moleskine-ipo-report-04-03-2013-mediobanca

moleskine-ipo-report-04-03-2013-mediobanca

moleskine-ipo-report-04-03-2013-mediobanca

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Moleskine<br />

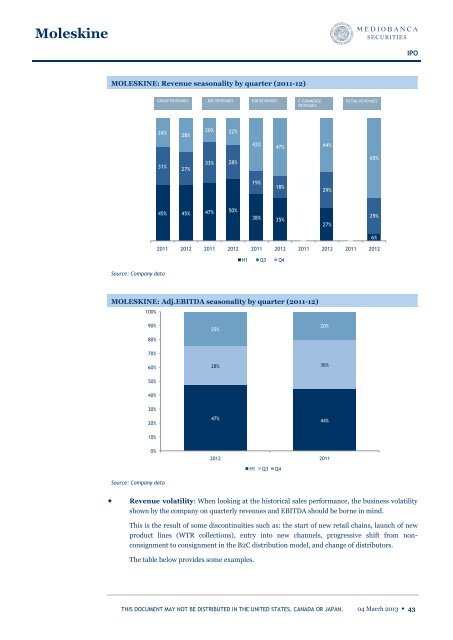

MOLESKINE: Revenue seasonality by quarter (2011-12)<br />

120%<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

24%<br />

31%<br />

Source: Company data<br />

GROUP REVENUES B2C REVENUES B2B REVENUES E-COMMERCE<br />

REVENUES<br />

28%<br />

27%<br />

20% 22%<br />

33%<br />

28%<br />

45% 45% 47% 50%<br />

38% 35%<br />

n.m.<br />

0%<br />

n.m.<br />

0%<br />

6%<br />

2011 2012 2011 2012 2011 2012 2011 2012 2011 2012<br />

THIS DOCUMENT MAY NOT BE DISTRIBUTED IN THE UNITED STATES, CANADA OR JAPAN.<br />

43%<br />

19%<br />

47%<br />

18%<br />

H1 Q3 Q4<br />

MOLESKINE: Adj.EBITDA seasonality by quarter (2011-12)<br />

100%<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

Source: Company data<br />

25%<br />

28%<br />

47%<br />

44%<br />

29%<br />

27%<br />

20%<br />

36%<br />

44%<br />

2012 2011<br />

H1 Q3 Q4<br />

RETAIL REVENUES<br />

Revenue volatility: When looking at the historical sales performance, the business volatility<br />

shown by the company on quarterly revenues and EBITDA should be borne in mind.<br />

This is the result of some discontinuities such as: the start of new retail chains, launch of new<br />

product lines (WTR collections), entry into new channels, progressive shift from nonconsignment<br />

to consignment in the B2C distribution model, and change of distributors.<br />

The table below provides some examples.<br />

65%<br />

29%<br />

IPO<br />

<strong>04</strong> March <strong>2013</strong> ◆ 43