Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

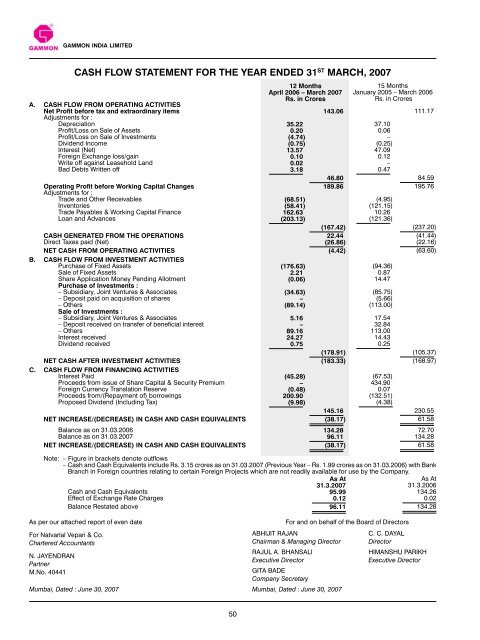

GAMMON INDIA LIMITED<br />

CASH FLOW STATEMENT FOR THE YEAR ENDED 31 ST MARCH, <strong>2007</strong><br />

50<br />

12 Months<br />

April <strong>2006</strong> – March <strong>2007</strong><br />

Rs. in Crores<br />

15 Months<br />

January 2005 – March <strong>2006</strong><br />

Rs. in Crores<br />

A. CASH FLOW FROM OPERATING ACTIVITIES<br />

Net Profit before tax and extraordinary items 143.06 111.17<br />

Adjustments for :<br />

Depreciation 35.22 37.10<br />

Profit/Loss on Sale of Assets 0.20 0.06<br />

Profit/Loss on Sale of Investments (4.74) –<br />

Dividend Income (0.75) (0.25)<br />

Interest (Net) 13.57 47.09<br />

Foreign Exchange loss/gain 0.10 0.12<br />

Write off against Leasehold Land 0.02 –<br />

Bad Debts Written off 3.18 0.47<br />

46.80 84.59<br />

Operating Profit before Working Capital Changes 189.86 195.76<br />

Adjustments for :<br />

Trade and Other Receivables (68.51) (4.95)<br />

Inventories (58.41) (121.15)<br />

Trade Payables & Working Capital Finance 162.63 10.26<br />

Loan and Advances (203.13) (121.36)<br />

(167.42) (237.20)<br />

CASH GENERATED FROM THE OPERATIONS 22.44 (41.44)<br />

Direct Taxes paid (Net) (26.86) (22.16)<br />

NET CASH FROM OPERATING ACTIVITIES (4.42) (63.60)<br />

B. CASH FLOW FROM INVESTMENT ACTIVITIES<br />

Purchase of Fixed Assets (176.63) (94.36)<br />

Sale of Fixed Assets 2.21 0.87<br />

Share Application Money Pending Allotment (0.06) 14.47<br />

Purchase of Investments :<br />

– Subsidiary, Joint Ventures & Associates (34.63) (85.75)<br />

– Deposit paid on acquisition of shares – (5.66)<br />

– Others (89.14) (113.00)<br />

Sale of Investments :<br />

– Subsidiary, Joint Ventures & Associates 5.16 17.54<br />

– Deposit received on transfer of beneficial interest – 32.84<br />

– Others 89.16 113.00<br />

Interest received 24.27 14.43<br />

Dividend received 0.75 0.25<br />

(178.91) (105.37)<br />

NET CASH AFTER INVESTMENT ACTIVITIES (183.33) (168.97)<br />

C. CASH FLOW FROM FINANCING ACTIVITIES<br />

Interest Paid (45.28) (67.53)<br />

Proceeds from issue of Share Capital & Security Premium – 434.90<br />

Foreign Currency Translation Reserve (0.48) 0.07<br />

Proceeds from/(Repayment of) borrowings 200.90 (132.51)<br />

Proposed Dividend (Including Tax) (9.98) (4.38)<br />

145.16 230.55<br />

NET INCREASE/(DECREASE) IN CASH AND CASH EQUIVALENTS (38.17) 61.58<br />

Balance as on 31.03.<strong>2006</strong> 134.28 72.70<br />

Balance as on 31.03.<strong>2007</strong> 96.11 134.28<br />

NET INCREASE/(DECREASE) IN CASH AND CASH EQUIVALENTS (38.17) 61.58<br />

Note: – Figure in brackets denote outflows<br />

– Cash and Cash Equivalents include Rs. 3.15 crores as on 31.03.<strong>2007</strong> (Previous Year – Rs. 1.99 crores as on 31.03.<strong>2006</strong>) with Bank<br />

Branch in Foreign countries relating to certain Foreign Projects which are not readily available for use by the Company.<br />

As At<br />

As At<br />

31.3.<strong>2007</strong><br />

31.3.<strong>2006</strong><br />

Cash and Cash Equivalents<br />

Effect of Exchange Rate Charges<br />

95.99<br />

0.12<br />

134.26<br />

0.02<br />

Balance Restated above 96.11 134.28<br />

As per our attached report of even date<br />

For Natvarlal Vepari & Co.<br />

Chartered Accountants<br />

N. JAYENDRAN<br />

Partner<br />

M.No. 40441<br />

For and on behalf of the Board of Directors<br />

ABHIJIT RAJAN C. C. DAYAL<br />

Chairman & Managing Director Director<br />

RAJUL A. BHANSALI HIMANSHU PARIKH<br />

Executive Director Executive Director<br />

GITA BADE<br />

Company Secretary<br />

Mumbai, Dated : June 30, <strong>2007</strong> Mumbai, Dated : June 30, <strong>2007</strong>