Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

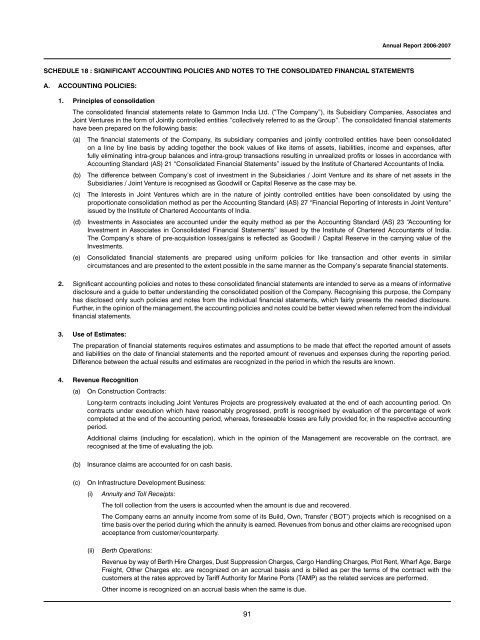

SCHEDULE 18 : SIGNIFICANT ACCOUNTING POLICIES AND NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

A. ACCOUNTING POLICIES:<br />

91<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2006</strong>-<strong>2007</strong><br />

1. Principles of consolidation<br />

The consolidated financial statements relate to <strong>Gammon</strong> <strong>India</strong> Ltd. (“The Company”), its Subsidiary Companies, Associates and<br />

Joint Ventures in the form of Jointly controlled entities “collectively referred to as the Group”. The consolidated financial statements<br />

have been prepared on the following basis:<br />

(a) The financial statements of the Company, its subsidiary companies and jointly controlled entities have been consolidated<br />

on a line by line basis by adding together the book values of like items of assets, liabilities, income and expenses, after<br />

fully eliminating intra-group balances and intra-group transactions resulting in unrealized profits or losses in accordance with<br />

Accounting Standard (AS) 21 “Consolidated Financial Statements” issued by the Institute of Chartered Accountants of <strong>India</strong>.<br />

(b) The difference between Company’s cost of investment in the Subsidiaries / Joint Venture and its share of net assets in the<br />

Subsidiaries / Joint Venture is recognised as Goodwill or Capital Reserve as the case may be.<br />

(c) The Interests in Joint Ventures which are in the nature of jointly controlled entities have been consolidated by using the<br />

proportionate consolidation method as per the Accounting Standard (AS) 27 “Financial <strong>Report</strong>ing of Interests in Joint Venture”<br />

issued by the Institute of Chartered Accountants of <strong>India</strong>.<br />

(d) Investments in Associates are accounted under the equity method as per the Accounting Standard (AS) 23 “Accounting for<br />

Investment in Associates in Consolidated Financial Statements” issued by the Institute of Chartered Accountants of <strong>India</strong>.<br />

The Company’s share of pre-acquisition losses/gains is reflected as Goodwill / Capital Reserve in the carrying value of the<br />

Investments.<br />

(e) Consolidated financial statements are prepared using uniform policies for like transaction and other events in similar<br />

circumstances and are presented to the extent possible in the same manner as the Company’s separate financial statements.<br />

2. Significant accounting policies and notes to these consolidated financial statements are intended to serve as a means of informative<br />

disclosure and a guide to better understanding the consolidated position of the Company. Recognising this purpose, the Company<br />

has disclosed only such policies and notes from the individual financial statements, which fairly presents the needed disclosure.<br />

Further, in the opinion of the management, the accounting policies and notes could be better viewed when referred from the individual<br />

financial statements.<br />

3. Use of Estimates:<br />

The preparation of financial statements requires estimates and assumptions to be made that effect the reported amount of assets<br />

and liabilities on the date of financial statements and the reported amount of revenues and expenses during the reporting period.<br />

Difference between the actual results and estimates are recognized in the period in which the results are known.<br />

4. Revenue Recognition<br />

(a) On Construction Contracts:<br />

Long-term contracts including Joint Ventures Projects are progressively evaluated at the end of each accounting period. On<br />

contracts under execution which have reasonably progressed, profit is recognised by evaluation of the percentage of work<br />

completed at the end of the accounting period, whereas, foreseeable losses are fully provided for, in the respective accounting<br />

period.<br />

Additional claims (including for escalation), which in the opinion of the Management are recoverable on the contract, are<br />

recognised at the time of evaluating the job.<br />

(b) Insurance claims are accounted for on cash basis.<br />

(c) On Infrastructure Development Business:<br />

(i) Annuity and Toll Receipts:<br />

The toll collection from the users is accounted when the amount is due and recovered.<br />

The Company earns an annuity income from some of its Build, Own, Transfer (‘BOT’) projects which is recognised on a<br />

time basis over the period during which the annuity is earned. Revenues from bonus and other claims are recognised upon<br />

acceptance from customer/counterparty.<br />

(ii) Berth Operations:<br />

Revenue by way of Berth Hire Charges, Dust Suppression Charges, Cargo Handling Charges, Plot Rent, Wharf Age, Barge<br />

Freight, Other Charges etc. are recognized on an accrual basis and is billed as per the terms of the contract with the<br />

customers at the rates approved by Tariff Authority for Marine Ports (TAMP) as the related services are performed.<br />

Other income is recognized on an accrual basis when the same is due.