Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

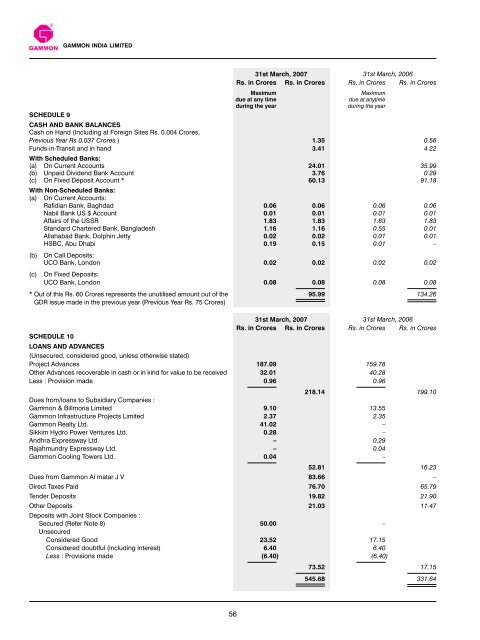

SCHEDULE 9<br />

GAMMON INDIA LIMITED<br />

56<br />

31st March, <strong>2007</strong> 31st March, <strong>2006</strong><br />

Rs. in Crores Rs. in Crores Rs. in Crores Rs. in Crores<br />

Maximum<br />

due at any time<br />

during the year<br />

Maximum<br />

due at anytime<br />

during the year<br />

CASH AND BANK BALANCES<br />

Cash on Hand (Including at Foreign Sites Rs. 0.004 Crores,<br />

Previous Year Rs 0.037 Crores ) 1.35 0.56<br />

Funds-in-Transit and in hand 3.41 4.22<br />

With Scheduled Banks:<br />

(a) On Current Accounts 24.01 35.99<br />

(b) Unpaid Dividend Bank Account 3.76 0.29<br />

(c) On Fixed Deposit Account * 60.13 91.18<br />

With Non-Scheduled Banks:<br />

(a) On Current Accounts:<br />

Rafidian Bank, Baghdad 0.06 0.06 0.06 0.06<br />

Nabil Bank US $ Account 0.01 0.01 0.01 0.01<br />

Affairs of the USSR 1.83 1.83 1.83 1.83<br />

Standard Chartered Bank, Bangladesh 1.16 1.16 0.55 0.01<br />

Allahabad Bank, Dolphin Jetty 0.02 0.02 0.01 0.01<br />

HSBC, Abu Dhabi 0.19 0.15 0.01 –<br />

(b) On Call Deposits:<br />

UCO Bank, London 0.02 0.02 0.02 0.02<br />

(c) On Fixed Deposits:<br />

UCO Bank, London 0.08 0.08 0.08 0.08<br />

* Out of this Rs. 60 Crores represents the unutilised amount out of the<br />

GDR issue made in the previous year (Previous Year Rs. 75 Crores)<br />

SCHEDULE 10<br />

95.99 134.26<br />

31st March, <strong>2007</strong> 31st March, <strong>2006</strong><br />

Rs. in Crores Rs. in Crores Rs. in Crores Rs. in Crores<br />

LOANS AND ADVANCES<br />

(Unsecured, considered good, unless otherwise stated)<br />

Project Advances 187.09 159.78<br />

Other Advances recoverable in cash or in kind for value to be received 32.01 40.28<br />

Less : Provision made 0.96 0.96<br />

218.14 199.10<br />

Dues from/loans to Subsidiary Companies :<br />

<strong>Gammon</strong> & Billmoria Limited 9.10 13.55<br />

<strong>Gammon</strong> Infrastructure Projects Limited 2.37 2.35<br />

<strong>Gammon</strong> Realty Ltd. 41.02 –<br />

Sikkim Hydro Power Ventures Ltd. 0.28 –<br />

Andhra Expressway Ltd. – 0.29<br />

Rajahmundry Expressway Ltd. – 0.04<br />

<strong>Gammon</strong> Cooling Towers Ltd. 0.04 –<br />

52.81 16.23<br />

Dues from <strong>Gammon</strong> Al matar J V 83.66 –<br />

Direct Taxes Paid 76.70 65.79<br />

Tender Deposits 19.82 21.90<br />

Other Deposits 21.03 11.47<br />

Deposits with Joint Stock Companies :<br />

Secured (Refer Note 8)<br />

Unsecured<br />

50.00 –<br />

Considered Good 23.52 17.15<br />

Considered doubtful (including interest) 6.40 6.40<br />

Less : Provisions made (6.40) (6.40)<br />

73.52 17.15<br />

545.68 331.64