Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GAMMON INDIA LIMITED<br />

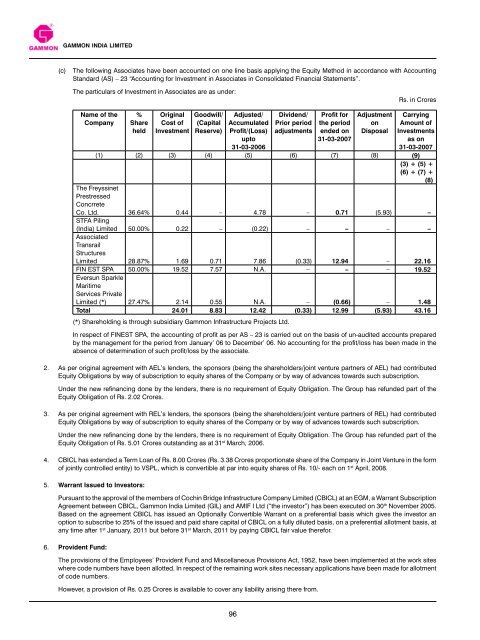

(c) The following Associates have been accounted on one line basis applying the Equity Method in accordance with Accounting<br />

Standard (AS) – 23 “Accounting for Investment in Associates in Consolidated Financial Statements”.<br />

The particulars of Investment in Associates are as under:<br />

Name of the<br />

Company<br />

%<br />

Share<br />

held<br />

Original<br />

Cost of<br />

Investment<br />

Goodwill/<br />

(Capital<br />

Reserve)<br />

Adjusted/<br />

Accumulated<br />

Profit/(Loss)<br />

upto<br />

31-03-<strong>2006</strong><br />

96<br />

Dividend/<br />

Prior period<br />

adjustments<br />

Profit for<br />

the period<br />

ended on<br />

31-03-<strong>2007</strong><br />

Adjustment<br />

on<br />

Disposal<br />

Rs. in Crores<br />

Carrying<br />

Amount of<br />

Investments<br />

as on<br />

31-03-<strong>2007</strong><br />

(1)<br />

The Freyssinet<br />

Prestressed<br />

Concrrete<br />

(2) (3) (4) (5) (6) (7) (8) (9)<br />

(3) + (5) +<br />

(6) + (7) +<br />

(8)<br />

Co. Ltd.<br />

STFA Piling<br />

36.64% 0.44 – 4.78 – 0.71 (5.93) –<br />

(<strong>India</strong>) Limited<br />

Associated<br />

Transrail<br />

Structures<br />

50.00% 0.22 – (0.22) – – – –<br />

Limited 28.87% 1.69 0.71 7.86 (0.33) 12.94 – 22.16<br />

FIN EST SPA<br />

Eversun Sparkle<br />

Maritime<br />

Services Private<br />

50.00% 19.52 7.57 N.A. – – – 19.52<br />

Limited (*) 27.47% 2.14 0.55 N.A. – (0.66) – 1.48<br />

Total 24.01 8.83 12.42 (0.33) 12.99 (5.93) 43.16<br />

(*) Shareholding is through subsidiary <strong>Gammon</strong> Infrastructure Projects Ltd.<br />

In respect of FINEST SPA, the accounting of profit as per AS – 23 is carried out on the basis of un-audited accounts prepared<br />

by the management for the period from January’ 06 to December’ 06. No accounting for the profit/loss has been made in the<br />

absence of determination of such profit/loss by the associate.<br />

2. As per original agreement with AEL’s lenders, the sponsors (being the shareholders/joint venture partners of AEL) had contributed<br />

Equity Obligations by way of subscription to equity shares of the Company or by way of advances towards such subscription.<br />

Under the new refinancing done by the lenders, there is no requirement of Equity Obligation. The Group has refunded part of the<br />

Equity Obligation of Rs. 2.02 Crores.<br />

3. As per original agreement with REL’s lenders, the sponsors (being the shareholders/joint venture partners of REL) had contributed<br />

Equity Obligations by way of subscription to equity shares of the Company or by way of advances towards such subscription.<br />

Under the new refinancing done by the lenders, there is no requirement of Equity Obligation. The Group has refunded part of the<br />

Equity Obligation of Rs. 5.01 Crores outstanding as at 31 st March, <strong>2006</strong>.<br />

4. CBICL has extended a Term Loan of Rs. 8.00 Crores (Rs. 3.38 Crores proportionate share of the Company in Joint Venture in the form<br />

of jointly controlled entity) to VSPL, which is convertible at par into equity shares of Rs. 10/- each on 1 st April, 2008.<br />

5. Warrant Issued to Investors:<br />

Pursuant to the approval of the members of Cochin Bridge Infrastructure Company Limited (CBICL) at an EGM, a Warrant Subscription<br />

Agreement between CBICL, <strong>Gammon</strong> <strong>India</strong> Limited (GIL) and AMIF I Ltd (“the investor”) has been executed on 30 th November 2005.<br />

Based on the agreement CBICL has issued an Optionally Convertible Warrant on a preferential basis which gives the investor an<br />

option to subscribe to 25% of the issued and paid share capital of CBICL on a fully diluted basis, on a preferential allotment basis, at<br />

any time after 1 st January, 2011 but before 31 st March, 2011 by paying CBICL fair value therefor.<br />

6. Provident Fund:<br />

The provisions of the Employees’ Provident Fund and Miscellaneous Provisions Act, 1952, have been implemented at the work sites<br />

where code numbers have been allotted. In respect of the remaining work sites necessary applications have been made for allotment<br />

of code numbers.<br />

However, a provision of Rs. 0.25 Crores is available to cover any liability arising there from.