Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

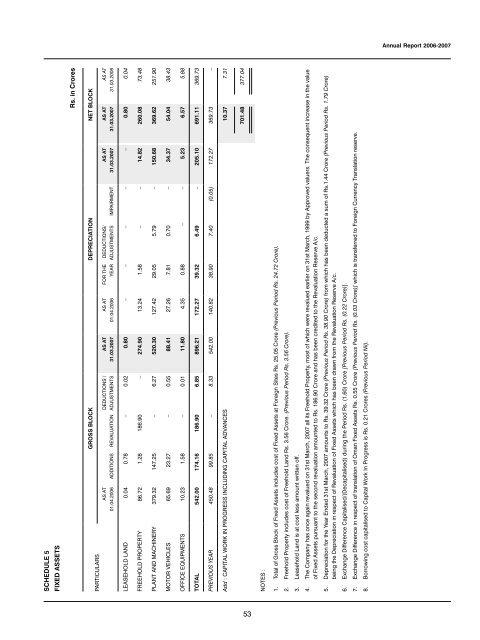

SCHEDULE 5<br />

FIXED ASSETS<br />

Rs. in Crores<br />

GROSS BLOCK DEPRECIATION NET BLOCK<br />

PARTICULARS<br />

AS AT<br />

31.03.<strong>2006</strong><br />

AS AT<br />

31.03.<strong>2007</strong><br />

AS AT<br />

31.03.<strong>2007</strong><br />

DEDUCTIONS/<br />

ADJUSTMENTS IMPAIRMENT<br />

FOR THE<br />

YEAR<br />

AS AT<br />

01.04.<strong>2006</strong><br />

AS AT<br />

31.03.<strong>2007</strong><br />

DEDUCTIONS /<br />

ADJUSTMENTS<br />

AS AT<br />

01.04.<strong>2006</strong> ADDITIONS REVALUATION<br />

LEASEHOLD LAND 0.04 0.78 – 0.02 0.80 – – – – – 0.80 0.04<br />

FREEHOLD PROPERTY 86.72 1.28 186.90 – 274.90 13.24 1.58 – – 14.82 260.08 73.48<br />

PLANT AND MACHINERY 379.32 147.25 – 6.27 520.30 127.42 29.05 5.79 – 150.68 369.62 251.90<br />

MOTOR VEHICLES 65.69 23.27 – 0.55 88.41 27.26 7.81 0.70 – 34.37 54.04 38.43<br />

OFFICE EQUIPMENTS 10.23 1.58 – 0.01 11.80 4.35 0.88 – – 5.23 6.57 5.88<br />

TOTAL 542.00 174.16 186.90 6.85 896.21 172.27 39.32 6.49 – 205.10 691.11 369.73<br />

PREVIOUS YEAR 450.48 99.85 – 8.33 542.00 140.82 38.90 7.40 (0.05) 172.27 369.73 –<br />

Add : CAPITAL WORK IN PROGRESS INCLUDING CAPITAL ADVANCES 10.37 7.31<br />

701.48 377.04<br />

53<br />

NOTES :<br />

1. Total of Gross Block of Fixed Assets includes cost of Fixed Assets at Foreign Sites Rs. 25.05 Crore (Previous Period Rs. 24.72 Crore).<br />

2. Freehold Property includes cost of Freehold Land Rs. 3.56 Crore. (Previous Period Rs. 3.56 Crore).<br />

3. Leasehold Land is at cost less amount written off.<br />

4. The Company has once again revalued on 31st March, <strong>2007</strong> all its Freehold Property, most of which were revalued earlier on 31st March, 1999 by Approved valuers. The consequent increase in the value<br />

of Fixed Assets pursuant to the second revaluation amounted to Rs. 186.90 Crore and has been credited to the Revaluation Reserve A/c.<br />

5. Depreciation for the Year Ended 31st March, <strong>2007</strong> amounts to Rs. 39.32 Crore (Previous Period Rs. 38.90 Crore) from which has been deducted a sum of Rs.1.44 Crore (Previous Period Rs. 1.79 Crore)<br />

being the Depreciation in respect of Revaluation of Fixed Assets which has been drawn from the Revaluation Reserve A/c.<br />

6. Exchange Difference Capitalised/(Decapitalised) during the Period Rs. (1.60) Crore [Previous Period Rs. (0.22 Crore)].<br />

7. Exchange Difference in respect of translation of Oman Fixed Assets Rs. 0.55 Crore [Previous Period Rs. (0.03 Crore)] which is transferred to Foreign Currency Translation reserve.<br />

8. Borrowing cost capitalised to Capital Work In Progress is Rs. 0.21 Crores (Previous Period Nil).<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2006</strong>-<strong>2007</strong>