moleskine-ipo-report-04-03-2013-mediobanca

moleskine-ipo-report-04-03-2013-mediobanca

moleskine-ipo-report-04-03-2013-mediobanca

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Moleskine<br />

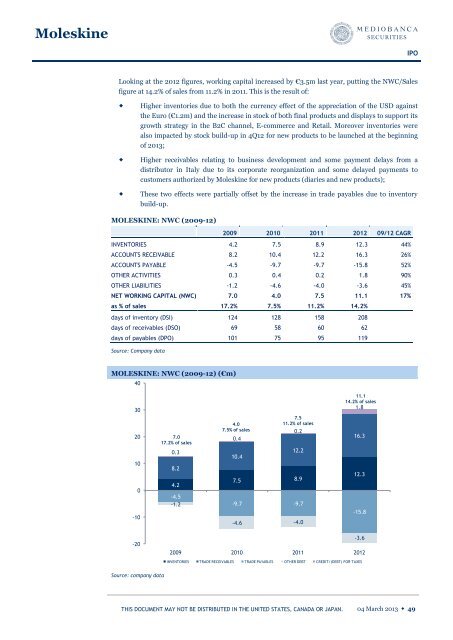

Looking at the 2012 figures, working capital increased by €3.5m last year, putting the NWC/Sales<br />

figure at 14.2% of sales from 11.2% in 2011. This is the result of:<br />

Higher inventories due to both the currency effect of the appreciation of the USD against<br />

the Euro (€1.2m) and the increase in stock of both final products and displays to support its<br />

growth strategy in the B2C channel, E-commerce and Retail. Moreover inventories were<br />

also impacted by stock build-up in 4Q12 for new products to be launched at the beginning<br />

of <strong>2013</strong>;<br />

Higher receivables relating to business development and some payment delays from a<br />

distributor in Italy due to its corporate reorganization and some delayed payments to<br />

customers authorized by Moleskine for new products (diaries and new products);<br />

These two effects were partially offset by the increase in trade payables due to inventory<br />

build-up.<br />

MOLESKINE: NWC (2009-12)<br />

2009 2010 2011 2012 09/12 CAGR<br />

INVENTORIES 4.2 7.5 8.9 12.3 44%<br />

ACCOUNTS RECEIVABLE 8.2 10.4 12.2 16.3 26%<br />

ACCOUNTS PAYABLE -4.5 -9.7 -9.7 -15.8 52%<br />

OTHER ACTIVITIES 0.3 0.4 0.2 1.8 90%<br />

OTHER LIABILITIES -1.2 -4.6 -4.0 -3.6 45%<br />

NET WORKING CAPITAL (NWC) 7.0 4.0 7.5 11.1 17%<br />

as % of sales 17.2% 7.5% 11.2% 14.2%<br />

days of inventory (DSI) 124 128 158 208<br />

days of receivables (DSO) 69 58 60 62<br />

days of payables (DPO) 101 75 95 119<br />

Source: Company data<br />

MOLESKINE: NWC (2009-12) (€m)<br />

40<br />

30<br />

20<br />

10<br />

0<br />

-10<br />

-20<br />

Source: company data<br />

7.0<br />

17.2% of sales<br />

0.3<br />

8.2<br />

4.2<br />

-4.5<br />

-1.2<br />

4.0<br />

7.5% of sales<br />

10.4<br />

THIS DOCUMENT MAY NOT BE DISTRIBUTED IN THE UNITED STATES, CANADA OR JAPAN.<br />

0.4<br />

7.5<br />

12.2<br />

8.9<br />

-9.7 -9.7<br />

-4.6<br />

7.5<br />

11.2% of sales<br />

0.2<br />

-4.0<br />

11.1<br />

14.2% of sales<br />

1.8<br />

16.3<br />

12.3<br />

-15.8<br />

-3.6<br />

2009 2010 2011 2012<br />

INVENTORIES TRADE RECEIVABLES TRADE PAYABLES OTHER DEBT CREDIT/(DEBT) FOR TAXES<br />

IPO<br />

<strong>04</strong> March <strong>2013</strong> ◆ 49