moleskine-ipo-report-04-03-2013-mediobanca

moleskine-ipo-report-04-03-2013-mediobanca

moleskine-ipo-report-04-03-2013-mediobanca

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Moleskine<br />

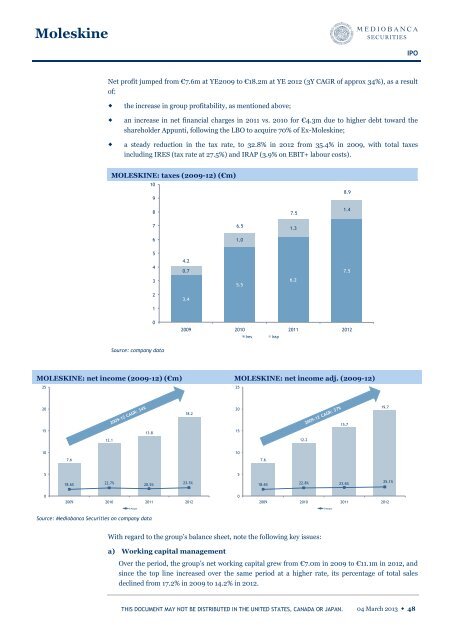

Net profit jumped from €7.6m at YE2009 to €18.2m at YE 2012 (3Y CAGR of approx 34%), as a result<br />

of:<br />

the increase in group profitability, as mentioned above;<br />

an increase in net financial charges in 2011 vs. 2010 for €4.3m due to higher debt toward the<br />

shareholder Appunti, following the LBO to acquire 70% of Ex-Moleskine;<br />

a steady reduction in the tax rate, to 32.8% in 2012 from 35.4% in 2009, with total taxes<br />

including IRES (tax rate at 27.5%) and IRAP (3.9% on EBIT+ labour costs).<br />

MOLESKINE: taxes (2009-12) (€m)<br />

10<br />

Source: company data<br />

9<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

4.2<br />

0.7<br />

3.4<br />

THIS DOCUMENT MAY NOT BE DISTRIBUTED IN THE UNITED STATES, CANADA OR JAPAN.<br />

1.0<br />

5.5<br />

2009 2010 2011 2012<br />

Ires Irap<br />

MOLESKINE: net income (2009-12) (€m) MOLESKINE: net income adj. (2009-12)<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

7.6<br />

18.6%<br />

12.1<br />

22.7%<br />

13.8<br />

20.5%<br />

18.2<br />

23.3%<br />

2009 2010 2011 2012<br />

% Margin<br />

Source: Mediobanca Securities on company data<br />

300%<br />

250%<br />

200%<br />

150%<br />

100%<br />

50%<br />

0%<br />

6.5<br />

7.6<br />

7.5<br />

1.3<br />

6.2<br />

12.2<br />

8.9<br />

1.4<br />

7.5<br />

15.7<br />

18.6% 22.8% 23.6%<br />

With regard to the group’s balance sheet, note the following key issues:<br />

a) Working capital management<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

19.7<br />

2009 2010 2011 2012<br />

Over the period, the group’s net working capital grew from €7.0m in 2009 to €11.1m in 2012, and<br />

since the top line increased over the same period at a higher rate, its percentage of total sales<br />

declined from 17.2% in 2009 to 14.2% in 2012.<br />

% Margin<br />

25.1%<br />

IPO<br />

300%<br />

250%<br />

200%<br />

150%<br />

100%<br />

50%<br />

0%<br />

<strong>04</strong> March <strong>2013</strong> ◆ 48