Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

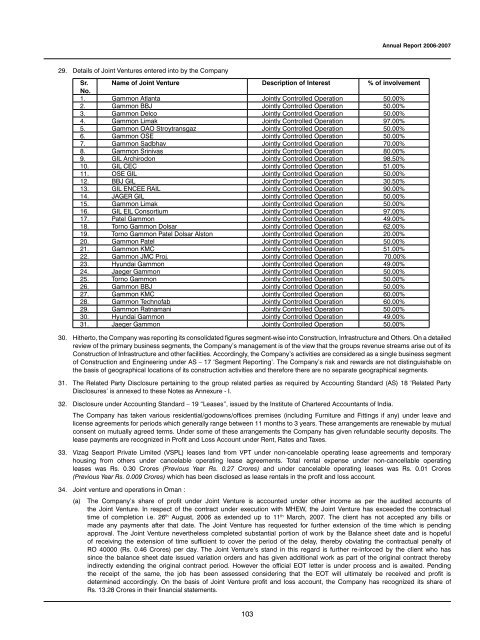

29. Details of Joint Ventures entered into by the Company<br />

103<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2006</strong>-<strong>2007</strong><br />

Sr.<br />

No.<br />

Name of Joint Venture Description of Interest % of involvement<br />

1. <strong>Gammon</strong> Atlanta Jointly Controlled Operation 50.00%<br />

2. <strong>Gammon</strong> BBJ Jointly Controlled Operation 50.00%<br />

3. <strong>Gammon</strong> Delco Jointly Controlled Operation 50.00%<br />

4. <strong>Gammon</strong> Limak Jointly Controlled Operation 97.00%<br />

5. <strong>Gammon</strong> OAO Stroytransgaz Jointly Controlled Operation 50.00%<br />

6. <strong>Gammon</strong> OSE Jointly Controlled Operation 50.00%<br />

7. <strong>Gammon</strong> Sadbhav Jointly Controlled Operation 70.00%<br />

8. <strong>Gammon</strong> Srinivas Jointly Controlled Operation 80.00%<br />

9. GIL Archirodon Jointly Controlled Operation 98.50%<br />

10. GIL CEC Jointly Controlled Operation 51.00%<br />

11. OSE GIL Jointly Controlled Operation 50.00%<br />

12. BBJ GIL Jointly Controlled Operation 30.50%<br />

13. GIL ENCEE RAIL Jointly Controlled Operation 90.00%<br />

14. JAGER GIL Jointly Controlled Operation 50.00%<br />

15. <strong>Gammon</strong> Limak Jointly Controlled Operation 50.00%<br />

16. GIL EIL Consortium Jointly Controlled Operation 97.00%<br />

17. Patel <strong>Gammon</strong> Jointly Controlled Operation 49.00%<br />

18. Torno <strong>Gammon</strong> Dolsar Jointly Controlled Operation 62.00%<br />

19. Torno <strong>Gammon</strong> Patel Dolsar Alston Jointly Controlled Operation 20.00%<br />

20. <strong>Gammon</strong> Patel Jointly Controlled Operation 50.00%<br />

21. <strong>Gammon</strong> KMC Jointly Controlled Operation 51.00%<br />

22. <strong>Gammon</strong> JMC Proj. Jointly Controlled Operation 70.00%<br />

23. Hyundai <strong>Gammon</strong> Jointly Controlled Operation 49.00%<br />

24. Jaeger <strong>Gammon</strong> Jointly Controlled Operation 50.00%<br />

25. Torno <strong>Gammon</strong> Jointly Controlled Operation 50.00%<br />

26. <strong>Gammon</strong> BBJ Jointly Controlled Operation 50.00%<br />

27. <strong>Gammon</strong> KMC Jointly Controlled Operation 60.00%<br />

28. <strong>Gammon</strong> Technofab Jointly Controlled Operation 60.00%<br />

29. <strong>Gammon</strong> Ratnamani Jointly Controlled Operation 50.00%<br />

30. Hyundai <strong>Gammon</strong> Jointly Controlled Operation 49.00%<br />

31. Jaeger <strong>Gammon</strong> Jointly Controlled Operation 50.00%<br />

30. Hitherto, the Company was reporting its consolidated figures segment-wise into Construction, Infrastructure and Others. On a detailed<br />

review of the primary business segments, the Company’s management is of the view that the groups revenue streams arise out of its<br />

Construction of Infrastructure and other facilities. Accordingly, the Company’s activities are considered as a single business segment<br />

of Construction and Engineering under AS – 17 ‘Segment <strong>Report</strong>ing’. The Company’s risk and rewards are not distinguishable on<br />

the basis of geographical locations of its construction activities and therefore there are no separate geographical segments.<br />

31. The Related Party Disclosure pertaining to the group related parties as required by Accounting Standard (AS) 18 ‘Related Party<br />

Disclosures’ is annexed to these Notes as Annexure - I.<br />

32. Disclosure under Accounting Standard – 19 “Leases”, issued by the Institute of Chartered Accountants of <strong>India</strong>.<br />

The Company has taken various residential/godowns/offices premises (including Furniture and Fittings if any) under leave and<br />

license agreements for periods which generally range between 11 months to 3 years. These arrangements are renewable by mutual<br />

consent on mutually agreed terms. Under some of these arrangements the Company has given refundable security deposits. The<br />

lease payments are recognized in Profit and Loss Account under Rent, Rates and Taxes.<br />

33. Vizag Seaport Private Limited (VSPL) leases land from VPT under non-cancelable operating lease agreements and temporary<br />

housing from others under cancelable operating lease agreements. Total rental expense under non-cancellable operating<br />

leases was Rs. 0.30 Crores (Previous Year Rs. 0.27 Crores) and under cancelable operating leases was Rs. 0.01 Crores<br />

(Previous Year Rs. 0.009 Crores) which has been disclosed as lease rentals in the profit and loss account.<br />

34. Joint venture and operations in Oman :<br />

(a) The Company’s share of profit under Joint Venture is accounted under other income as per the audited accounts of<br />

the Joint Venture. In respect of the contract under execution with MHEW, the Joint Venture has exceeded the contractual<br />

time of completion i.e. 26th August, <strong>2006</strong> as extended up to 11th March, <strong>2007</strong>. The client has not accepted any bills or<br />

made any payments after that date. The Joint Venture has requested for further extension of the time which is pending<br />

approval. The Joint Venture nevertheless completed substantial portion of work by the Balance sheet date and is hopeful<br />

of receiving the extension of time sufficient to cover the period of the delay, thereby obviating the contractual penalty of<br />

RO 40000 (Rs. 0.46 Crores) per day. The Joint Venture’s stand in this regard is further re-inforced by the client who has<br />

since the balance sheet date issued variation orders and has given additional work as part of the original contract thereby<br />

indirectly extending the original contract period. However the official EOT letter is under process and is awaited. Pending<br />

the receipt of the same, the job has been assessed considering that the EOT will ultimately be received and profit is<br />

determined accordingly. On the basis of Joint Venture profit and loss account, the Company has recognized its share of<br />

Rs. 13.28 Crores in their financial statements.