Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Agra<br />

Makhanpur<br />

Road<br />

8<br />

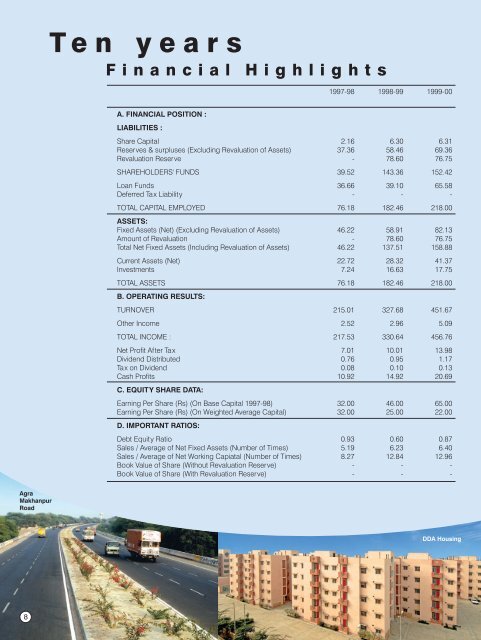

T e n y e a r s<br />

F i n a n c i a l H i g h l i g h t s<br />

A. FINANCIAL A. POSITION FINANCIAL : POSITION :<br />

LIABILITIES :<br />

LIABILITIES :<br />

Dolphin Jetty, Bangladesh<br />

1997-98 1998-99 1997-98 1999-00 1998-99 19<br />

Share Capital Share Capital 2.16 6.30 2.16 6.31 6.30<br />

Reserves & surpluses Reserves (Excluding & surpluses Revaluation (Excluding of Assets) Revaluation of Assets) 37.36 58.46 37.36 69.36 58.46<br />

Revaluation Reserve Revaluation Reserve - 78.60- 76.75 78.60<br />

SHAREHOLDERS' SHAREHOLDERS' FUNDS FUNDS 39.52 143.36 39.52 152.42 143.36 1<br />

Loan Funds Loan Funds 36.66 39.10 36.66 65.58 39.10<br />

Deferred Tax Liability Deferred Tax Liability<br />

- - -<br />

TOTAL CAPITAL TOTAL EMPLOYED CAPITAL EMPLOYED 76.18 182.46 76.18 218.00 182.46 2<br />

ASSETS: ASSETS:<br />

Fixed Assets (Net) Fixed (Excluding Assets (Net) Revaluation (Excluding of Assets) Revaluation of Assets) 46.22 58.91 46.22 82.13 58.91<br />

Amount of Revaluation Amount of Revaluation - 78.60- 76.75 78.60<br />

Total Net Fixed Assets Total Net (Including Fixed Assets Revaluation (Including of Assets) Revaluation of Assets) 46.22 137.51 46.22 158.88 137.51 1<br />

Current Assets (Net) Current Assets (Net) 22.72 28.32 22.72 41.37 28.32<br />

Investments Investments 7.24 16.63 7.24 17.75 16.63<br />

TOTAL ASSETS TOTAL ASSETS 76.18 182.46 76.18 218.00 182.46 2<br />

B. OPERATING B. RESULTS: OPERATING RESULTS:<br />

TURNOVER TURNOVER 215.01 327.68 215.01 451.67 327.68 4<br />

Other Income Other Income 2.52 2.96 2.52 5.09 2.96<br />

TOTAL INCOME TOTAL : INCOME : 217.53 330.64 217.53 456.76 330.64 4<br />

Net Profit After Tax Net Profit After Tax 7.01 10.01 7.01 13.98 10.01<br />

Dividend Distributed Dividend Distributed 0.76 0.95 0.76 1.17 0.95<br />

Tax on DividendTax on Dividend 0.08 0.10 0.08 0.13 0.10<br />

Cash Profits Cash Profits 10.92 14.92 10.92 20.69 14.92<br />

C. EQUITY SHARE C. EQUITY DATA: CASH DATA<br />

Earning Per Share Earning (Rs) (On Per Base Share Capital (Rs) (On 1997-98) Base Capital 1997-98) 32.00 46.00 32.00 65.00 46.00<br />

Earning Per Share Earning (Rs) (On Per Weighted Share (Rs) Average (On Weighted Capital) Average Capital) 32.00 25.00 32.00 22.00 25.00<br />

D. IMPORTANT D. RATIOS: IMPORTANT RATIOS:<br />

Debt Equity Ratio Debt Equity Ratio 0.93 0.60 0.93 0.87 0.60<br />

Sales / Average Sales of Net / Fixed Average Assets of Net (Number Fixed Assets of Times) (Number of Times) 5.19 6.23 5.19 6.40 6.23<br />

Sales / Average Sales of Net / Working Average Capiatal of Net Working (Number Capiatal of Times) (Number of Times) 8.27 12.84 8.27 12.96 12.84<br />

Book Value of Share Book (Without Value of Revaluation Share (Without Reserve) Revaluation Reserve) - - -<br />

Book Value of Share Book (With Value Revaluation of Share (With Reserve) Revaluation Reserve)<br />

- - -<br />

DDA Housing