moleskine-ipo-report-04-03-2013-mediobanca

moleskine-ipo-report-04-03-2013-mediobanca

moleskine-ipo-report-04-03-2013-mediobanca

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Moleskine<br />

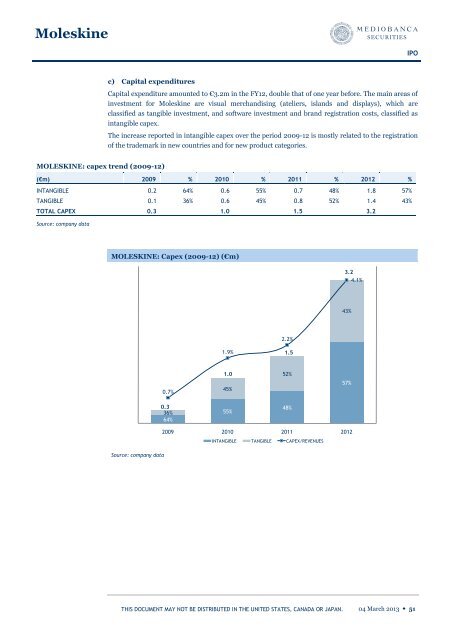

c) Capital expenditures<br />

MOLESKINE: capex trend (2009-12)<br />

Capital expenditure amounted to €3.2m in the FY12, double that of one year before. The main areas of<br />

investment for Moleskine are visual merchandising (ateliers, islands and displays), which are<br />

classified as tangible investment, and software investment and brand registration costs, classified as<br />

intangible capex.<br />

The increase <strong>report</strong>ed in intangible capex over the period 2009-12 is mostly related to the registration<br />

of the trademark in new countries and for new product categories.<br />

(€m) 2009 % 2010 % 2011 % 2012 %<br />

INTANGIBLE 0.2 64% 0.6 55% 0.7 48% 1.8 57%<br />

TANGIBLE 0.1 36% 0.6 45% 0.8 52% 1.4 43%<br />

TOTAL CAPEX 0.3<br />

Source: company data<br />

1.0<br />

MOLESKINE: Capex (2009-12) (€m)<br />

4<br />

3<br />

3<br />

2<br />

2<br />

1<br />

1<br />

0<br />

Source: company data<br />

0.7%<br />

0.3<br />

36%<br />

64%<br />

1.9%<br />

1.0<br />

45%<br />

55%<br />

2.2%<br />

2009 2010 2011 2012<br />

THIS DOCUMENT MAY NOT BE DISTRIBUTED IN THE UNITED STATES, CANADA OR JAPAN.<br />

1.5<br />

52%<br />

48%<br />

1.5<br />

INTANGIBLE TANGIBLE CAPEX/REVENUES<br />

3.2<br />

4.1%<br />

43%<br />

57%<br />

3.2<br />

4.5%<br />

4.0%<br />

3.5%<br />

3.0%<br />

2.5%<br />

2.0%<br />

1.5%<br />

1.0%<br />

0.5%<br />

0.0%<br />

IPO<br />

<strong>04</strong> March <strong>2013</strong> ◆ 51