moleskine-ipo-report-04-03-2013-mediobanca

moleskine-ipo-report-04-03-2013-mediobanca

moleskine-ipo-report-04-03-2013-mediobanca

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Moleskine<br />

DCF Analysis<br />

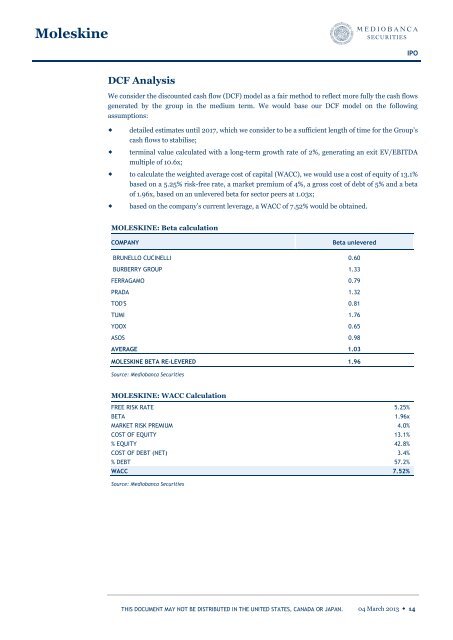

We consider the discounted cash flow (DCF) model as a fair method to reflect more fully the cash flows<br />

generated by the group in the medium term. We would base our DCF model on the following<br />

assumptions:<br />

detailed estimates until 2017, which we consider to be a sufficient length of time for the Group’s<br />

cash flows to stabilise;<br />

terminal value calculated with a long-term growth rate of 2%, generating an exit EV/EBITDA<br />

multiple of 10.6x;<br />

to calculate the weighted average cost of capital (WACC), we would use a cost of equity of 13.1%<br />

based on a 5.25% risk-free rate, a market premium of 4%, a gross cost of debt of 5% and a beta<br />

of 1.96x, based on an unlevered beta for sector peers at 1.<strong>03</strong>x;<br />

based on the company’s current leverage, a WACC of 7.52% would be obtained.<br />

MOLESKINE: Beta calculation<br />

COMPANY Beta unlevered<br />

BRUNELLO CUCINELLI 0.60<br />

BURBERRY GROUP 1.33<br />

FERRAGAMO 0.79<br />

PRADA 1.32<br />

TOD'S 0.81<br />

TUMI 1.76<br />

YOOX 0.65<br />

ASOS 0.98<br />

AVERAGE 1.<strong>03</strong><br />

MOLESKINE BETA RE-LEVERED 1.96<br />

Source: Mediobanca Securities<br />

MOLESKINE: WACC Calculation<br />

FREE RISK RATE 5.25%<br />

BETA 1.96x<br />

MARKET RISK PREMIUM 4.0%<br />

COST OF EQUITY 13.1%<br />

% EQUITY 42.8%<br />

COST OF DEBT (NET) 3.4%<br />

% DEBT 57.2%<br />

WACC 7.52%<br />

Source: Mediobanca Securities<br />

THIS DOCUMENT MAY NOT BE DISTRIBUTED IN THE UNITED STATES, CANADA OR JAPAN.<br />

IPO<br />

<strong>04</strong> March <strong>2013</strong> ◆ 14