Michelin couv courteGB

Michelin couv courteGB

Michelin couv courteGB

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Economic<br />

performance target<br />

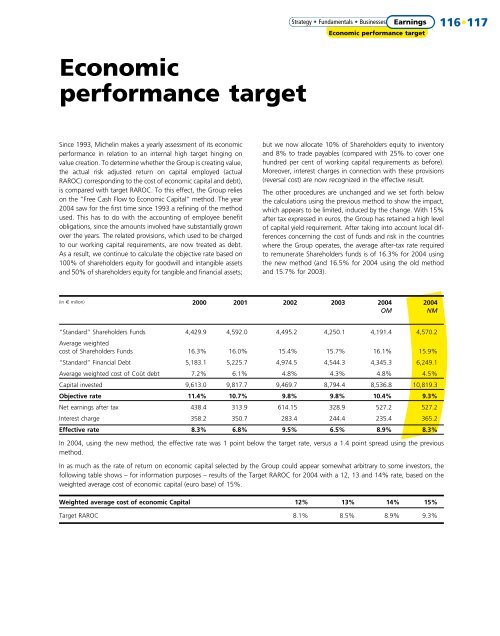

Since 1993, <strong>Michelin</strong> makes a yearly assessment of its economic<br />

performance in relation to an internal high target hinging on<br />

value creation. To determine whether the Group is creating value,<br />

the actual risk adjusted return on capital employed (actual<br />

RAROC) corresponding to the cost of economic capital and debt),<br />

is compared with target RAROC. To this effect, the Group relies<br />

on the “Free Cash Flow to Economic Capital” method. The year<br />

2004 saw for the first time since 1993 a refining of the method<br />

used. This has to do with the accounting of employee benefit<br />

obligations, since the amounts involved have substantially grown<br />

over the years. The related provisions, which used to be charged<br />

to our working capital requirements, are now treated as debt.<br />

As a result, we continue to calculate the objective rate based on<br />

100% of shareholders equity for goodwill and intangible assets<br />

and 50% of shareholders equity for tangible and financial assets;<br />

Strategy • Fundamentals • Businesses • Résultats Earnings<br />

Economic performance target<br />

but we now allocate 10% of Shareholders equity to inventory<br />

and 8% to trade payables (compared with 25% to cover one<br />

hundred per cent of working capital requirements as before).<br />

Moreover, interest charges in connection with these provisions<br />

(reversal cost) are now recognized in the effective result.<br />

The other procedures are unchanged and we set forth below<br />

the calculations using the previous method to show the impact,<br />

which appears to be limited, induced by the change. With 15%<br />

after tax expressed in euros, the Group has retained a high level<br />

of capital yield requirement. After taking into account local differences<br />

concerning the cost of funds and risk in the countries<br />

where the Group operates, the average after-tax rate required<br />

to remunerate Shareholders funds is of 16.3% for 2004 using<br />

the new method (and 16.5% for 2004 using the old method<br />

and 15.7% for 2003).<br />

(in € milion) 2000 2001 2002 2003 2004 2004<br />

OM NM<br />

“Standard” Shareholders Funds<br />

Average weighted<br />

4,429.9 4,592.0 4,495.2 4,250.1 4,191.4 4,570.2<br />

cost of Shareholders Funds 16.3% 16.0% 15.4% 15.7% 16.1% 15.9%<br />

“Standard” Financial Debt 5,183.1 5,225.7 4,974.5 4,544.3 4,345.3 6,249.1<br />

Average weighted cost of Coût debt 7.2% 6.1% 4.8% 4.3% 4.8% 4.5%<br />

Capital invested 9,613.0 9,817.7 9,469.7 8,794.4 8,536.8 10,819.3<br />

Objective rate 11.4% 10.7% 9.8% 9.8% 10.4% 9.3%<br />

Net earnings after tax 438.4 313.9 614.15 328.9 527.2 527.2<br />

Interest charge 358.2 350.7 283.4 244.4 235.4 365.2<br />

Effective rate 8.3% 6.8% 9.5% 6.5% 8.9% 8.3%<br />

In 2004, using the new method, the effective rate was 1 point below the target rate, versus a 1.4 point spread using the previous<br />

method.<br />

In as much as the rate of return on economic capital selected by the Group could appear somewhat arbitrary to some investors, the<br />

following table shows – for information purposes – results of the Target RAROC for 2004 with a 12, 13 and 14% rate, based on the<br />

weighted average cost of economic capital (euro base) of 15%.<br />

Weighted average cost of economic Capital 12% 13% 14% 15%<br />

Target RAROC 8.1% 8.5% 8.9% 9.3%<br />

116•117