Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GAMMON INDIA LIMITED<br />

(c) During the year, pursuant to the retrospective amendment of proviso to Section 80IA the Company has reviewed its claim in<br />

respect of Section 80IA and has decided to provide for income tax of earlier years without considering the benefits available<br />

u/s 80IA. The amount of short provision including interest amounting to Rs. 50.09 crores is being debited to the profit and loss<br />

account as short provision of earlier years.<br />

25. The Company has deposited customs duty of Rs. 2.20 crores (Previous Year Rs. 2.20 crores) under protest in respect of certain<br />

machineries imported for the project in Sikkim. The Company contends that the import of machinery is duty free as per the Project<br />

Import regulations prevailing then. The Company has preferred an appeal against the levy of Custom Duty. Pending outcome of the<br />

appeal, the said amount is carried under Advances recoverable in cash or in kind.<br />

26. Unpaid dividend includes Rs. 0.03 crores (Previous year Rs. 0.01 crores) to be transferred to the Investor Education & Protection<br />

Fund.<br />

Unpaid dividend also includes the interim dividend declared on 21 st March, <strong>2007</strong> remaining unpaid at the end of the year.<br />

Unpaid matured Fixed Deposits includes Rs. Nil (Previous Year Rs. 0.001 crores) to be transferred to the Investor Education &<br />

Protection Fund.<br />

27. On a further assessment of the impairment of Fixed Assets of the Company as at the Balance Sheet date as required by Accounting<br />

Standard AS 28 – “Impairment of Assets” issued by the Institute of Chartered Accountants of <strong>India</strong>, Company is of the view that no<br />

further provision for impairment of Fixed Assets is required.<br />

28. The balance with The Freyssinet Prestressed Concrete Company Limited is as per books of accounts and subject to reconciliation.<br />

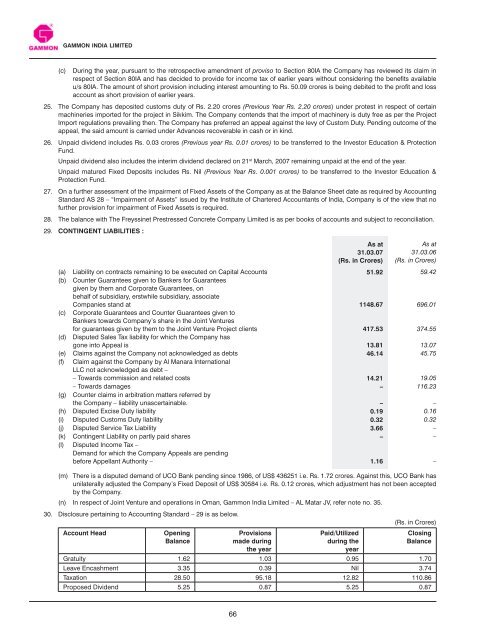

29. CONTINGENT LIABILITIES :<br />

66<br />

As at<br />

31.03.07<br />

(Rs. in Crores)<br />

As at<br />

31.03.06<br />

(Rs. in Crores)<br />

(a) Liability on contracts remaining to be executed on Capital Accounts 51.92 59.42<br />

(b) Counter Guarantees given to Bankers for Guarantees<br />

given by them and Corporate Guarantees, on<br />

behalf of subsidiary, erstwhile subsidiary, associate<br />

Companies stand at 1148.67 696.01<br />

(c) Corporate Guarantees and Counter Guarantees given to<br />

Bankers towards Company’s share in the Joint Ventures<br />

for guarantees given by them to the Joint Venture Project clients 417.53 374.55<br />

(d) Disputed Sales Tax liability for which the Company has<br />

gone into Appeal is 13.81 13.07<br />

(e) Claims against the Company not acknowledged as debts 46.14 45.75<br />

(f) Claim against the Company by Al Manara International<br />

LLC not acknowledged as debt –<br />

– Towards commission and related costs 14.21 19.05<br />

– Towards damages – 116.23<br />

(g) Counter claims in arbitration matters referred by<br />

the Company – liability unascertainable. – –<br />

(h) Disputed Excise Duty liability 0.19 0.16<br />

(i) Disputed Customs Duty liability 0.32 0.32<br />

(j) Disputed Service Tax Liability 3.66 –<br />

(k) Contingent Liability on partly paid shares – –<br />

(l) Disputed Income Tax –<br />

Demand for which the Company Appeals are pending<br />

before Appellant Authority – 1.16 –<br />

(m) There is a disputed demand of UCO Bank pending since 1986, of US$ 436251 i.e. Rs. 1.72 crores. Against this, UCO Bank has<br />

unilaterally adjusted the Company’s Fixed Deposit of US$ 30584 i.e. Rs. 0.12 crores, which adjustment has not been accepted<br />

by the Company.<br />

(n) In respect of Joint Venture and operations in Oman, <strong>Gammon</strong> <strong>India</strong> Limited – AL Matar JV, refer note no. 35.<br />

30. Disclosure pertaining to Accounting Standard – 29 is as below.<br />

(Rs. in Crores)<br />

Account Head Opening<br />

Balance<br />

Provisions<br />

made during<br />

the year<br />

Paid/Utilized<br />

during the<br />

year<br />

Closing<br />

Balance<br />

Gratuity 1.62 1.03 0.95 1.70<br />

Leave Encashment 3.35 0.39 Nil 3.74<br />

Taxation 28.50 95.18 12.82 110.86<br />

Proposed Dividend 5.25 0.87 5.25 0.87