Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

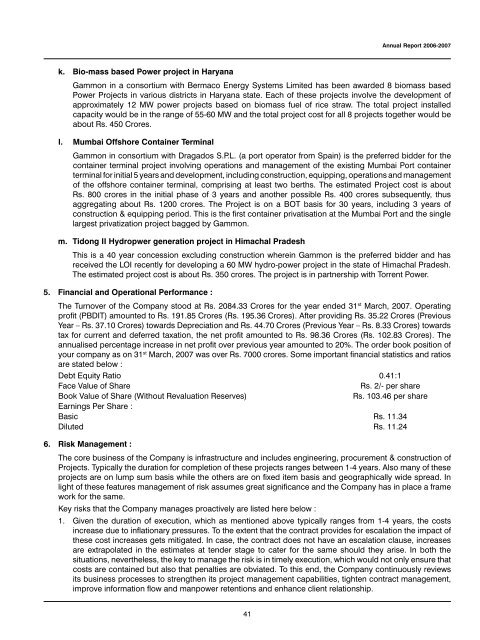

k. Bio-mass based Power project in Haryana<br />

41<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2006</strong>-<strong>2007</strong><br />

<strong>Gammon</strong> in a consortium with Bermaco Energy Systems Limited has been awarded 8 biomass based<br />

Power Projects in various districts in Haryana state. Each of these projects involve the development of<br />

approximately 12 MW power projects based on biomass fuel of rice straw. The total project installed<br />

capacity would be in the range of 55-60 MW and the total project cost for all 8 projects together would be<br />

about Rs. 450 Crores.<br />

l. Mumbai Offshore Container Terminal<br />

<strong>Gammon</strong> in consortium with Dragados S.P.L. (a port operator from Spain) is the preferred bidder for the<br />

container terminal project involving operations and management of the existing Mumbai Port container<br />

terminal for initial 5 years and development, including construction, equipping, operations and management<br />

of the offshore container terminal, comprising at least two berths. The estimated Project cost is about<br />

Rs. 800 crores in the initial phase of 3 years and another possible Rs. 400 crores subsequently, thus<br />

aggregating about Rs. 1200 crores. The Project is on a BOT basis for 30 years, including 3 years of<br />

construction & equipping period. This is the first container privatisation at the Mumbai Port and the single<br />

largest privatization project bagged by <strong>Gammon</strong>.<br />

m. Tidong II Hydropwer generation project in Himachal Pradesh<br />

This is a 40 year concession excluding construction wherein <strong>Gammon</strong> is the preferred bidder and has<br />

received the LOI recently for developing a 60 MW hydro-power project in the state of Himachal Pradesh.<br />

The estimated project cost is about Rs. 350 crores. The project is in partnership with Torrent Power.<br />

5. Financial and Operational Performance :<br />

The Turnover of the Company stood at Rs. 2084.33 Crores for the year ended 31 st March, <strong>2007</strong>. Operating<br />

profit (PBDIT) amounted to Rs. 191.85 Crores (Rs. 195.36 Crores). After providing Rs. 35.22 Crores (Previous<br />

Year – Rs. 37.10 Crores) towards Depreciation and Rs. 44.70 Crores (Previous Year – Rs. 8.33 Crores) towards<br />

tax for current and deferred taxation, the net profit amounted to Rs. 98.36 Crores (Rs. 102.83 Crores). The<br />

annualised percentage increase in net profit over previous year amounted to 20%. The order book position of<br />

your company as on 31 st March, <strong>2007</strong> was over Rs. 7000 crores. Some important financial statistics and ratios<br />

are stated below :<br />

Debt Equity Ratio 0.41:1<br />

Face Value of Share Rs. 2/- per share<br />

Book Value of Share (Without Revaluation Reserves) Rs. 103.46 per share<br />

Earnings Per Share :<br />

Basic Rs. 11.34<br />

Diluted Rs. 11.24<br />

6. Risk Management :<br />

The core business of the Company is infrastructure and includes engineering, procurement & construction of<br />

Projects. Typically the duration for completion of these projects ranges between 1-4 years. Also many of these<br />

projects are on lump sum basis while the others are on fixed item basis and geographically wide spread. In<br />

light of these features management of risk assumes great significance and the Company has in place a frame<br />

work for the same.<br />

Key risks that the Company manages proactively are listed here below :<br />

1. Given the duration of execution, which as mentioned above typically ranges from 1-4 years, the costs<br />

increase due to inflationary pressures. To the extent that the contract provides for escalation the impact of<br />

these cost increases gets mitigated. In case, the contract does not have an escalation clause, increases<br />

are extrapolated in the estimates at tender stage to cater for the same should they arise. In both the<br />

situations, nevertheless, the key to manage the risk is in timely execution, which would not only ensure that<br />

costs are contained but also that penalties are obviated. To this end, the Company continuously reviews<br />

its business processes to strengthen its project management capabilities, tighten contract management,<br />

improve information flow and manpower retentions and enhance client relationship.