DRAVA, KUPA, RJE»INA, LOKVARKA, LI»ANKA LIKA, DOBRA ...

DRAVA, KUPA, RJE»INA, LOKVARKA, LI»ANKA LIKA, DOBRA ...

DRAVA, KUPA, RJE»INA, LOKVARKA, LI»ANKA LIKA, DOBRA ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

100<br />

HEP ANNUAL REPORT 2010<br />

CHAPTER 6 - FINANCIAL STATEMENTS<br />

NOTES TO THE CONSOLIDATED FINANCIAL<br />

STATEMENTS OF THE HEP GROUP (CONTINUED)<br />

FOR THE YEAR ENDED 31 DECEMBER 2010<br />

14. INVESTMENT IN THE NUCLEAR POWER PLANT KRŠKO (continued)<br />

CURRENT STATUS<br />

According to the above stated agreement, the decommissioning of NPPK will be a joint obligation of both parties.<br />

Each party will provide half of the funds necessary to prepare the decommissioning plan and to cover the cost of<br />

implementation of the plan. In addition, each party will form a separate fund to allocate the funds for this purpose<br />

in the amounts estimated by the decommissioning plans. When the Croatian parliament accepted the decommissioning<br />

program (including radioactive waste disposal),Once the Croatian Parliament has adopted the decommissioning<br />

program (including radioactive waste disposal), the establishment of a Croatian fund for gathering decommissioning<br />

funds and for nuclear waste management is expected. The amount of annual payments to be made to the Fund will<br />

be determined taking into account the decommissioning program. From 2004 to 2010, the Group disclosed radioactive<br />

waste disposal and decommissioning provisions in the amount of HRK 964,917 thousand, and paid HRK 959,893<br />

thousand on a separate account in the period from 2006 to 2010. Provision as of 31 December 2010 amounts to HRK<br />

5,024 thousands which in fact represents current portion (Note 33).<br />

The investment in NPPK is accounted for using the equity method and amounts to HRK 1,622,947 thousand.<br />

The positive foreign exchange differences arising on recalculating the capital from the Group’s investment amounting<br />

to HRK 17,354 thousand (2009: negative foreign exchange difference arising on recalculating the capital from the<br />

company’s investment amounting to HRK 4,005 thousand) was charged to capital reserves.<br />

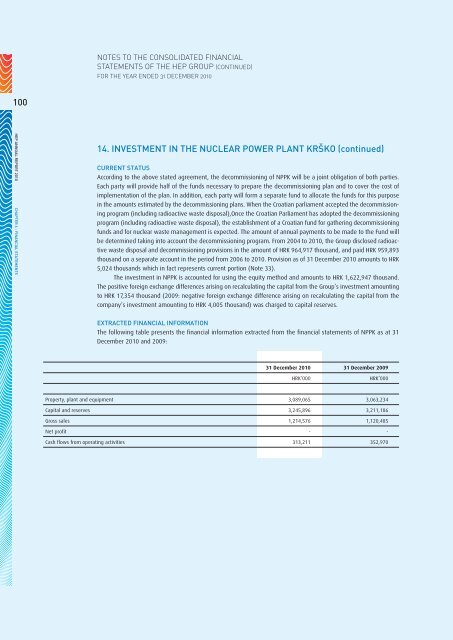

EXTRACTED FINANCIAL INFORMATION<br />

The following table presents the financial information extracted from the financial statements of NPPK as at 31<br />

December 2010 and 2009:<br />

31 December 2010 31 December 2009<br />

HRK’000 HRK’000<br />

Property, plant and equipment 3,089,065 3,063,234<br />

Capital and reserves 3,245,896 3,211,186<br />

Gross sales 1,214,576 1,120,485<br />

Net profit - -<br />

Cash flows from operating activities 313,211 352,970