moleskine-ipo-report-04-03-2013-mediobanca

moleskine-ipo-report-04-03-2013-mediobanca

moleskine-ipo-report-04-03-2013-mediobanca

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Moleskine<br />

Valuation criteria<br />

We have identified two criteria to provide a fair valuation of Moleskine:<br />

a sector comparison, in which we identify a panel of comparable companies that target a<br />

similar reference market or have business similarities with Moleskine, as detailed below;<br />

a discounted cash flow model, which we would use only to cross-check the sector multiples<br />

valuation, but do not consider a fully reliable criterion. We therefore suggest due caution when<br />

looking at it, given Moleskine’s growth profile and therefore the difficulty in assessing when its<br />

cash flows will start to stabilize.<br />

Sector comparison<br />

Moleskine’s unique market positioning, with the brand expressing a set of intangible values combining<br />

identity and culture, its product profile (premium and high-end products) and business model make it<br />

very hard to identify a clear panel of comparable companies with the same features and future<br />

prospects.<br />

For this reason, we have identified two categories of possible comparable companies:<br />

a) Premium & branded goods companies with an iconic core product and brand<br />

extension opportunities<br />

This group includes premium and branded goods companies, whose past and current appeal to<br />

consumers is strictly linked to the success of one or few iconic products, which from being the<br />

brand’s historical flagship, have now become a benchmark within their market segment.<br />

The cultural significance behind owning this product, the sense of being part of a community<br />

sharing common values, together with the product’s intrinsic value, justifies its premium<br />

positioning. This helps these groups to keep the business risk under better control and make<br />

the overall business resilient in a sector where tastes and fashion trends usually generate some<br />

volatility.<br />

Moreover, for brands whose awareness among consumers is very high for the core product,<br />

there are opportunities to extend the brand to other product categories, which is likely to<br />

become an additional source of top-line growth when the flagship product reaches a maturity<br />

phase in its growth path.<br />

For these reasons, we include in our panel of companies comparable to Moleskine Tod’s,<br />

Ferragamo, Burberry, Tumi, Brunello Cucinelli and Prada.<br />

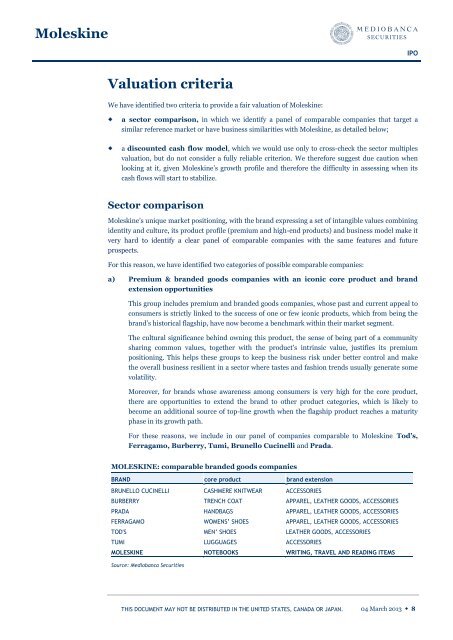

MOLESKINE: comparable branded goods companies<br />

BRAND core product brand extension<br />

BRUNELLO CUCINELLI CASHMERE KNITWEAR ACCESSORIES<br />

BURBERRY TRENCH COAT APPAREL, LEATHER GOODS, ACCESSORIES<br />

PRADA HANDBAGS APPAREL, LEATHER GOODS, ACCESSORIES<br />

FERRAGAMO WOMENS’ SHOES APPAREL, LEATHER GOODS, ACCESSORIES<br />

TOD'S MEN’ SHOES LEATHER GOODS, ACCESSORIES<br />

TUMI LUGGUAGES ACCESSORIES<br />

MOLESKINE NOTEBOOKS WRITING, TRAVEL AND READING ITEMS<br />

Source: Mediobanca Securities<br />

THIS DOCUMENT MAY NOT BE DISTRIBUTED IN THE UNITED STATES, CANADA OR JAPAN.<br />

IPO<br />

<strong>04</strong> March <strong>2013</strong> ◆ 8