moleskine-ipo-report-04-03-2013-mediobanca

moleskine-ipo-report-04-03-2013-mediobanca

moleskine-ipo-report-04-03-2013-mediobanca

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Moleskine<br />

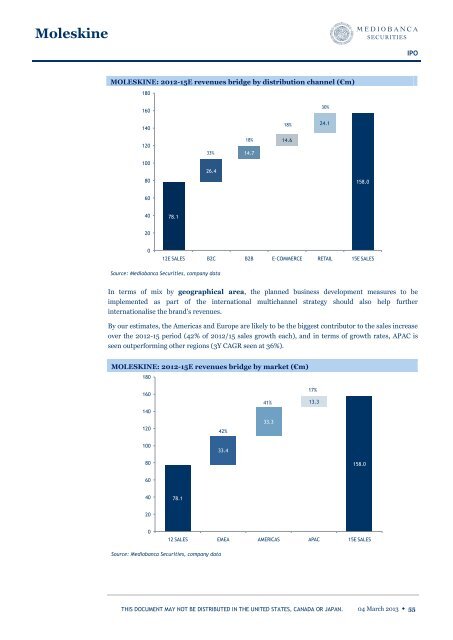

MOLESKINE: 2012-15E revenues bridge by distribution channel (€m)<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

78.1<br />

33%<br />

26.4<br />

THIS DOCUMENT MAY NOT BE DISTRIBUTED IN THE UNITED STATES, CANADA OR JAPAN.<br />

14.7<br />

14.6<br />

24.1<br />

158.0<br />

12E SALES B2C B2B E-COMMERCE RETAIL 15E SALES<br />

Source: Mediobanca Securities, company data<br />

18%<br />

In terms of mix by geographical area, the planned business development measures to be<br />

implemented as part of the international multichannel strategy should also help further<br />

internationalise the brand’s revenues.<br />

By our estimates, the Americas and Europe are likely to be the biggest contributor to the sales increase<br />

over the 2012-15 period (42% of 2012/15 sales growth each), and in terms of growth rates, APAC is<br />

seen outperforming other regions (3Y CAGR seen at 36%).<br />

MOLESKINE: 2012-15E revenues bridge by market (€m)<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

Source: Mediobanca Securities, company data<br />

42%<br />

33.4<br />

41%<br />

33.3<br />

18%<br />

13.3<br />

78.1 78.1 78.1 78.1<br />

30%<br />

158.0<br />

12 SALES EMEA AMERICAS APAC 15E SALES<br />

17%<br />

IPO<br />

<strong>04</strong> March <strong>2013</strong> ◆ 55