moleskine-ipo-report-04-03-2013-mediobanca

moleskine-ipo-report-04-03-2013-mediobanca

moleskine-ipo-report-04-03-2013-mediobanca

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Moleskine<br />

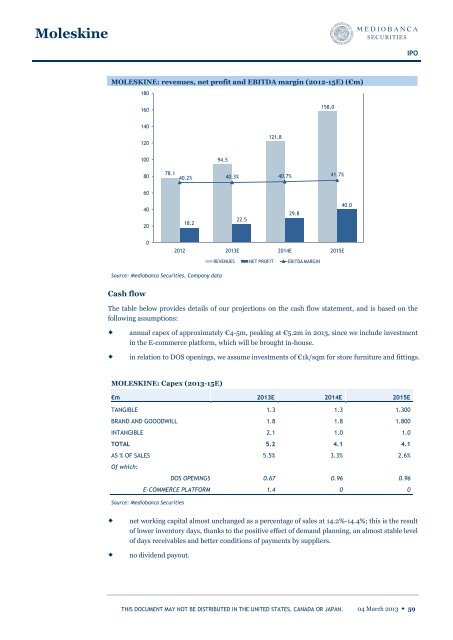

MOLESKINE: revenues, net profit and EBITDA margin (2012-15E) (€m)<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

78.1<br />

18.2<br />

Source: Mediobanca Securities, Company data<br />

Cash flow<br />

94.5<br />

121.8<br />

158.0<br />

40.2% 40.3% 40.7% 41.7%<br />

THIS DOCUMENT MAY NOT BE DISTRIBUTED IN THE UNITED STATES, CANADA OR JAPAN.<br />

22.5<br />

29.8<br />

2012 <strong>2013</strong>E 2014E 2015E<br />

REVENUES NET PROFIT EBITDA MARGIN<br />

40.0<br />

100.0%<br />

The table below provides details of our projections on the cash flow statement, and is based on the<br />

following assumptions:<br />

annual capex of approximately €4-5m, peaking at €5.2m in <strong>2013</strong>, since we include investment<br />

in the E-commerce platform, which will be brought in-house.<br />

in relation to DOS openings, we assume investments of €1k/sqm for store furniture and fittings.<br />

MOLESKINE: Capex (<strong>2013</strong>-15E)<br />

€m <strong>2013</strong>E 2014E 2015E<br />

TANGIBLE 1.3 1.3 1.300<br />

BRAND AND GOOODWILL 1.8 1.8 1.800<br />

INTANGIBLE 2.1 1.0 1.0<br />

TOTAL 5.2 4.1 4.1<br />

AS % OF SALES 5.5% 3.3% 2.6%<br />

Of which:<br />

90.0%<br />

80.0%<br />

70.0%<br />

60.0%<br />

50.0%<br />

40.0%<br />

30.0%<br />

20.0%<br />

10.0%<br />

DOS OPENINGS 0.67 0.96 0.96<br />

E-COMMERCE PLATFORM 1.4 0 0<br />

Source: Mediobanca Securities<br />

net working capital almost unchanged as a percentage of sales at 14.2%-14.4%; this is the result<br />

of lower inventory days, thanks to the positive effect of demand planning, an almost stable level<br />

of days receivables and better conditions of payments by suppliers.<br />

no dividend payout.<br />

0.0%<br />

IPO<br />

<strong>04</strong> March <strong>2013</strong> ◆ 59