Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

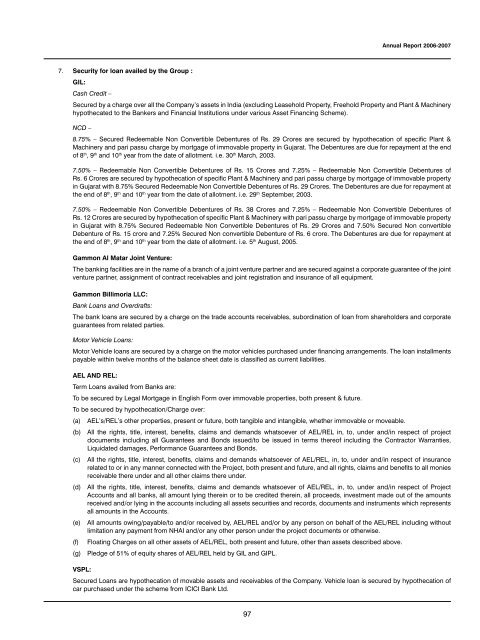

7. Security for loan availed by the Group :<br />

GIL:<br />

Cash Credit –<br />

97<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2006</strong>-<strong>2007</strong><br />

Secured by a charge over all the Company’s assets in <strong>India</strong> (excluding Leasehold Property, Freehold Property and Plant & Machinery<br />

hypothecated to the Bankers and Financial Institutions under various Asset Financing Scheme).<br />

NCD –<br />

8.75% – Secured Redeemable Non Convertible Debentures of Rs. 29 Crores are secured by hypothecation of specific Plant &<br />

Machinery and pari passu charge by mortgage of immovable property in Gujarat. The Debentures are due for repayment at the end<br />

of 8 th , 9 th and 10 th year from the date of allotment. i.e. 30 th March, 2003.<br />

7.50% – Redeemable Non Convertible Debentures of Rs. 15 Crores and 7.25% – Redeemable Non Convertible Debentures of<br />

Rs. 6 Crores are secured by hypothecation of specific Plant & Machinery and pari passu charge by mortgage of immovable property<br />

in Gujarat with 8.75% Secured Redeemable Non Convertible Debentures of Rs. 29 Crores. The Debentures are due for repayment at<br />

the end of 8 th , 9 th and 10 th year from the date of allotment. i.e. 29 th September, 2003.<br />

7.50% – Redeemable Non Convertible Debentures of Rs. 38 Crores and 7.25% – Redeemable Non Convertible Debentures of<br />

Rs. 12 Crores are secured by hypothecation of specific Plant & Machinery with pari passu charge by mortgage of immovable property<br />

in Gujarat with 8.75% Secured Redeemable Non Convertible Debentures of Rs. 29 Crores and 7.50% Secured Non convertible<br />

Debenture of Rs. 15 crore and 7.25% Secured Non convertible Debenture of Rs. 6 crore. The Debentures are due for repayment at<br />

the end of 8 th , 9 th and 10 th year from the date of allotment. i.e. 5 th August, 2005.<br />

<strong>Gammon</strong> Al Matar Joint Venture:<br />

The banking facilities are in the name of a branch of a joint venture partner and are secured against a corporate guarantee of the joint<br />

venture partner, assignment of contract receivables and joint registration and insurance of all equipment.<br />

<strong>Gammon</strong> Billimoria LLC:<br />

Bank Loans and Overdrafts:<br />

The bank loans are secured by a charge on the trade accounts receivables, subordination of loan from shareholders and corporate<br />

guarantees from related parties.<br />

Motor Vehicle Loans:<br />

Motor Vehicle loans are secured by a charge on the motor vehicles purchased under financing arrangements. The loan installments<br />

payable within twelve months of the balance sheet date is classified as current liabilities.<br />

AEL AND REL:<br />

Term Loans availed from Banks are:<br />

To be secured by Legal Mortgage in English Form over immovable properties, both present & future.<br />

To be secured by hypothecation/Charge over:<br />

(a) AEL’s/REL’s other properties, present or future, both tangible and intangible, whether immovable or moveable.<br />

(b) All the rights, title, interest, benefits, claims and demands whatsoever of AEL/REL in, to, under and/in respect of project<br />

documents including all Guarantees and Bonds issued/to be issued in terms thereof including the Contractor Warranties,<br />

Liquidated damages, Performance Guarantees and Bonds.<br />

(c) All the rights, title, interest, benefits, claims and demands whatsoever of AEL/REL, in, to, under and/in respect of insurance<br />

related to or in any manner connected with the Project, both present and future, and all rights, claims and benefits to all monies<br />

receivable there under and all other claims there under.<br />

(d) All the rights, title, interest, benefits, claims and demands whatsoever of AEL/REL, in, to, under and/in respect of Project<br />

Accounts and all banks, all amount lying therein or to be credited therein, all proceeds, investment made out of the amounts<br />

received and/or lying in the accounts including all assets securities and records, documents and instruments which represents<br />

all amounts in the Accounts.<br />

(e) All amounts owing/payable/to and/or received by, AEL/REL and/or by any person on behalf of the AEL/REL including without<br />

limitation any payment from NHAI and/or any other person under the project documents or otherwise.<br />

(f) Floating Charges on all other assets of AEL/REL, both present and future, other than assets described above.<br />

(g) Pledge of 51% of equity shares of AEL/REL held by GIL and GIPL.<br />

VSPL:<br />

Secured Loans are hypothecation of movable assets and receivables of the Company. Vehicle loan is secured by hypothecation of<br />

car purchased under the scheme from ICICI Bank Ltd.