Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

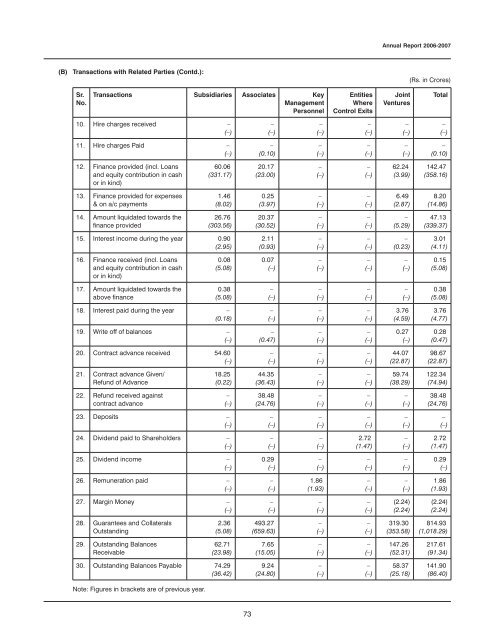

(B) Transactions with Related Parties (Contd.):<br />

Sr.<br />

No.<br />

Transactions Subsidiaries Associates Key<br />

Management<br />

Personnel<br />

10. Hire charges received –<br />

(–)<br />

11. Hire charges Paid –<br />

(–)<br />

12. Finance provided (incl. Loans<br />

and equity contribution in cash<br />

or in kind)<br />

13. Finance provided for expenses<br />

& on a/c payments<br />

14. Amount liquidated towards the<br />

finance provided<br />

60.06<br />

(331.17)<br />

1.46<br />

(8.02)<br />

26.76<br />

(303.56)<br />

15. Interest income during the year 0.90<br />

(2.95)<br />

16. Finance received (incl. Loans<br />

and equity contribution in cash<br />

or in kind)<br />

17. Amount liquidated towards the<br />

above finance<br />

0.08<br />

(5.08)<br />

0.38<br />

(5.08)<br />

18. Interest paid during the year –<br />

(0.18)<br />

19. Write off of balances –<br />

(–)<br />

20. Contract advance received 54.60<br />

(–)<br />

21. Contract advance Given/<br />

Refund of Advance<br />

22. Refund received against<br />

contract advance<br />

18.25<br />

(0.22)<br />

–<br />

(–)<br />

23. Deposits –<br />

(–)<br />

24. Dividend paid to Shareholders –<br />

(–)<br />

25. Dividend income –<br />

(–)<br />

26. Remuneration paid –<br />

(–)<br />

27. Margin Money –<br />

(–)<br />

28. Guarantees and Collaterals<br />

Outstanding<br />

29. Outstanding Balances<br />

Receivable<br />

2.36<br />

(5.08)<br />

62.71<br />

(23.98)<br />

30. Outstanding Balances Payable 74.29<br />

(36.42)<br />

Note: Figures in brackets are of previous year.<br />

73<br />

–<br />

(–)<br />

–<br />

(0.10)<br />

20.17<br />

(23.00)<br />

0.25<br />

(3.97)<br />

20.37<br />

(30.52)<br />

2.11<br />

(0.93)<br />

0.07<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(0.47)<br />

–<br />

(–)<br />

44.35<br />

(36.43)<br />

38.48<br />

(24.76)<br />

–<br />

(–)<br />

–<br />

(–)<br />

0.29<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

493.27<br />

(659.63)<br />

7.65<br />

(15.05)<br />

9.24<br />

(24.80)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

1.86<br />

(1.93)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

Entities<br />

Where<br />

Control Exits<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

2.72<br />

(1.47)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2006</strong>-<strong>2007</strong><br />

Joint<br />

Ventures<br />

–<br />

(–)<br />

–<br />

(–)<br />

62.24<br />

(3.99)<br />

6.49<br />

(2.87)<br />

–<br />

(5.29)<br />

–<br />

(0.23)<br />

–<br />

(–)<br />

–<br />

(–)<br />

3.76<br />

(4.59)<br />

0.27<br />

(–)<br />

44.07<br />

(22.87)<br />

59.74<br />

(38.29)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

–<br />

(–)<br />

(2.24)<br />

(2.24)<br />

319.30<br />

(353.58)<br />

147.26<br />

(52.31)<br />

58.37<br />

(25.18)<br />

(Rs. in Crores)<br />

Total<br />

–<br />

(–)<br />

–<br />

(0.10)<br />

142.47<br />

(358.16)<br />

8.20<br />

(14.86)<br />

47.13<br />

(339.37)<br />

3.01<br />

(4.11)<br />

0.15<br />

(5.08)<br />

0.38<br />

(5.08)<br />

3.76<br />

(4.77)<br />

0.28<br />

(0.47)<br />

98.67<br />

(22.87)<br />

122.34<br />

(74.94)<br />

38.48<br />

(24.76)<br />

–<br />

(–)<br />

2.72<br />

(1.47)<br />

0.29<br />

(–)<br />

1.86<br />

(1.93)<br />

(2.24)<br />

(2.24)<br />

814.93<br />

(1,018.29)<br />

217.61<br />

(91.34)<br />

141.90<br />

(86.40)