moleskine-ipo-report-04-03-2013-mediobanca

moleskine-ipo-report-04-03-2013-mediobanca

moleskine-ipo-report-04-03-2013-mediobanca

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Moleskine<br />

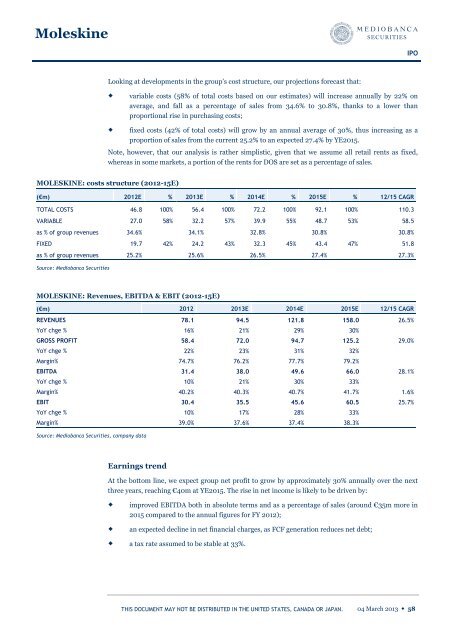

Looking at developments in the group’s cost structure, our projections forecast that:<br />

variable costs (58% of total costs based on our estimates) will increase annually by 22% on<br />

average, and fall as a percentage of sales from 34.6% to 30.8%, thanks to a lower than<br />

proportional rise in purchasing costs;<br />

fixed costs (42% of total costs) will grow by an annual average of 30%, thus increasing as a<br />

proportion of sales from the current 25.2% to an expected 27.4% by YE2015.<br />

Note, however, that our analysis is rather simplistic, given that we assume all retail rents as fixed,<br />

whereas in some markets, a portion of the rents for DOS are set as a percentage of sales.<br />

MOLESKINE: costs structure (2012-15E)<br />

(€m) 2012E % <strong>2013</strong>E % 2014E % 2015E % 12/15 CAGR<br />

TOTAL COSTS 46.8 100% 56.4 100% 72.2 100% 92.1 100% 110.3<br />

VARIABLE 27.0 58% 32.2 57% 39.9 55% 48.7 53% 58.5<br />

as % of group revenues 34.6%<br />

34.1%<br />

FIXED 19.7 42% 24.2 43% 32.3 45% 43.4 47% 51.8<br />

as % of group revenues 25.2%<br />

Source: Mediobanca Securities<br />

25.6%<br />

MOLESKINE: Revenues, EBITDA & EBIT (2012-15E)<br />

(€m) 2012 <strong>2013</strong>E 2014E 2015E 12/15 CAGR<br />

REVENUES 78.1 94.5 121.8 158.0 26.5%<br />

YoY chge % 16% 21% 29% 30%<br />

GROSS PROFIT 58.4 72.0 94.7 125.2 29.0%<br />

YoY chge % 22% 23% 31% 32%<br />

Margin% 74.7% 76.2% 77.7% 79.2%<br />

EBITDA 31.4 38.0 49.6 66.0 28.1%<br />

YoY chge % 10% 21% 30% 33%<br />

Margin% 40.2% 40.3% 40.7% 41.7% 1.6%<br />

EBIT 30.4 35.5 45.6 60.5 25.7%<br />

YoY chge % 10% 17% 28% 33%<br />

Margin% 39.0% 37.6% 37.4% 38.3%<br />

Source: Mediobanca Securities, company data<br />

Earnings trend<br />

32.8%<br />

26.5%<br />

At the bottom line, we expect group net profit to grow by approximately 30% annually over the next<br />

three years, reaching €40m at YE2015. The rise in net income is likely to be driven by:<br />

30.8%<br />

27.4%<br />

THIS DOCUMENT MAY NOT BE DISTRIBUTED IN THE UNITED STATES, CANADA OR JAPAN.<br />

IPO<br />

30.8%<br />

27.3%<br />

improved EBITDA both in absolute terms and as a percentage of sales (around €35m more in<br />

2015 compared to the annual figures for FY 2012);<br />

an expected decline in net financial charges, as FCF generation reduces net debt;<br />

a tax rate assumed to be stable at 33%.<br />

<strong>04</strong> March <strong>2013</strong> ◆ 58