Michelin couv courteGB

Michelin couv courteGB

Michelin couv courteGB

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Strategy • Fundamentals • Businesses • Résultats Earnings<br />

International Financial Accounting Standards<br />

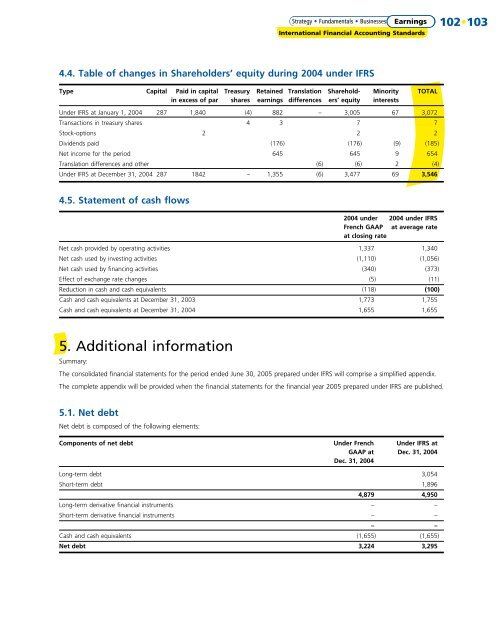

4.4. Table of changes in Shareholders’ equity during 2004 under IFRS<br />

Type Capital Paid in capital Treasury Retained Translation Sharehold- Minority TOTAL<br />

in excess of par shares earnings differences ers’ equity interests<br />

Under IFRS at January 1, 2004 287 1,840 (4) 882 – 3,005 67 3,072<br />

Transactions in treasury shares 4 3 7 7<br />

Stock-options 2 2 2<br />

Dividends paid (176) (176) (9) (185)<br />

Net income for the period 645 645 9 654<br />

Translation differences and other (6) (6) 2 (4)<br />

Under IFRS at December 31, 2004 287 1842 – 1,355 (6) 3,477 69 3,546<br />

4.5. Statement of cash flows<br />

2004 under 2004 under IFRS<br />

French GAAP at average rate<br />

at closing rate<br />

Net cash provided by operating activities 1,337 1,340<br />

Net cash used by investing activities (1,110) (1,056)<br />

Net cash used by financing activities (340) (373)<br />

Effect of exchange rate changes (5) (11)<br />

Reduction in cash and cash equivalents (118) (100)<br />

Cash and cash equivalents at December 31, 2003 1,773 1,755<br />

Cash and cash equivalents at December 31, 2004 1,655 1,655<br />

5. Additional information<br />

Summary:<br />

The consolidated financial statements for the period ended June 30, 2005 prepared under IFRS will comprise a simplified appendix.<br />

The complete appendix will be provided when the financial statements for the financial year 2005 prepared under IFRS are published.<br />

5.1. Net debt<br />

Net debt is composed of the following elements:<br />

Components of net debt Under French Under IFRS at<br />

GAAP at Dec. 31, 2004<br />

Dec. 31, 2004<br />

Long-term debt 3,054<br />

Short-term debt 1,896<br />

4,879 4,950<br />

Long-term derivative financial instruments – –<br />

Short-term derivative financial instruments – –<br />

– –<br />

Cash and cash equivalents (1,655) (1,655)<br />

Net debt 3,224 3,295<br />

102•103