Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GAMMON INDIA LIMITED<br />

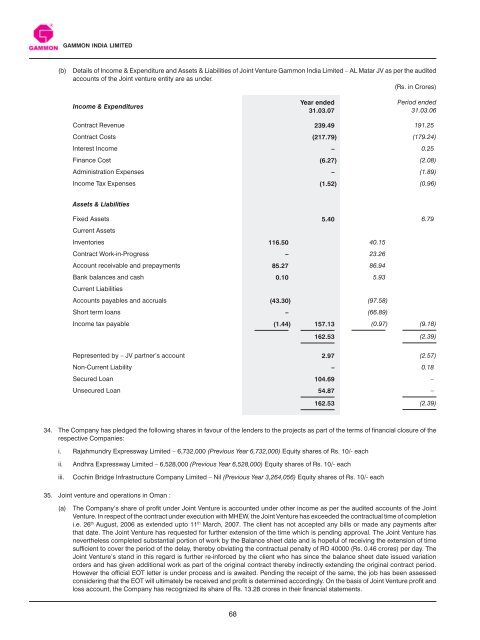

(b) Details of Income & Expenditure and Assets & Liabilities of Joint Venture <strong>Gammon</strong> <strong>India</strong> Limited – AL Matar JV as per the audited<br />

accounts of the Joint venture entity are as under.<br />

(Rs. in Crores)<br />

Income & Expenditures<br />

68<br />

Year ended<br />

31.03.07<br />

Period ended<br />

31.03.06<br />

Contract Revenue 239.49 191.25<br />

Contract Costs (217.79) (179.24)<br />

Interest Income – 0.25<br />

Finance Cost (6.27) (2.08)<br />

Administration Expenses – (1.89)<br />

Income Tax Expenses (1.52) (0.96)<br />

Assets & Liabilities<br />

Fixed Assets<br />

Current Assets<br />

5.40 6.79<br />

Inventories 116.50 40.15<br />

Contract Work-in-Progress – 23.26<br />

Account receivable and prepayments 85.27 86.94<br />

Bank balances and cash<br />

Current Liabilities<br />

0.10 5.93<br />

Accounts payables and accruals (43.30) (97.58)<br />

Short term loans – (66.89)<br />

Income tax payable (1.44) 157.13 (0.97) (9.18)<br />

162.53 (2.39)<br />

Represented by – JV partner’s account 2.97 (2.57)<br />

Non-Current Liability – 0.18<br />

Secured Loan 104.69 –<br />

Unsecured Loan 54.87 –<br />

162.53 (2.39)<br />

34. The Company has pledged the following shares in favour of the lenders to the projects as part of the terms of financial closure of the<br />

respective Companies:<br />

i. Rajahmundry Expressway Limited – 6,732,000 (Previous Year 6,732,000) Equity shares of Rs. 10/- each<br />

ii. Andhra Expressway Limited – 6,528,000 (Previous Year 6,528,000) Equity shares of Rs. 10/- each<br />

iii. Cochin Bridge Infrastructure Company Limited – Nil (Previous Year 3,264,056) Equity shares of Rs. 10/- each<br />

35. Joint venture and operations in Oman :<br />

(a) The Company’s share of profit under Joint Venture is accounted under other income as per the audited accounts of the Joint<br />

Venture. In respect of the contract under execution with MHEW, the Joint Venture has exceeded the contractual time of completion<br />

i.e. 26 th August, <strong>2006</strong> as extended upto 11 th March, <strong>2007</strong>. The client has not accepted any bills or made any payments after<br />

that date. The Joint Venture has requested for further extension of the time which is pending approval. The Joint Venture has<br />

nevertheless completed substantial portion of work by the Balance sheet date and is hopeful of receiving the extension of time<br />

sufficient to cover the period of the delay, thereby obviating the contractual penalty of RO 40000 (Rs. 0.46 crores) per day. The<br />

Joint Venture’s stand in this regard is further re-inforced by the client who has since the balance sheet date issued variation<br />

orders and has given additional work as part of the original contract thereby indirectly extending the original contract period.<br />

However the official EOT letter is under process and is awaited. Pending the receipt of the same, the job has been assessed<br />

considering that the EOT will ultimately be received and profit is determined accordingly. On the basis of Joint Venture profit and<br />

loss account, the Company has recognized its share of Rs. 13.28 crores in their financial statements.