moleskine-ipo-report-04-03-2013-mediobanca

moleskine-ipo-report-04-03-2013-mediobanca

moleskine-ipo-report-04-03-2013-mediobanca

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Moleskine<br />

b) Capital structure<br />

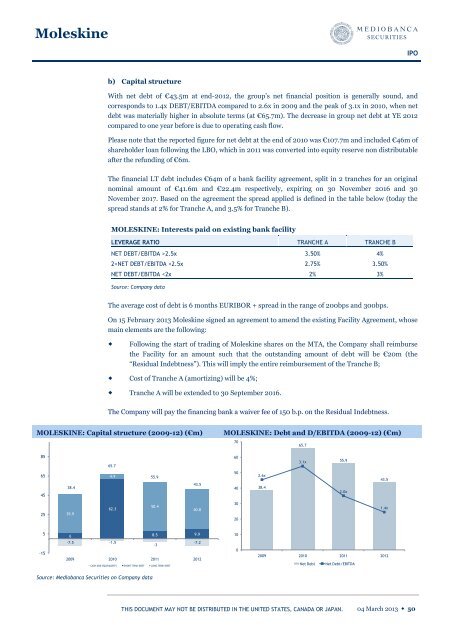

With net debt of €43.5m at end-2012, the group’s net financial position is generally sound, and<br />

corresponds to 1.4x DEBT/EBITDA compared to 2.6x in 2009 and the peak of 3.1x in 2010, when net<br />

debt was materially higher in absolute terms (at €65.7m). The decrease in group net debt at YE 2012<br />

compared to one year before is due to operating cash flow.<br />

Please note that the <strong>report</strong>ed figure for net debt at the end of 2010 was €107.7m and included €46m of<br />

shareholder loan following the LBO, which in 2011 was converted into equity reserve non distributable<br />

after the refunding of €6m.<br />

The financial LT debt includes €64m of a bank facility agreement, split in 2 tranches for an original<br />

nominal amount of €41.6m and €22.4m respectively, expiring on 30 November 2016 and 30<br />

November 2017. Based on the agreement the spread applied is defined in the table below (today the<br />

spread stands at 2% for Tranche A, and 3.5% for Tranche B).<br />

MOLESKINE: Interests paid on existing bank facility<br />

LEVERAGE RATIO TRANCHE A TRANCHE B<br />

NET DEBT/EBITDA >2.5x 3.50% 4%<br />

2