Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GAMMON INDIA LIMITED<br />

MNEL:<br />

The Secured Loan together with all upfront fee, interest, further interest, additional interest, liquidated damages, premium on pre<br />

payment, costs, expenses and other monies whatsoever stipulated in the Agreement (‘Secured Obligations’) has been secured by:<br />

(a) A first mortgage and charge on all the Borrower’s immovable properties, both present and future,<br />

(b) A first charge by way of hypothecation of all the Borrower’s moveables, including current and non-current assets, moveable<br />

plant and machinery, machinery spares, tools and accessories, furniture, fixtures, vehicles and all other moveable assets, both<br />

present and future,<br />

(c) A first charge on Borrowers’ Receivables,<br />

(d) A first charge over all bank accounts of the Borrower including without limitation, the Escrow Account, the Retention Accounts<br />

(or any account in substitution thereof) and such Other Bank Accounts that may be opened in terms thereof and of the Project<br />

Documents and in all funds from time to time deposited therein and in all Authorised Investments or other securities representing<br />

all amounts credited thereto,<br />

(e) A first charge on all intangibles of the Borrower including but not limited to goodwill, rights, undertakings and uncalled capital,<br />

present or future.<br />

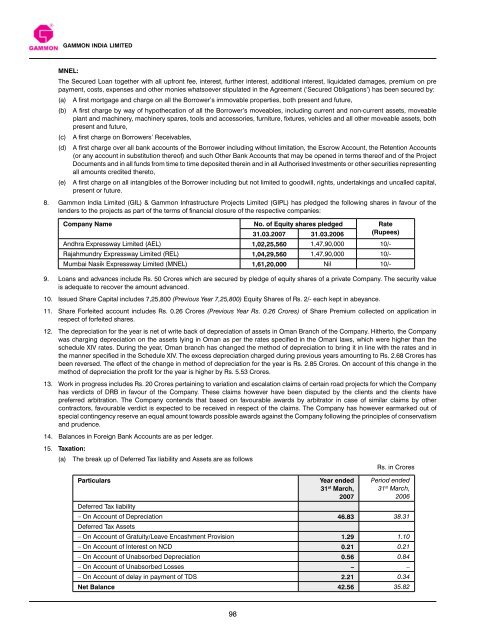

8. <strong>Gammon</strong> <strong>India</strong> Limited (GIL) & <strong>Gammon</strong> Infrastructure Projects Limited (GIPL) has pledged the following shares in favour of the<br />

lenders to the projects as part of the terms of financial closure of the respective companies:<br />

Company Name No. of Equity shares pledged Rate<br />

31.03.<strong>2007</strong> 31.03.<strong>2006</strong> (Rupees)<br />

Andhra Expressway Limited (AEL) 1,02,25,560 1,47,90,000 10/-<br />

Rajahmundry Expressway Limited (REL) 1,04,29,560 1,47,90,000 10/-<br />

Mumbai Nasik Expressway Limited (MNEL) 1,61,20,000 Nil 10/-<br />

9. Loans and advances include Rs. 50 Crores which are secured by pledge of equity shares of a private Company. The security value<br />

is adequate to recover the amount advanced.<br />

10. Issued Share Capital includes 7,25,800 (Previous Year 7,25,800) Equity Shares of Rs. 2/- each kept in abeyance.<br />

11. Share Forfeited account includes Rs. 0.26 Crores (Previous Year Rs. 0.26 Crores) of Share Premium collected on application in<br />

respect of forfeited shares.<br />

12. The depreciation for the year is net of write back of depreciation of assets in Oman Branch of the Company. Hitherto, the Company<br />

was charging depreciation on the assets lying in Oman as per the rates specified in the Omani laws, which were higher than the<br />

schedule XIV rates. During the year, Oman branch has changed the method of depreciation to bring it in line with the rates and in<br />

the manner specified in the Schedule XIV. The excess depreciation charged during previous years amounting to Rs. 2.68 Crores has<br />

been reversed. The effect of the change in method of depreciation for the year is Rs. 2.85 Crores. On account of this change in the<br />

method of depreciation the profit for the year is higher by Rs. 5.53 Crores.<br />

13. Work in progress includes Rs. 20 Crores pertaining to variation and escalation claims of certain road projects for which the Company<br />

has verdicts of DRB in favour of the Company. These claims however have been disputed by the clients and the clients have<br />

preferred arbitration. The Company contends that based on favourable awards by arbitrator in case of similar claims by other<br />

contractors, favourable verdict is expected to be received in respect of the claims. The Company has however earmarked out of<br />

special contingency reserve an equal amount towards possible awards against the Company following the principles of conservatism<br />

and prudence.<br />

14. Balances in Foreign Bank Accounts are as per ledger.<br />

15. Taxation:<br />

(a) The break up of Deferred Tax liability and Assets are as follows<br />

Particulars Year ended<br />

31st March,<br />

<strong>2007</strong><br />

Deferred Tax liability<br />

98<br />

Rs. in Crores<br />

Period ended<br />

31 st March,<br />

<strong>2006</strong><br />

– On Account of Depreciation<br />

Deferred Tax Assets<br />

46.83 38.31<br />

– On Account of Gratuity/Leave Encashment Provision 1.29 1.10<br />

– On Account of Interest on NCD 0.21 0.21<br />

– On Account of Unabsorbed Depreciation 0.56 0.84<br />

– On Account of Unabsorbed Losses – –<br />

– On Account of delay in payment of TDS 2.21 0.34<br />

Net Balance 42.56 35.82