />

trends<br />

+ Ongoing analyses of locations<br />

+ No-delay responses to market<br />

conditions and trends<br />

+ Strategy of increasing value to<br />

tap value potential in properties<br />

+ Proactive asset management<br />

reducing vacancies<br />

+ Examination of creditworthiness<br />

+ High degree of diversification<br />

of property portfolio<br />

+ High-quality and price-stable<br />

properties in top locations<br />

+ Adjusting rents to market levels<br />

+ Strategy of increasing<br />

value and leading to write-ups<br />

of properties<br />

+ Spreading of cost-related<br />

risks among suppliers, service<br />

providers and others<br />

+ Agreeing upon penalties<br />

+ <strong>conwert</strong> Baudevelopment GmbH<br />

is an in-group supplier<br />

+ Supervision on an ongoing<br />

basis of budgets and stage of<br />

construction completion<br />

FINANCE<br />

This category includes all indirect and direct risks which have a significant effect on securing<br />

liquidity, securing solvency and thus the going concern of the <strong>conwert</strong> Group. It comprises<br />

securing income, securing cash and cash equivalents and hedges of interest charges on loans. In<br />

addition, it contains risks related to the timely and correct reporting to authorities and investors.<br />

<strong>conwert</strong> manages its liquidity requirements on the basis of continuously updated liquidity planning,<br />

which takes into account the probable and foreseeable cash inflows and outflows. Nevertheless,<br />

it cannot be ruled out that correlating endogenous or exogenous events in other risk categories<br />

can lead to liquidity shortages. With respect to compliance with timely reporting to authorities and<br />

investors, improvements in the systems used, their operational safety and the processes and methods<br />

applied are made on an ongoing basis. In the case of a longer-term complete failure of the<br />

systems used, delays may occur which make timely reporting impossible.