Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

63<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2006</strong>-<strong>2007</strong><br />

10. Foreign currency exposure un-hedged as at 31 st March, <strong>2007</strong> is Rs. 185.39 crores (Previous Year Rs. 84.88 crores) and Rs. 106.89<br />

crores (Previous year Rs. 50.29 crores) payables. The Company does not have any outstanding derivative contracts as at 31.03.07.<br />

(In the previous year, there was one option contract for Rs. 32.33 crores outstanding towards hedging).<br />

11. Sundry Creditors include Rs. Nil (Previous Year Rs. 2.24 crores) due to Vizag Seaport Pvt. Ltd., a Joint Venture Company,<br />

Rs. 2.33 crores (Previous Year Rs. 1.11 crores) due to <strong>Gammon</strong> Infrastructure Projects Ltd., a subsidiary Company and Rs. 0.16<br />

crores (Previous Year Nil) due to Cochin Bridge Infrastructure Company Ltd., a subsidiary Company.<br />

Sundry Debtors include Rs. 2.27 crores (Previous Year Rs. 4.64 crores) due from Rajahmundry Expressway Ltd., a subsidiary<br />

Company, Rs. 2.15 crores (Previous Year Rs. 2.36 crores) due from Andhra Expressway Ltd., a subsidiary Company and<br />

Rs. 0.99 crores (Previous Year Nil) due from Associated Transrail Structures Ltd., an associate Company.<br />

Loans and Advances include Rs. 9.10 crores (Previous Year Rs. 13.55 crores) due from <strong>Gammon</strong> & Billimoria Ltd, Rs. 41.00 crores<br />

(Previous Year Nil) due from <strong>Gammon</strong> Realty Ltd., Rs. 0.04 crores (Previous Year Nil) due from <strong>Gammon</strong> Cooling Towers Ltd. and<br />

Rs. 0.28 crores (Previous Year Nil) due from Sikkim Hydro Power Ventures Ltd., all subsidiary Companies and Rs. 0.41 crores<br />

(Previous Year Rs. 0.39 crores) due from Vizag Seaport Pvt. Ltd., a Joint Venture Company.<br />

Interest receivables include Rs. 1.15 crores (Previous Year Rs. 0.31 crores) due from <strong>Gammon</strong> & Billimoria Ltd., Rs. 0.06 crores<br />

due from <strong>Gammon</strong> Realty Ltd., both subsidiary Companies and Rs. 0.31 crores due from Associated Transrail Structures Ltd., an<br />

associate Company.<br />

Investment includes Rs. 32.84 crores received from <strong>Gammon</strong> Infrastructure Projects Ltd., on account of deposit for acquisition of<br />

shares.<br />

12. The depreciation for the year is net of write back of depreciation of assets in Oman Branch of the Company. Hitherto, the Company<br />

was charging depreciation on the assets lying in Oman as per the rates specified in the Omani laws, which were higher than the<br />

schedule XIV rates. During the year, Oman branch has changed the method of depreciation to bring it in line with the rates and in<br />

the manner specified in the schedule XIV. The excess depreciation charged during previous years amounting to Rs. 2.68 crores has<br />

been reversed. The effect of the change in method of depreciation for the year is Rs. 2.85 crores. On account of this change in the<br />

method of charging depreciation the profit for the year is higher by Rs. 5.53 crores.<br />

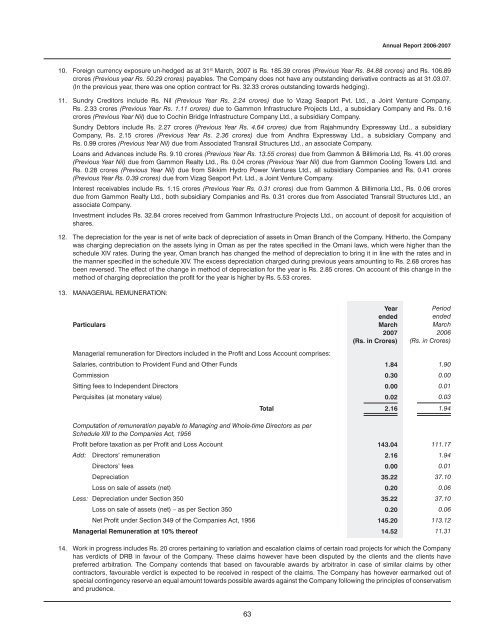

13. MANAGERIAL REMUNERATION:<br />

Particulars<br />

Year<br />

ended<br />

March<br />

<strong>2007</strong><br />

(Rs. in Crores)<br />

Period<br />

ended<br />

March<br />

<strong>2006</strong><br />

(Rs. in Crores)<br />

Managerial remuneration for Directors included in the Profit and Loss Account comprises:<br />

Salaries, contribution to Provident Fund and Other Funds 1.84 1.90<br />

Commission 0.30 0.00<br />

Sitting fees to Independent Directors 0.00 0.01<br />

Perquisites (at monetary value) 0.02 0.03<br />

Total 2.16 1.94<br />

Computation of remuneration payable to Managing and Whole-time Directors as per<br />

Schedule XIII to the Companies Act, 1956<br />

Profit before taxation as per Profit and Loss Account 143.04 111.17<br />

Add: Directors’ remuneration 2.16 1.94<br />

Directors’ fees 0.00 0.01<br />

Depreciation 35.22 37.10<br />

Loss on sale of assets (net) 0.20 0.06<br />

Less: Depreciation under Section 350 35.22 37.10<br />

Loss on sale of assets (net) – as per Section 350 0.20 0.06<br />

Net Profit under Section 349 of the Companies Act, 1956 145.20 113.12<br />

Managerial Remuneration at 10% thereof 14.52 11.31<br />

14. Work in progress includes Rs. 20 crores pertaining to variation and escalation claims of certain road projects for which the Company<br />

has verdicts of DRB in favour of the Company. These claims however have been disputed by the clients and the clients have<br />

preferred arbitration. The Company contends that based on favourable awards by arbitrator in case of similar claims by other<br />

contractors, favourable verdict is expected to be received in respect of the claims. The Company has however earmarked out of<br />

special contingency reserve an equal amount towards possible awards against the Company following the principles of conservatism<br />

and prudence.