moleskine-ipo-report-04-03-2013-mediobanca

moleskine-ipo-report-04-03-2013-mediobanca

moleskine-ipo-report-04-03-2013-mediobanca

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Moleskine<br />

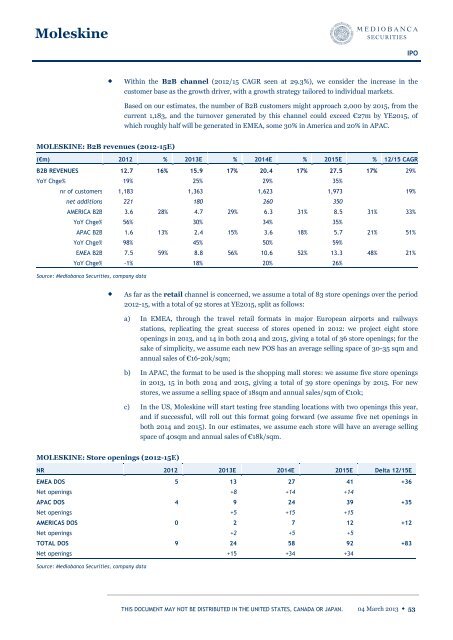

MOLESKINE: B2B revenues (2012-15E)<br />

Within the B2B channel (2012/15 CAGR seen at 29.3%), we consider the increase in the<br />

customer base as the growth driver, with a growth strategy tailored to individual markets.<br />

Based on our estimates, the number of B2B customers might approach 2,000 by 2015, from the<br />

current 1,183, and the turnover generated by this channel could exceed €27m by YE2015, of<br />

which roughly half will be generated in EMEA, some 30% in America and 20% in APAC.<br />

(€m) 2012 % <strong>2013</strong>E % 2014E % 2015E % 12/15 CAGR<br />

B2B REVENUES 12.7 16% 15.9 17% 20.4 17% 27.5 17% 29%<br />

YoY Chge% 19%<br />

nr of customers 1,183<br />

net additions 221<br />

25%<br />

1,363<br />

180<br />

AMERICA B2B 3.6 28% 4.7 29% 6.3 31% 8.5 31% 33%<br />

YoY Chge% 56%<br />

30%<br />

APAC B2B 1.6 13% 2.4 15% 3.6 18% 5.7 21% 51%<br />

YoY Chge% 98%<br />

45%<br />

EMEA B2B 7.5 59% 8.8 56% 10.6 52% 13.3 48% 21%<br />

THIS DOCUMENT MAY NOT BE DISTRIBUTED IN THE UNITED STATES, CANADA OR JAPAN.<br />

29%<br />

1,623<br />

260<br />

34%<br />

35%<br />

1,973<br />

YoY Chge% -1% 18% 20% 26%<br />

Source: Mediobanca Securities, company data<br />

50%<br />

As far as the retail channel is concerned, we assume a total of 83 store openings over the period<br />

2012-15, with a total of 92 stores at YE2015, split as follows:<br />

MOLESKINE: Store openings (2012-15E)<br />

a) In EMEA, through the travel retail formats in major European airports and railways<br />

stations, replicating the great success of stores opened in 2012: we project eight store<br />

openings in <strong>2013</strong>, and 14 in both 2014 and 2015, giving a total of 36 store openings; for the<br />

sake of simplicity, we assume each new POS has an average selling space of 30-35 sqm and<br />

annual sales of €16-20k/sqm;<br />

b) In APAC, the format to be used is the shopping mall stores: we assume five store openings<br />

in <strong>2013</strong>, 15 in both 2014 and 2015, giving a total of 39 store openings by 2015. For new<br />

stores, we assume a selling space of 18sqm and annual sales/sqm of €10k;<br />

c) In the US, Moleskine will start testing free standing locations with two openings this year,<br />

and if successful, will roll out this format going forward (we assume five net openings in<br />

both 2014 and 2015). In our estimates, we assume each store will have an average selling<br />

space of 40sqm and annual sales of €18k/sqm.<br />

NR 2012 <strong>2013</strong>E 2014E 2015E Delta 12/15E<br />

EMEA DOS 5 13 27 41 +36<br />

Net openings<br />

350<br />

35%<br />

59%<br />

+8 +14 +14<br />

APAC DOS 4 9 24 39 +35<br />

Net openings<br />

+5 +15 +15<br />

AMERICAS DOS 0 2 7 12 +12<br />

Net openings<br />

+2 +5 +5<br />

TOTAL DOS 9 24 58 92 +83<br />

Net openings +15 +34 +34<br />

Source: Mediobanca Securities, company data<br />

IPO<br />

19%<br />

<strong>04</strong> March <strong>2013</strong> ◆ 53