Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

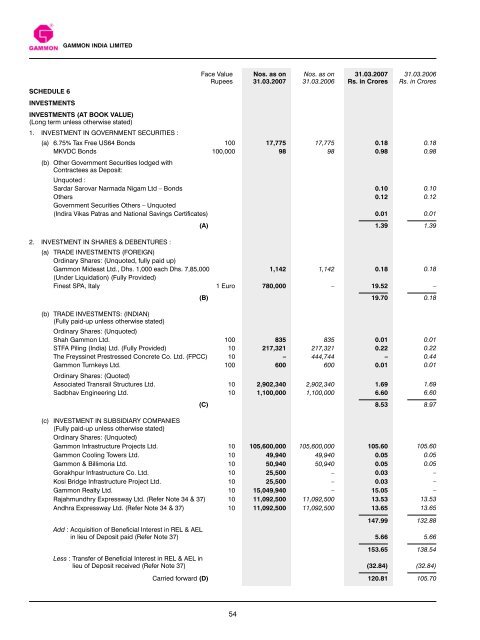

SCHEDULE 6<br />

INVESTMENTS<br />

GAMMON INDIA LIMITED<br />

Face Value<br />

Rupees<br />

54<br />

Nos. as on<br />

31.03.<strong>2007</strong><br />

Nos. as on<br />

31.03.<strong>2006</strong><br />

31.03.<strong>2007</strong><br />

Rs. in Crores<br />

31.03.<strong>2006</strong><br />

Rs. in Crores<br />

INVESTMENTS (AT BOOK VALUE)<br />

(Long term unless otherwise stated)<br />

1. INVESTMENT IN GOVERNMENT SECURITIES :<br />

(a) 6.75% Tax Free US64 Bonds 100 17,775 17,775 0.18 0.18<br />

MKVDC Bonds<br />

(b) Other Government Securities lodged with<br />

Contractees as Deposit:<br />

Unquoted :<br />

100,000 98 98 0.98 0.98<br />

Sardar Sarovar Narmada Nigam Ltd – Bonds 0.10 0.10<br />

Others<br />

Government Securities Others – Unquoted<br />

0.12 0.12<br />

(Indira Vikas Patras and National Savings Certificates) 0.01 0.01<br />

(A) 1.39 1.39<br />

2. INVESTMENT IN SHARES & DEBENTURES :<br />

(a) TRADE INVESTMENTS (FOREIGN)<br />

Ordinary Shares: (Unquoted, fully paid up)<br />

<strong>Gammon</strong> Mideast Ltd., Dhs. 1,000 each Dhs. 7,85,000<br />

(Under Liquidation) (Fully Provided)<br />

1,142 1,142 0.18 0.18<br />

Finest SPA, Italy 1 Euro 780,000 – 19.52 –<br />

(B) 19.70 0.18<br />

(b) TRADE INVESTMENTS: (INDIAN)<br />

(Fully paid-up unless otherwise stated)<br />

Ordinary Shares: (Unquoted)<br />

Shah <strong>Gammon</strong> Ltd. 100 835 835 0.01 0.01<br />

STFA Piling (<strong>India</strong>) Ltd. (Fully Provided) 10 217,321 217,321 0.22 0.22<br />

The Freyssinet Prestressed Concrete Co. Ltd. (FPCC) 10 – 444,744 – 0.44<br />

<strong>Gammon</strong> Turnkeys Ltd.<br />

Ordinary Shares: (Quoted)<br />

100 600 600 0.01 0.01<br />

Associated Transrail Structures Ltd. 10 2,902,340 2,902,340 1.69 1.69<br />

Sadbhav Engineering Ltd. 10 1,100,000 1,100,000 6.60 6.60<br />

(C) 8.53 8.97<br />

(c) INVESTMENT IN SUBSIDIARY COMPANIES<br />

(Fully paid-up unless otherwise stated)<br />

Ordinary Shares: (Unquoted)<br />

<strong>Gammon</strong> Infrastructure Projects Ltd. 10 105,600,000 105,600,000 105.60 105.60<br />

<strong>Gammon</strong> Cooling Towers Ltd. 10 49,940 49,940 0.05 0.05<br />

<strong>Gammon</strong> & Billimoria Ltd. 10 50,940 50,940 0.05 0.05<br />

Gorakhpur Infrastructure Co. Ltd. 10 25,500 – 0.03 –<br />

Kosi Bridge Infrastructure Project Ltd. 10 25,500 – 0.03 –<br />

<strong>Gammon</strong> Realty Ltd. 10 15,049,940 – 15.05 –<br />

Rajahmundhry Expressway Ltd. (Refer Note 34 & 37) 10 11,092,500 11,092,500 13.53 13.53<br />

Andhra Expressway Ltd. (Refer Note 34 & 37) 10 11,092,500 11,092,500 13.65 13.65<br />

147.99 132.88<br />

Add : Acquisition of Beneficial Interest in REL & AEL<br />

in lieu of Deposit paid (Refer Note 37) 5.66 5.66<br />

153.65 138.54<br />

Less : Transfer of Beneficial Interest in REL & AEL in<br />

lieu of Deposit received (Refer Note 37) (32.84) (32.84)<br />

Carried forward (D) 120.81 105.70