DRAVA, KUPA, RJE»INA, LOKVARKA, LI»ANKA LIKA, DOBRA ...

DRAVA, KUPA, RJE»INA, LOKVARKA, LI»ANKA LIKA, DOBRA ...

DRAVA, KUPA, RJE»INA, LOKVARKA, LI»ANKA LIKA, DOBRA ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

36<br />

HEP ANNUAL REPORT 2010<br />

CHAPTER 3 - HEP’S BUSINESS OPERATIONS IN 2010<br />

ASSETS<br />

The value of total assets of HEP Group in 2010 increased by 909.9 million kuna to 33.6 billion kuna. The increase<br />

was achieved in short-term assets while long-term assets remained of approximately the same value as at the end<br />

of 2009 due to investment in construction, replacement and reconstruction of energy plants and networks being<br />

lower than annual value adjustment for depreciation. Long-term assets account for 89 percent of the value of the<br />

Group’s assets.<br />

The value of short-term assets is 3.8 billion kuna, an increase of 922.0 million kuna, with the greatest increase<br />

in the item of cash and cash equivalents. The most significant item in short-term assets is accounts receivable amounting<br />

to 1.7 billion kuna, which increased in 2010 due to worse payment collection. This is followed by inventories<br />

of materials, spare parts and energy fuel which amount to 1.1 billion kuna with an increase in the value of fuel<br />

inventories due to higher prices and quantities of oil and coal.<br />

CAPITAL AND LIABILITIES<br />

Capital and reserves at the end of 2010 amounted to 19.7 billion kuna with a share of 59 percent in the Group’s total<br />

assets and an increase of 1,431.8 million kuna compared to 2009, due to the profit of the year.<br />

The structure of liabilities did not change significantly, short-term liabilities decreased by 659.9 million kuna<br />

compared to the beginning of the year due to which their share decreased from 14 to 12 percent. Trade payables<br />

decreased as well as liabilities for short-term loans. Since July 2010, all GEP Group companies have settled their<br />

trade payables by due dates.<br />

Long-term liabilities for loans and securities decreased, but the current portion of these liabilities whose<br />

repayment is due in 2011 increased. Long-term provisions for risks and costs increased due to provisions for legal<br />

suits, unused annual vacations, severance payments in accordance with the Collective Agreement, damage arising<br />

from contracts and increase in estimated costs of nuclear plant decommissioning.<br />

Due to decrease in interest-bearing debt and increase in the value of capital and reserves, net debt to equity<br />

ratio decreased from 32 to 24 percent.<br />

INVESTMENTS<br />

In 2010 the value of the investments that were made by the Group was 1,693.3 million kuna, of which the greatest<br />

part is related to new construction and to replacement and reconstruction of existing energy facilities, plants and<br />

networks. The remaining part is related to information technology and telecommunications infrastructure, remote<br />

control systems, measuring devices and instruments, business premises and transport vehicles.<br />

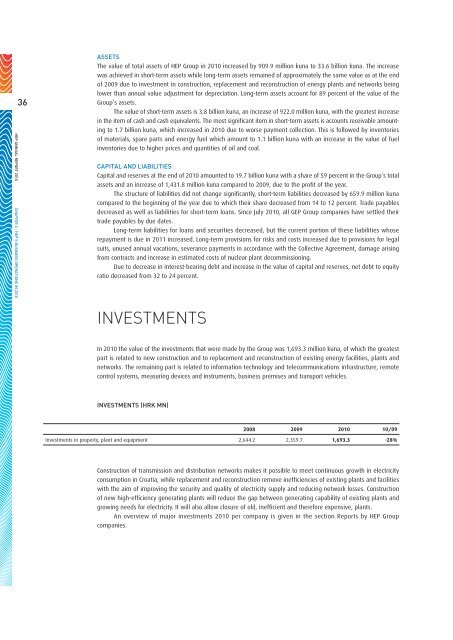

INVESTMENTS (HRK MN)<br />

2008 2009 2010 10/09<br />

Investments in property, plant and equipment 2,644.2 2,359.7 1,693.3 -28%<br />

Construction of transmission and distribution networks makes it possible to meet continuous growth in electricity<br />

consumption in Croatia, while replacement and reconstruction remove inefficiencies of existing plants and facilities<br />

with the aim of improving the security and quality of electricity supply and reducing network losses. Construction<br />

of new high-efficiency generating plants will reduce the gap between generating capability of existing plants and<br />

growing needs for electricity. It will also allow closure of old, inefficient and therefore expensive, plants.<br />

An overview of major investments 2010 per company is given in the section Reports by HEP Group<br />

companies.