Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Face Value<br />

Rupees<br />

55<br />

Nos. as on<br />

31.03.<strong>2007</strong><br />

Nos. as on<br />

31.03.<strong>2006</strong><br />

31.03.<strong>2007</strong><br />

Rs. in Crores<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2006</strong>-<strong>2007</strong><br />

31.03.<strong>2006</strong><br />

Rs. in Crores<br />

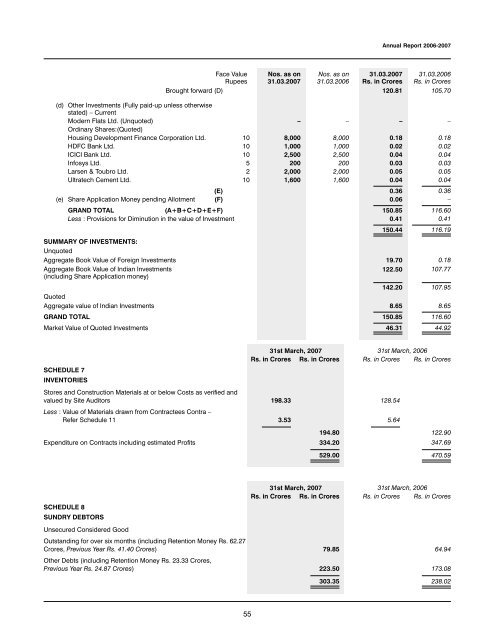

Brought forward (D) 120.81 105.70<br />

(d) Other Investments (Fully paid-up unless otherwise<br />

stated) – Current<br />

Modern Flats Ltd. (Unquoted) – – – –<br />

Ordinary Shares:(Quoted)<br />

Housing Development Finance Corporation Ltd. 10 8,000 8,000 0.18 0.18<br />

HDFC Bank Ltd. 10 1,000 1,000 0.02 0.02<br />

ICICI Bank Ltd. 10 2,500 2,500 0.04 0.04<br />

Infosys Ltd. 5 200 200 0.03 0.03<br />

Larsen & Toubro Ltd. 2 2,000 2,000 0.05 0.05<br />

Ultratech Cement Ltd. 10 1,600 1,600 0.04 0.04<br />

(E) 0.36 0.36<br />

(e) Share Application Money pending Allotment (F) 0.06 –<br />

GRAND TOTAL (A+B+C+D+E+F) 150.85 116.60<br />

Less : Provisions for Diminution in the value of Investment 0.41 0.41<br />

150.44 116.19<br />

SUMMARY OF INVESTMENTS:<br />

Unquoted<br />

Aggregate Book Value of Foreign Investments 19.70 0.18<br />

Aggregate Book Value of <strong>India</strong>n Investments<br />

(including Share Application money)<br />

122.50 107.77<br />

142.20 107.95<br />

Quoted<br />

Aggregate value of <strong>India</strong>n Investments 8.65 8.65<br />

GRAND TOTAL 150.85 116.60<br />

Market Value of Quoted Investments 46.31 44.92<br />

SCHEDULE 7<br />

INVENTORIES<br />

31st March, <strong>2007</strong> 31st March, <strong>2006</strong><br />

Rs. in Crores Rs. in Crores Rs. in Crores Rs. in Crores<br />

Stores and Construction Materials at or below Costs as verified and<br />

valued by Site Auditors 198.33 128.54<br />

Less : Value of Materials drawn from Contractees Contra –<br />

Refer Schedule 11 3.53 5.64<br />

194.80 122.90<br />

Expenditure on Contracts including estimated Profits 334.20 347.69<br />

SCHEDULE 8<br />

SUNDRY DEBTORS<br />

Unsecured Considered Good<br />

529.00 470.59<br />

31st March, <strong>2007</strong> 31st March, <strong>2006</strong><br />

Rs. in Crores Rs. in Crores Rs. in Crores Rs. in Crores<br />

Outstanding for over six months (including Retention Money Rs. 62.27<br />

Crores, Previous Year Rs. 41.40 Crores) 79.85 64.94<br />

Other Debts (including Retention Money Rs. 23.33 Crores,<br />

Previous Year Rs. 24.87 Crores) 223.50 173.08<br />

303.35 238.02